What to Expect When Approaching Investors to Fund Your Startup

2020-11-30

In a modern world that seems almost saturated with rising entrepreneurs and cool startup ideas, bringing your own idea to any table might seem like a tedious task at times. Add to that the pressure of asking for funding from angel investors, venture capitalists, friends or family, and the future of your budding company could appear doubtful. This is why you should be prepared to answer any questions that investors may have about your startup, in order to be confident and minimize the risk of them saying no to that bright idea you so firmly believe in.

Let’s dive into what you should do to try and convince investors that your startup is worth their time and money.

The Research

Like any successful approach to almost anything in the business world, you need to do your research on what you are trying to achieve, and in this case it’s appealing to investors.

Begin by identifying your potential investors. If you’re a FinTech startup, you need to target investors that have expressed interest in that industry and/or have previously invested in FinTech products and services. If you’re just starting out, you can reach out to lesser-known investors who are known to support startups and small businesses to increase your chances. Knowing which investors to approach and researching them thoroughly to find out things like what questions they ask and how, what their beliefs and interests are, is the first step to approach them for funding. The more like-mindedness there is and the more information you have, the easier your pitch will be to tailor according to his or her reputation and investment history.

The Pitch

After knowing who you’re targeting, preparing a solid business plan is the next step to convincing investors to fund you. Whatever your claims may be, you must be ready to back them up in a professional, persuasive way, and your business plan is the core of your confidence. Business plans need to be comprehensive and address all concerns related to your business, including complete financial projections, a strategic rollout plan, and perhaps most importantly, the compelling story of how your idea solves one or more real-world problems in a commercially viable way.

Your pitch should be concise and easy to understand for the average person, which entails not using complicated words to deliver simple concepts. What should also be concise is your conversation with investors; get to the point without circling around it needlessly. Specificity is also desirable when talking about your products and/or services in detail, keeping in mind the pricing aspect of your commercial solution and justifying why it was priced that way.

Talking about your relevant experience is a good starting point to build your credibility and highlight your expertise when investors ask about why the targeted market needs your business idea. Once these points are out of the way, now comes the time to reveal just how much capital the company currently has, and how much funding is required to attain the next stage. Stating who your current investors are also builds credibility, and if a large investment capital is what you are after, it is imperative to mention your startup’s exit strategy so that the attendees can know exactly what to expect. It should also be mentioned that having an established social media presence in terms of both the amount of fans/followers and having the accounts set up properly helps greatly in attracting investors, as well as having a well-established website that communicates your brand in a visually appealing, simple and professionally trendy way.

The Questions

Whenever asking investors for funding in your startup, no matter the amount or the stage it’s in, there are certain questions that you can expect to be asked. Let’s take a dive into what these questions could be.

1) How good is the management team?

Your idea or solution is definitely an important part of your business’ attractiveness, but some investors put more weight on the team that is working on it. They usually try to determine the team members’ skillset, passion, experience, and temperament before considering investing any money, and they are right to do so. They could ask about the founders, the key members, their relevant domain experience, what makes the team unique for that specific business, what the expectations are for hiring in the short term, as well as what the plan is to scale that team in the medium to long term. Stating the number of people working on the project, their relevant expertise in filling those key roles, and what motivated them to start working is paramount to providing a good picture of what the investors can expect. Investors want people who are enjoyable to work with, have good synergy, and are willing to listen and learn. All these factors need to be addressed so that investors can first believe in the startup and its people, in order for them to consider funding it.

2) How big is the market opportunity?

VCs, angel investors and similar investors are always on the lookout for the next big thing, in terms of scalability, long-term profitability and market impact. How meaningful is your startup idea in this regard? You need to be prepared with a proper vision to put things into perspective for them, even if it’s just projections at your current stage. If your business is relatively small, positioning it as a platform that is poised to grow through providing multiple products, services or apps can be a good strategy to mitigate this question, and the promise of future growth is an area you should hammer on in detail to convince investors that you are worth their money. Talking about your target segment and how you plan to expand your customer base over time is a desirable aspect of your pitch as well.

3) How much traction has the business achieved so far?

Early-stage traction and adoption is a critical aspect of a startup for investors, as it serves as a promising sign of success at later stages. Even if your early adopters are friends and family, it is worth mentioning that they like the product or service in a commercially sustainable and value-adding way. Businesses that have obtained early traction are more likely to get funded and this can be achieved through a number of ways, such as launching a beta version or minimum viable product (MVP), having pilot customers that relate to a brand name, establishing strategic partnerships with relevant entities that complement your idea, publishing customer testimonials, and joining incubators or accelerator programs. The more mentions, publications, testimonials or similar buzz you show about your company during the pitch, the better your chances are at clinching that investment opportunity.

4) How well do the founders understand the startup’s key metrics and financials?

Founders need to be familiar with their financials and KPIs, as well as having a strong handle on them and be able to discuss and articulate them rationally, in order to attract investment. Communicating the actual value of your business is best done through numbers, and connecting with investors requires having a detailed conversation on your company’s revenue growth sales funnel, customer churn rate and similar KPI-driven aspects of your business. This is what investors expect from entrepreneurs, and the more you know about your financials and KPIs, the better chance you have of getting them on board.

5) Have you been referred to me by a trusted colleague?

In today’s fast-paced world filled with budding startup ideas, investors are more often than not overwhelmed with unsolicited executive summaries and pitch decks. If you can get referred by a mutual acquaintance or trusted colleague such as a fellow entrepreneur, lawyer, or another investor, you are more likely to grab your investors’ attention and stand out from the crowd. Seek referrals if they are available to you to increase your likelihood of getting your funding.

6) Have you identified the potential risks to your business idea?

Any business idea, no matter how great, has potential risks that loom over its success, and determining them is part of your homework before asking for funding. Investors will always seek to understand what potential risks can impact your business, your thought process behind mitigating them and the precautions you’re taking to minimize them. These risks include the core competitors to your idea, the legal and regulatory risks associated with your target market and its applicable laws, risks associated with technology and the underlying infrastructure of your business, and product/service liability risks. Knowing them is one thing, and knowing how to deal with and mitigate them is another, and investors want to know both. Communicating them coherently and highlighting how you intend to address them will definitely grant you an advantage in securing your required investment.

7) How will the investment capital be used and what progress is expected?

The bigger the sum you are asking for, the more you need to explain where and how that amount will be used. Investors need to know exactly how you intend to spend that capital and your proposed burn rate. This is for them to determine when you’ll need the next round of financing, but perhaps more importantly to test whether you know what you need that funding for. You need to prove to them that your estimation in terms of costs and revenue is reasonable, both in regards to the required investment and to meeting your next milestone, highlighting your growth progress along the way. Explain thoroughly where their money will be allocated in the short and/or long term and for what purpose to increase your chances of getting that investment.

8) How differentiated is your company’s technology?

In a highly digitized world that is first and foremost largely dependent on technology, it’s more likely than not that your potential investors have already funded software, internet, mobile, or other technology businesses. This means that your technology needs to differentiate from its competitors in one or more aspects, and investors expect you to state how. Mention your competitive advantage(s) over existing technology, the ease or difficulty of replicating it, and the cost of building that tech into each product, and also the cost of integrating it with potential partner products or services down the line. The more you delve into the details of your underlying technology, the more you establish your credibility in our highly connected and competitive world.

Approaching investors to get the needed funding for your startup can be stressful, but being prepared with proper planning and knowing what to expect can greatly ease that stress and increase your chances of success. Research your crowd, know your business inside out, align your mission and vision with your co-founders and management team, study the answers to their expected questions well, and you will gain a definite advantage in presenting your awesome idea to potential investors and you’ll hopefully secure that funding to launch your business into stardom.

related articles

A New Milestone in Egypt’s FinTech Journey

The FinTech Reality Show

Egypt Shines at the FinTech Arab Challenge 2025!

Announcing the Winners of FinTech Got Talent 2025!

Why does innovation often fail in organizations, and how can we truly enable it?

How can banks successfully enable AI — safely, strategically, and at scale?

We’re excited to announce the kick-off of the FinTech Hackathon

.jpg)

Attention all FinTech/FinTech-enabled Startups and PSPs!

.jpg)

Calling all Investors!

.jpg)

Calling all the accelerators and incubators!

AI is not the future. It’s NOW.

Most important moments from FinTekrs Assiut Round!

Celebrating Innovation: Top 10 Universities in the FinTech Got Talent Competition!

Proudly Announcing Mansoura Demo Day From Fintekrs Program Round 3!

Announcement: FinTech Got Talent Competition - 2nd Edition!

Don’t miss the chance to be part of a live conversation on the latest in FinTech, right at the Central Bank of Egypt Booth during the Cairo ICT!

Thrilled to announce that FinTekrs is taking the FinTech track by storm at Techne Summit!

.png)

The Central Bank of Egypt Supports Women’s Empowerment to Expand their Businesses

Agri-FinTech Applications by Fresh Source

4th Episode of 7areef FinTech Podcast – Supply Chain Finance

3rd Episode of 7areef FinTech Podcast – Digital Payments

2nd Episode of 7areef FinTech Podcast – ROSCA

1st Episode of 7areef FinTech Podcast - FinTekrs Introduction

Are you interested to be “7areef FinTech”?!

.jpg)

“FinTech Egypt” Launches the First Digital Academy to Upskill the Workforce Skills in the Banking, Financial, and FinTech Sector

FINTECH IS EGYPT’S NEXT BIG OPPORTUNITY..Catch up with FINTEKRS

The Future is FinTech..JOIN FINTEKRS NOW!

FinTekrs’ Alex Round Sponsor

FinTech Worldwide Statistics...FINTEKRS is Not-To-Miss!

Who Can Apply to FINTEKRS

Knowledge from FINTEKRS!

4 Reasons to Join FINTEKRS!

Launching FINTEKRS

FinTech Egypt releases its FinTech Investments-focused H1 2022 Landscape Review “Why Egypt is a promising market for FinTech Investments?”

The Women Techsters Initiative Fellowship Class of 2023

We're bringing top LPs and GPs from around the world

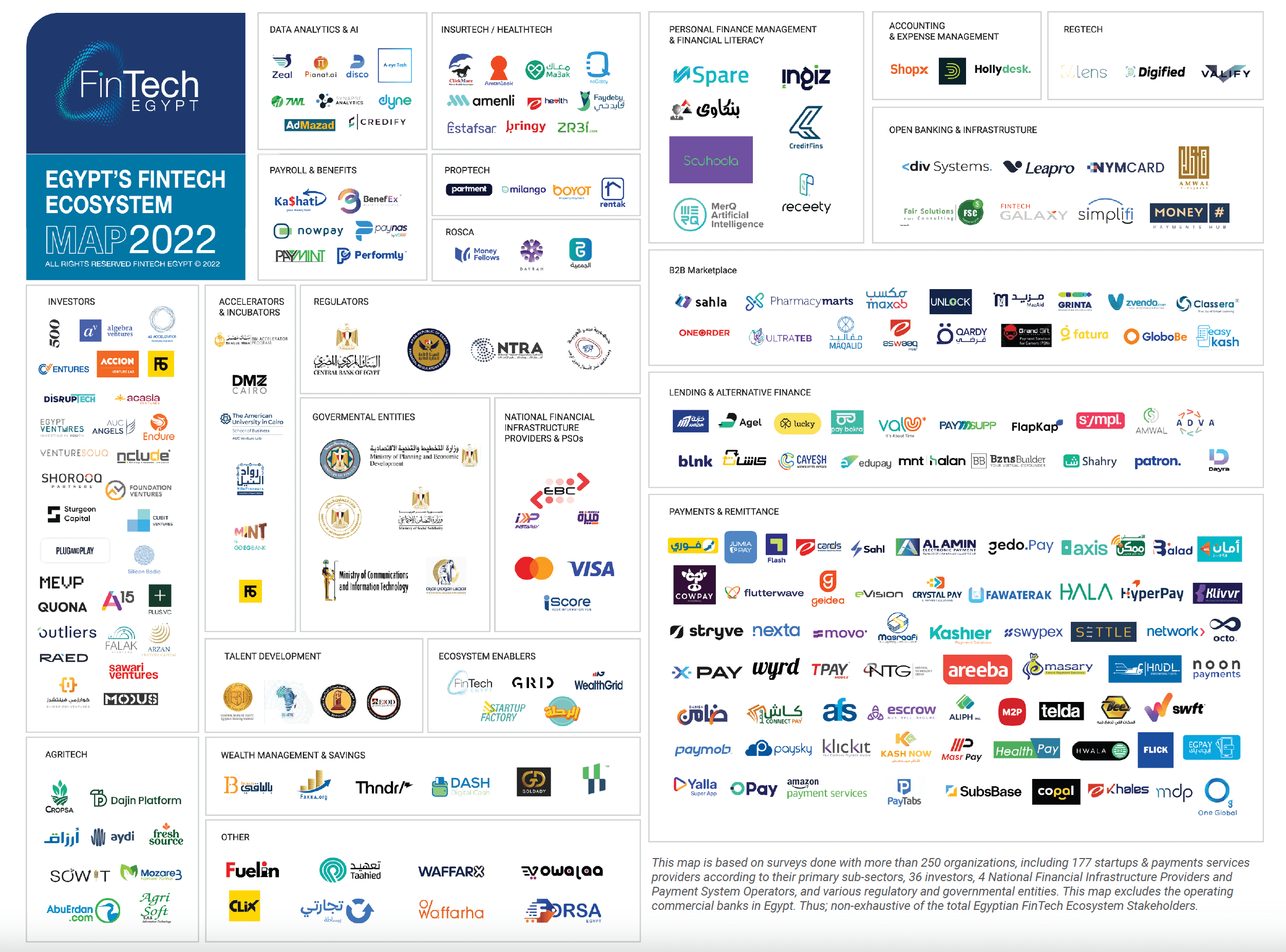

The Egyptian FinTech ecosystem is booming

We've joined forces to bring the best LPs and GPs together

We're taking a closer look at Egypt

Come and join the key players in the Middle East & Africa’s VC market

Connect with Egypt

Frontier of Egypt, Africa & the middle East in the 2022

Egypt’s First VC Summit kicks off in partnership between GIZ Egypt, AfricaGrow and Fintech Egypt

BANQUE MISR, NATIONAL BANK OF EGYPT, AND BANQUE DU CAIRE LEAD INVESTMENT IN NEW FINTECH FUND

The Increasing Influence of Women in FinTech

FinTech Egypt is releasing the first comprehensive report of its kind providing an overview of the unprecedented growth of FinTech in the Egyptian market

5 FinTech Trends to Follow in 2022

How FinTech is Disrupting an Age-Old Industry

RESHAPING FINTECH WITH AI: TOP AI INNOVATIONS IN THE FINANCIAL INDUSTRY

Accelerate’ha’ Female-Focused Problem Statements Now Live!

Breaking Entry Barriers for Women in FinTech

Have Traditional Banks Realized the Full Potential of Fintech By Now?

Episode 5: Accelerating FinTech Innovation through Open APIs

Episode 4: Understanding Blockchain’ s Potential in Disrupting FinTech

.png)

Episode 3: Discovering FinTech Talent through “FinYology - FinTech for Youth”

Episode 2: The Current & Future state of FinTech during COVID-19

FinTech Egypt Dialogue podcast launches its first-ever session about E-KYC Regulations and Regulatory Sandbox

Where does Artificial Intelligence fit in FinTech?

Critical FinTech Questions That Only the Near Future Can Answer

Special Interview With Dor-E, Winner Of The AI-Customer Experience FinTech Innovation Challenge

Egyptian Banking Institute Announces “The Future Of FinTech And Latest Digitalization Trends” Field Trip

Artificial Intelligence Is Transforming Banking As We Know It

Artificial Intelligence Is Transforming Banking As We Know It

Hub71 Partners With Techstars In Launching An Accelerator Program To Boost Startups

FINTECH IN THE SAVANNAH: Afro-Asia FinTech festival 2019 that took place in Nairobi Kenya

How Machine Learning Supports Credit Profiling

The Central Bank of Egypt’s Regulatory Sandbox started its first cohort in “e-KYC” to empower the FinTech ecosystem in Egypt.

Dubai Smart City Accelerator invites Egyptian startups to join Cairo Fast Track

Calling All Egyptian FinTech Startups To Participate In The Afro-Asia FinTech Festival!

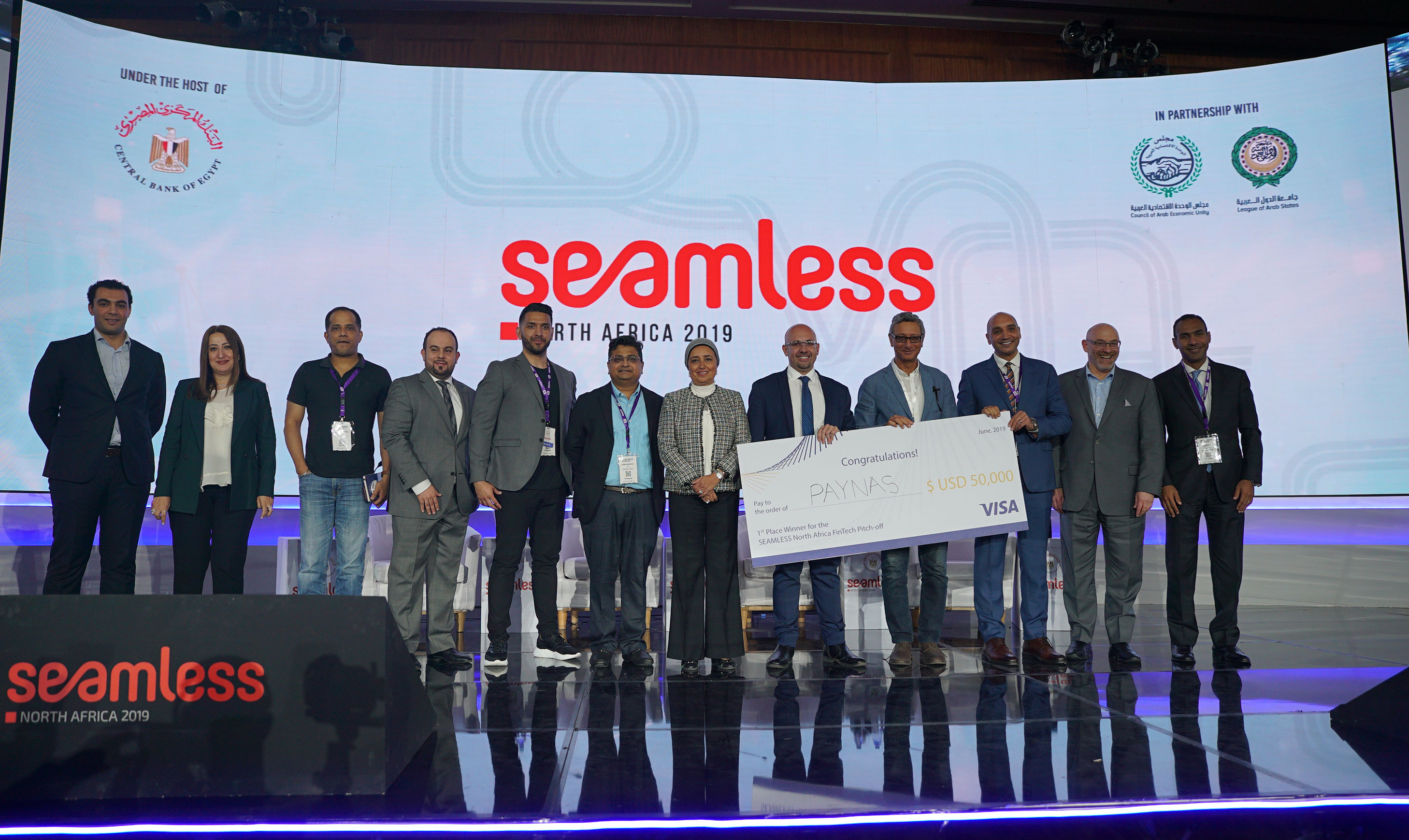

Paynas Wins Big At Seamless North Africa 2019

.jpg)

Seamless North Africa 2019

Announcing The Inaugural AFI FinTech Showcase

Fintech Trends In 2019 - Blockchain Adoption

.jpg)

Discounted Start-Up Passes

0

0

1.6k

1.6k

Comments