How Machine Learning Supports Credit Profiling

22 July 2019

Machine learning provides systems with the ability to automatically learn and improve from applied experience without being explicitly programmed for that. Based on certain patterns, it judges whether a borrower is credit-worthy or not and regulates the process of loan decisioning engine.

So Artificial Intelligence may help you make credit decisions at scale but it is Machine Learning that helps improve algorithms and ensure that you are one step ahead of the industry in understanding credit and market patterns.

Here are few platforms which offer help in credit analysis.

CoinTribe

CoinTribe is the only online lending platform which has back-tested its credit model with large banks. As a leading online loan disbursement platform, it provides quick and easy collateral-free loans to small businesses and individuals. The marketplace model facilitates loan origination and credit assessment through CoinTribe before it is shared with the banks.

PaaS (Platform as a Service) enables banks and NBFCs to utilize CoinTribe’s platform for effective risk analysis and recommendations to digitally underwrite their own consumers. CoinTribe’s PaaS is equipping lenders across the country to become digital-ready and enhance the efficiency of their lending process.

Aye Finance

Aye Finance is one such commercial institution built around the mission to solve these challenges of funding MSMEs and enabling their inclusion into the economy mainstream.

Aye Finance differentiates itself by creating a technically enabled process that builds credit insights through a variety of available business and behavioral data. This effective credit appraisal coupled with the use of modern workflow automation and a small but engaged workforce is helping bridge the gap between the MSMEs and organized lending.

Satya MicroCapital

Satya MicroCapital is an NBFC-MFI serving low-income entrepreneurs in India’s rural and urban areas. The firm provides prompt, convenient and affordable collateral-free credit to unbanked and under-served people through a strong credit assessment and centralized approval system.

Happy Loans

Happy Loans assesses over 1000 variables about the merchant to underwrite his micro business. Its credit model is based on the merchant’s level of business engagement with the partner, his behavior towards borrowing, APIs, demographics & business trends.

Promising a unique borrowing experience to Indians, Happy Loans provides customized loan offerings to microenterprise owners to meet their specific demands. It even offers micro business loans that start at as low as Rs. 2,000 for durations as short as 30 days.

MoneyTap

MoneyTap is India’s first app-based consumer credit line, where “credit line” means that the bank will issue a limit of up to Rs. 5 Lakh, without any collateral or charging any interest.

Against this limit, using the MoneyTap app, consumers can borrow as little as Rs. 3,000 or as much as Rs. 5 Lakh and repay it as EMIs from 2 months to 3 years. The app securely connects with banking systems to give them not only instant approval but also a credit limit, depending on the individual credit history.

related articles

A New Milestone in Egypt’s FinTech Journey

The FinTech Reality Show

Egypt Shines at the FinTech Arab Challenge 2025!

Announcing the Winners of FinTech Got Talent 2025!

Why does innovation often fail in organizations, and how can we truly enable it?

How can banks successfully enable AI — safely, strategically, and at scale?

We’re excited to announce the kick-off of the FinTech Hackathon

.jpg)

Attention all FinTech/FinTech-enabled Startups and PSPs!

.jpg)

Calling all Investors!

.jpg)

Calling all the accelerators and incubators!

AI is not the future. It’s NOW.

Most important moments from FinTekrs Assiut Round!

Celebrating Innovation: Top 10 Universities in the FinTech Got Talent Competition!

Proudly Announcing Mansoura Demo Day From Fintekrs Program Round 3!

Announcement: FinTech Got Talent Competition - 2nd Edition!

Don’t miss the chance to be part of a live conversation on the latest in FinTech, right at the Central Bank of Egypt Booth during the Cairo ICT!

Thrilled to announce that FinTekrs is taking the FinTech track by storm at Techne Summit!

.png)

The Central Bank of Egypt Supports Women’s Empowerment to Expand their Businesses

Agri-FinTech Applications by Fresh Source

4th Episode of 7areef FinTech Podcast – Supply Chain Finance

3rd Episode of 7areef FinTech Podcast – Digital Payments

2nd Episode of 7areef FinTech Podcast – ROSCA

1st Episode of 7areef FinTech Podcast - FinTekrs Introduction

Are you interested to be “7areef FinTech”?!

.jpg)

“FinTech Egypt” Launches the First Digital Academy to Upskill the Workforce Skills in the Banking, Financial, and FinTech Sector

FINTECH IS EGYPT’S NEXT BIG OPPORTUNITY..Catch up with FINTEKRS

The Future is FinTech..JOIN FINTEKRS NOW!

FinTekrs’ Alex Round Sponsor

FinTech Worldwide Statistics...FINTEKRS is Not-To-Miss!

Who Can Apply to FINTEKRS

Knowledge from FINTEKRS!

4 Reasons to Join FINTEKRS!

Launching FINTEKRS

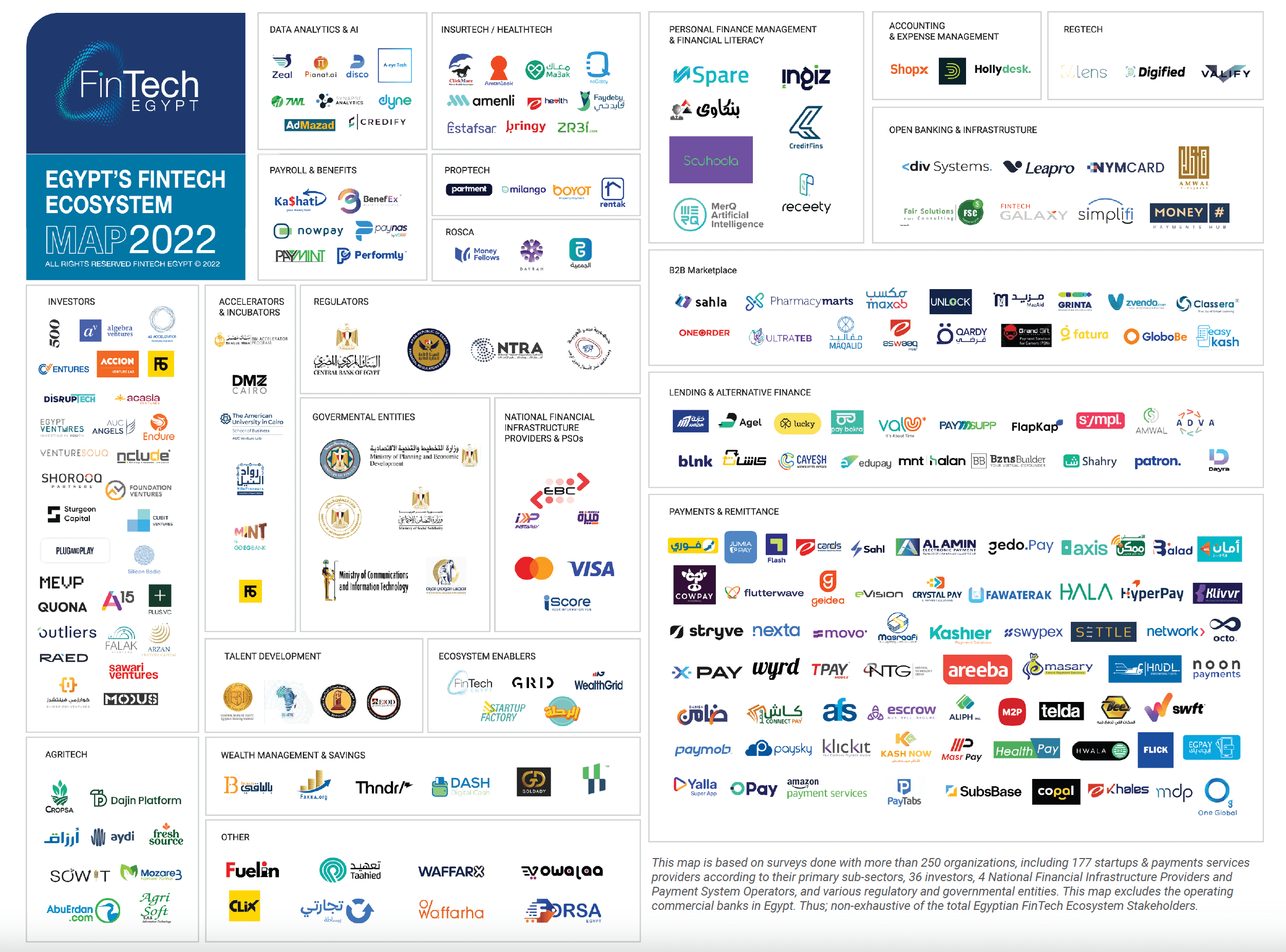

FinTech Egypt releases its FinTech Investments-focused H1 2022 Landscape Review “Why Egypt is a promising market for FinTech Investments?”

The Women Techsters Initiative Fellowship Class of 2023

We're bringing top LPs and GPs from around the world

The Egyptian FinTech ecosystem is booming

We've joined forces to bring the best LPs and GPs together

We're taking a closer look at Egypt

Come and join the key players in the Middle East & Africa’s VC market

Connect with Egypt

Frontier of Egypt, Africa & the middle East in the 2022

Egypt’s First VC Summit kicks off in partnership between GIZ Egypt, AfricaGrow and Fintech Egypt

BANQUE MISR, NATIONAL BANK OF EGYPT, AND BANQUE DU CAIRE LEAD INVESTMENT IN NEW FINTECH FUND

The Increasing Influence of Women in FinTech

FinTech Egypt is releasing the first comprehensive report of its kind providing an overview of the unprecedented growth of FinTech in the Egyptian market

5 FinTech Trends to Follow in 2022

How FinTech is Disrupting an Age-Old Industry

RESHAPING FINTECH WITH AI: TOP AI INNOVATIONS IN THE FINANCIAL INDUSTRY

Accelerate’ha’ Female-Focused Problem Statements Now Live!

Breaking Entry Barriers for Women in FinTech

Have Traditional Banks Realized the Full Potential of Fintech By Now?

Episode 5: Accelerating FinTech Innovation through Open APIs

Episode 4: Understanding Blockchain’ s Potential in Disrupting FinTech

.png)

Episode 3: Discovering FinTech Talent through “FinYology - FinTech for Youth”

Episode 2: The Current & Future state of FinTech during COVID-19

FinTech Egypt Dialogue podcast launches its first-ever session about E-KYC Regulations and Regulatory Sandbox

Where does Artificial Intelligence fit in FinTech?

Critical FinTech Questions That Only the Near Future Can Answer

Special Interview With Dor-E, Winner Of The AI-Customer Experience FinTech Innovation Challenge

Egyptian Banking Institute Announces “The Future Of FinTech And Latest Digitalization Trends” Field Trip

Artificial Intelligence Is Transforming Banking As We Know It

Artificial Intelligence Is Transforming Banking As We Know It

Hub71 Partners With Techstars In Launching An Accelerator Program To Boost Startups

FINTECH IN THE SAVANNAH: Afro-Asia FinTech festival 2019 that took place in Nairobi Kenya

The Central Bank of Egypt’s Regulatory Sandbox started its first cohort in “e-KYC” to empower the FinTech ecosystem in Egypt.

Dubai Smart City Accelerator invites Egyptian startups to join Cairo Fast Track

Calling All Egyptian FinTech Startups To Participate In The Afro-Asia FinTech Festival!

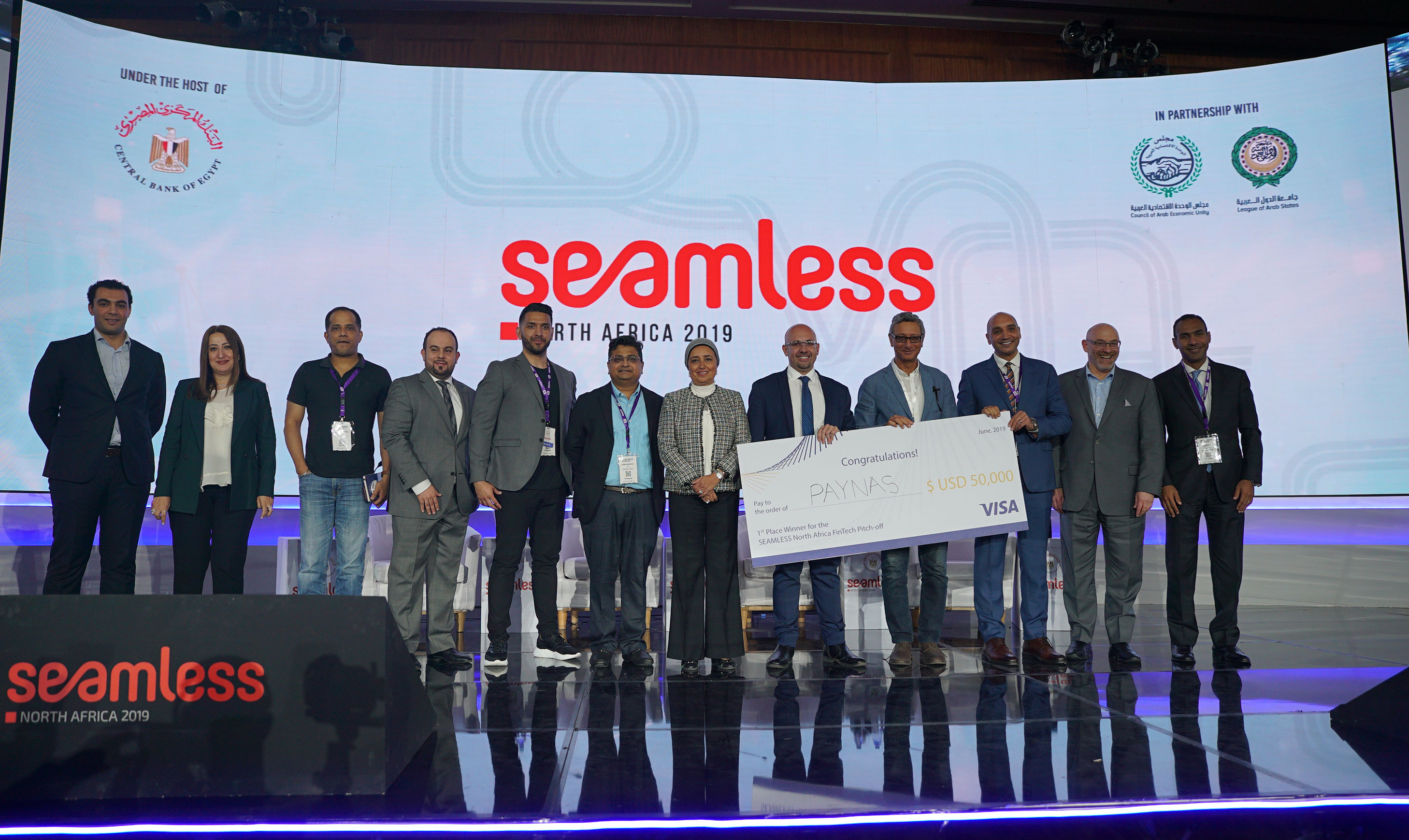

Paynas Wins Big At Seamless North Africa 2019

.jpg)

Seamless North Africa 2019

Announcing The Inaugural AFI FinTech Showcase

Fintech Trends In 2019 - Blockchain Adoption

.jpg)

Discounted Start-Up Passes

0

0

29.2k

29.2k

Comments