Artificial Intelligence Is Transforming Banking As We Know It

1 Sept 2019

Traditional banks and FinTech companies are often portrayed as rivals that are in constant opposition for popularity and new customer acquisition. This notion is not entirely false, especially when considering that some of their paths rarely meet such as with disruptive digital-only banks. However, innovative technologies are emerging at a rapid pace and their impact on banking is felt at an almost-daily basis. Artificial Intelligence (AI) happens to be at the forefront of this impact, eventually leading to inevitable change in the finance sector.

From complex machine learning applications to combat money laundering and automated big data processes for fraud detection to customer service chatbots, smart contracts and credit scoring, people have probably already interacted with banking AI software without necessarily knowing it. Here are some of the most happening banking areas that AI is changing:

Customer Support & Front Office

Although consumer-centric digital banking technically dates back to the 1960s with the introduction of ATMs, today we see that clients’ customer support expectations haven’t really changed since then. Millennials are often blamed for “killing” industries and that includes brick-and-mortar banks, and in the present they can hardly be held accountable for not wanting to engage wit banking services except at a digital level. AI-powered chatbots, voice assistants and smarter-than-regular applications are now the norm in the digital age, and this impact is further amplified into the future by AI-enabled biometrics and similar state-of-the-art solutions.

Fraud Protection & Middle Office

Security of funds and fraud countermeasures are still an ongoing concerns when it comes to digital finance, and artificial intelligence might be the one application that actually revolutionized this area, commonly known in the industry as middle office functions. Middle office is where banks and financial institutions perform risk management and security processes, including fraud detection, anti-money laundering efforts and KYC verification to identify customers; platforms that have all greatly benefitted from AI incorporation into their systems.

Lending and Risk Management

When U.C. Berkeley researchers published a study called “Consumer-Lending in the FinTech Era”, there were two major takeaways from it; firstly, FinTech lenders were revealed to discriminate less than overall lending firms by about one-third, whereas secondly, discrimination still occurs at variable levels. Enter AI applications that ought to enable more equitable credit underwriting in the future, providing that existing AI algorithms will be constantly fine-tuned to make that happen. Expanding beyond lending, AI has also affected risk assessment and management in banks.

For now, artificial intelligence is positively contributing to a seamless, more efficient e-finance age that is still experimental in some aspects. However, banking and financial services are bound to be safer and more secure as we move forward into the future.

related articles

A New Milestone in Egypt’s FinTech Journey

The FinTech Reality Show

Egypt Shines at the FinTech Arab Challenge 2025!

Announcing the Winners of FinTech Got Talent 2025!

Why does innovation often fail in organizations, and how can we truly enable it?

How can banks successfully enable AI — safely, strategically, and at scale?

We’re excited to announce the kick-off of the FinTech Hackathon

.jpg)

Attention all FinTech/FinTech-enabled Startups and PSPs!

.jpg)

Calling all Investors!

.jpg)

Calling all the accelerators and incubators!

AI is not the future. It’s NOW.

Most important moments from FinTekrs Assiut Round!

Celebrating Innovation: Top 10 Universities in the FinTech Got Talent Competition!

Proudly Announcing Mansoura Demo Day From Fintekrs Program Round 3!

Announcement: FinTech Got Talent Competition - 2nd Edition!

Don’t miss the chance to be part of a live conversation on the latest in FinTech, right at the Central Bank of Egypt Booth during the Cairo ICT!

Thrilled to announce that FinTekrs is taking the FinTech track by storm at Techne Summit!

.png)

The Central Bank of Egypt Supports Women’s Empowerment to Expand their Businesses

Agri-FinTech Applications by Fresh Source

4th Episode of 7areef FinTech Podcast – Supply Chain Finance

3rd Episode of 7areef FinTech Podcast – Digital Payments

2nd Episode of 7areef FinTech Podcast – ROSCA

1st Episode of 7areef FinTech Podcast - FinTekrs Introduction

Are you interested to be “7areef FinTech”?!

.jpg)

“FinTech Egypt” Launches the First Digital Academy to Upskill the Workforce Skills in the Banking, Financial, and FinTech Sector

FINTECH IS EGYPT’S NEXT BIG OPPORTUNITY..Catch up with FINTEKRS

The Future is FinTech..JOIN FINTEKRS NOW!

FinTekrs’ Alex Round Sponsor

FinTech Worldwide Statistics...FINTEKRS is Not-To-Miss!

Who Can Apply to FINTEKRS

Knowledge from FINTEKRS!

4 Reasons to Join FINTEKRS!

Launching FINTEKRS

FinTech Egypt releases its FinTech Investments-focused H1 2022 Landscape Review “Why Egypt is a promising market for FinTech Investments?”

The Women Techsters Initiative Fellowship Class of 2023

We're bringing top LPs and GPs from around the world

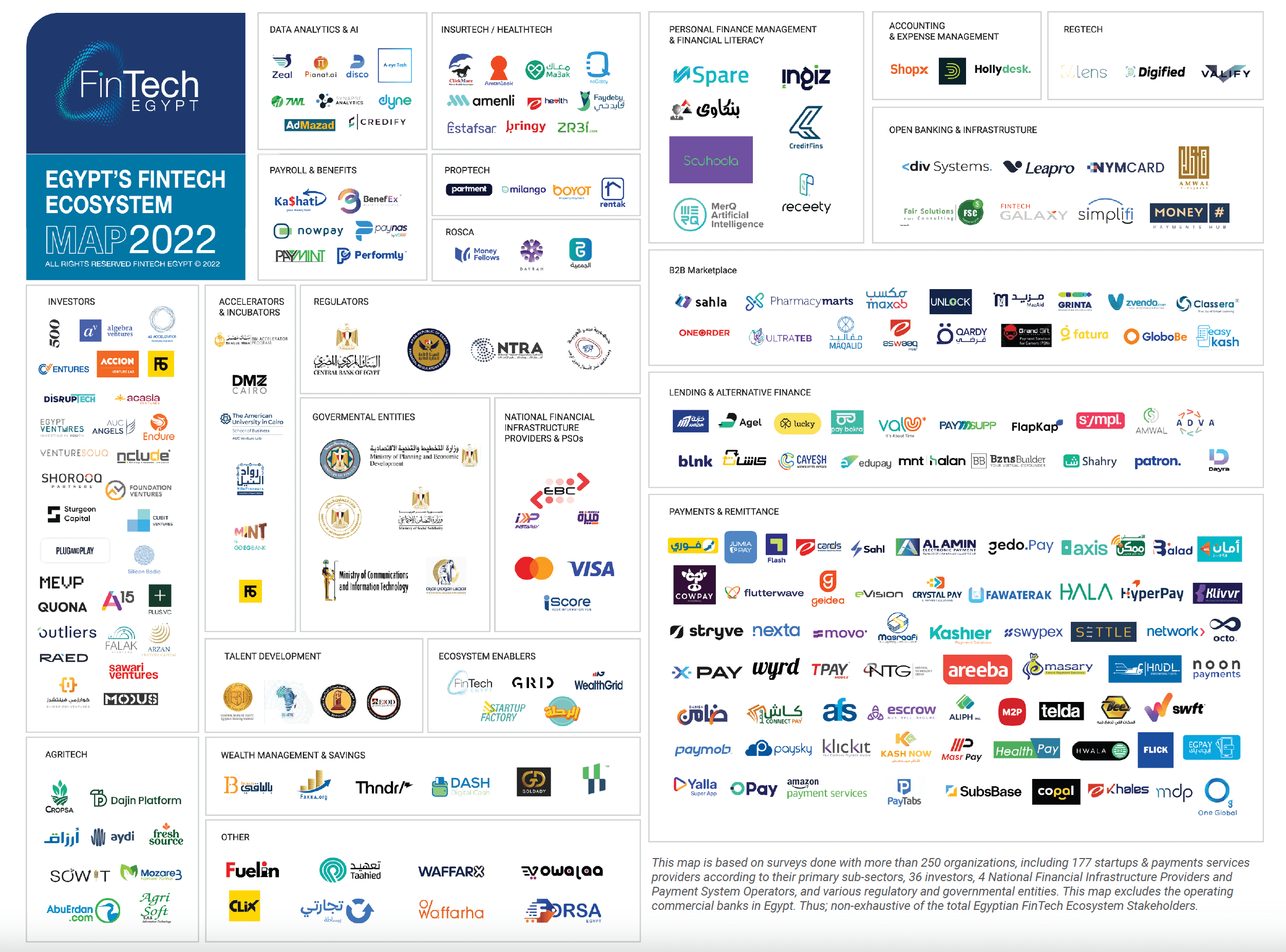

The Egyptian FinTech ecosystem is booming

We've joined forces to bring the best LPs and GPs together

We're taking a closer look at Egypt

Come and join the key players in the Middle East & Africa’s VC market

Connect with Egypt

Frontier of Egypt, Africa & the middle East in the 2022

Egypt’s First VC Summit kicks off in partnership between GIZ Egypt, AfricaGrow and Fintech Egypt

BANQUE MISR, NATIONAL BANK OF EGYPT, AND BANQUE DU CAIRE LEAD INVESTMENT IN NEW FINTECH FUND

The Increasing Influence of Women in FinTech

FinTech Egypt is releasing the first comprehensive report of its kind providing an overview of the unprecedented growth of FinTech in the Egyptian market

5 FinTech Trends to Follow in 2022

How FinTech is Disrupting an Age-Old Industry

RESHAPING FINTECH WITH AI: TOP AI INNOVATIONS IN THE FINANCIAL INDUSTRY

Accelerate’ha’ Female-Focused Problem Statements Now Live!

Breaking Entry Barriers for Women in FinTech

Have Traditional Banks Realized the Full Potential of Fintech By Now?

Episode 5: Accelerating FinTech Innovation through Open APIs

Episode 4: Understanding Blockchain’ s Potential in Disrupting FinTech

.png)

Episode 3: Discovering FinTech Talent through “FinYology - FinTech for Youth”

Episode 2: The Current & Future state of FinTech during COVID-19

FinTech Egypt Dialogue podcast launches its first-ever session about E-KYC Regulations and Regulatory Sandbox

Where does Artificial Intelligence fit in FinTech?

Critical FinTech Questions That Only the Near Future Can Answer

Special Interview With Dor-E, Winner Of The AI-Customer Experience FinTech Innovation Challenge

Egyptian Banking Institute Announces “The Future Of FinTech And Latest Digitalization Trends” Field Trip

Artificial Intelligence Is Transforming Banking As We Know It

Hub71 Partners With Techstars In Launching An Accelerator Program To Boost Startups

FINTECH IN THE SAVANNAH: Afro-Asia FinTech festival 2019 that took place in Nairobi Kenya

How Machine Learning Supports Credit Profiling

The Central Bank of Egypt’s Regulatory Sandbox started its first cohort in “e-KYC” to empower the FinTech ecosystem in Egypt.

Dubai Smart City Accelerator invites Egyptian startups to join Cairo Fast Track

Calling All Egyptian FinTech Startups To Participate In The Afro-Asia FinTech Festival!

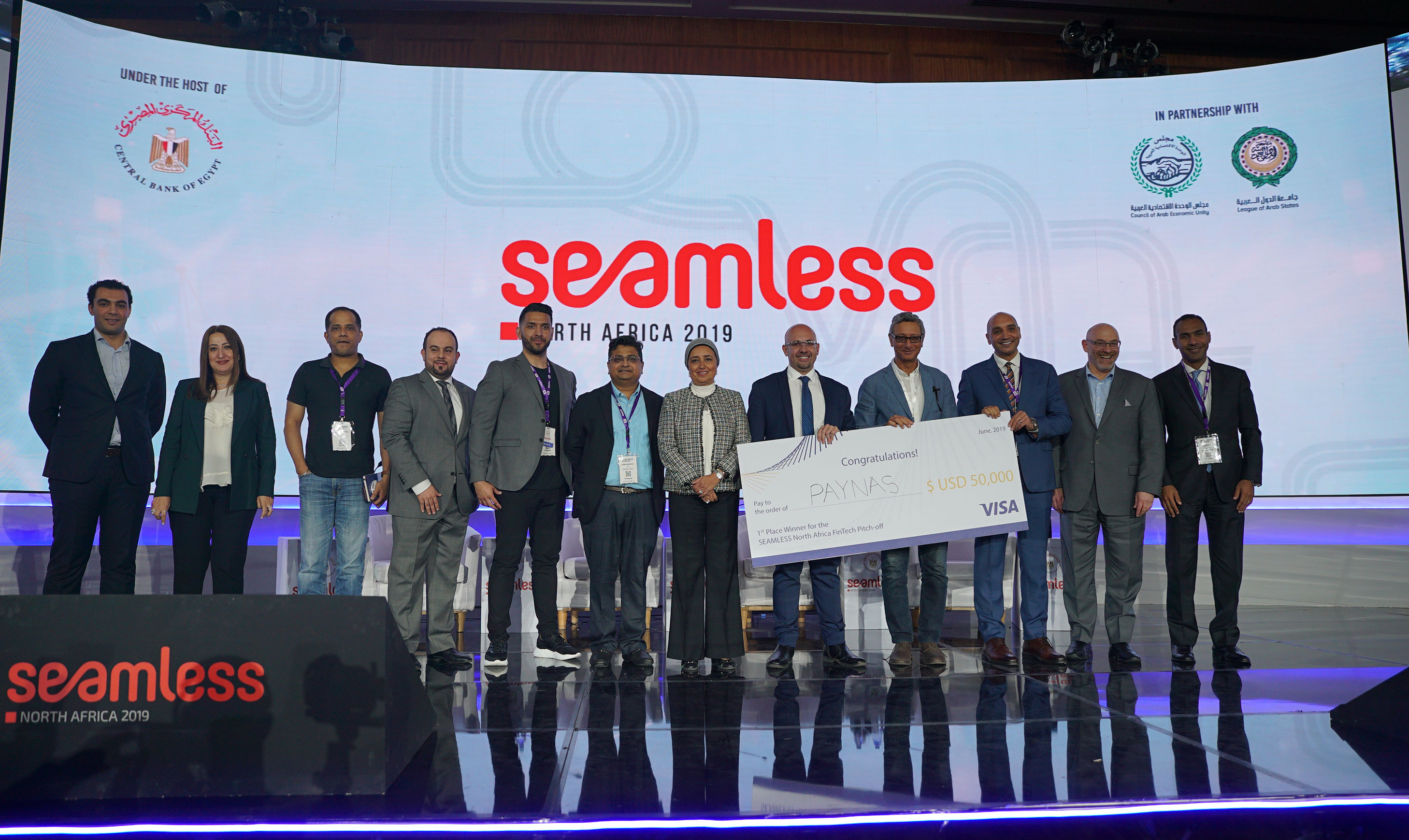

Paynas Wins Big At Seamless North Africa 2019

.jpg)

Seamless North Africa 2019

Announcing The Inaugural AFI FinTech Showcase

Fintech Trends In 2019 - Blockchain Adoption

.jpg)

Discounted Start-Up Passes

0

0

4.4k

4.4k

Comments