Where does Artificial Intelligence fit in FinTech?

6 April 2020

By now the global FinTech ecosystem has accepted several

innovative directions for the development and enhancement of FinTech as an

industry, and Artificial Intelligence (AI) might be the most adopted concept as

of yet, even if its implementation still needs fine-tuning and optimization.

Its benefits are clear; AI solves human problems by

utilizing methods that are derived from human intelligence and increasing these

methods’ efficiency and output. It achieves this by saving time, effort and

human intervention efforts across a wide array of automated services. Emerging

technologies like Machine Learning (ML), Artificial Intelligence (AI), Neural

Networks and Big Data Analytics have enabled computers to crunch and analyze

huge and diversified datasets like never before.

It’s ironic that the pre-digital-age banking industry used

to boast about having personal connections with their customers and be proud of

the fact that they provide personalized support to any customer in need of it,

and then the digital age came to take away that aspect of personal care. The

irony is that AI as a concept actually uses more technology to bridge that gap

of lost personalized attention and human-to-human interaction, by providing

efficient customer support and problem-solving skills that no human could

achieve in so little time; a perfect example is Chatbots that are used in

customer support to achieve quick and consistent customer satisfaction.

Let’s define the specific areas in which AI can greatly

enhance FinTech products & services.

Potential

AI Use Cases in FinTech

Better

Decision-Making

Top-level management decisions are made safer & easier

when they are data-driven; add lower costs to these decisions and you have a

winning formula. AI helps empower these decisions based on agreed-upon

processes and robust architectures, allowing top management to use their time

in other areas more efficiently. In the future, questions will be asked to intelligent

machines, rather than humans, and in turn will analyze the data fed to them and

return with proper, reliable answers in little to no time. This will guarantee

faster and more efficient decision-making across the board.

Automated

Customer Support

Customer support has always been a focus of banks and

financial institutions in order to set themselves apart from the competition.

Customers are always looking to get fast, reliable answers on demand, and

AI-based software like Chatbots or Voice assistants do just that. Standard

inquiries by customers are answered almost instantaneously, while more complex

questions are also slowly but surely being handled by automation software,

resulting in saving time & money for FinTech companies while keeping customers

satisfied at most levels. AI today is still being supported by humans when

needed, but the future of customer service will definitely be fully automated

at some point.

Fraud

Detection & Claims Management

Perhaps one of the most tedious aspects of digital banking,

fraud detection and claims management are as essential to any tech platform as

they are time-consuming; but much less so with AI. While analytical tools are

used to collect evidence and break down data needed for conviction, AI tools

teach themselves and learn user behavioral patterns to identify warning signs and

flag suspicious activity like fraud and theft attempts.

Machine Learning (ML) can greatly help out in various

stages of claim handling processes, like fastening certain claims and reducing

the processing time and cost of claim management. Over time, AI will learn to

adapt to new undiscovered cases and increase detection capabilities.

Insurance

Management

Automation of the underwriting process and the

transformation of crude data into meaningful information can be handled by

smart AI processes. AI can also gather insurance requirements from users

online, speeding up the process and eliminating expensive tests. Since

insurance is usually triggered after the loss has occurred, AI can help prevent

that by better detecting risks and diseases to prevent them from occurring in

the firsts help place, through extensive data collection and complicated algorithms.

This data greatly helps in lowering the probability of damages to the insured

and thus helping out the insurer as well.

Automated

Virtual Financial Assistants

Virtual financial assistants based on automation can really

help out users to make important financial decisions, including event

monitoring like stock and bond price fluctuations and trends. According to

users’ financial goals and portfolios, recommendations can be delivered for

buying & selling stocks or bonds. These ‘Robo-advisors”, as they are known,

are being provided more and more by financial institutions and FinTech startups

alike.

Predictive

Analysis in Financial Services

Predictive analytics in financial services is a crucial part

of any FI’s strategy, affecting revenue generation, resource optimization and sales.

It can help deliver personalized experiences, calculate credit scores and help

prevent risky loans. Analytical processes gather data from a wide range of

sectors and organize this data with state-of-the-art algorithms and deep data

analysis to provide customized solutions that are unique to every customer.

Wealth Management for the Masses

Wealth management advisory services are offered to lower net

worth market segments, leading to the provision of lower fee-based commissions.

When AI is applied to smart wallets and digital wealth services, the result is

a self-learning algorithm that monitors and learns from user behavior to guide

users on personal finance management like spending to save their expenses and

ultimately their wealth.

The potential benefits of applying Artificial Intelligence

are becoming clearer as the medium progresses. High automation levels are

taking over and machines are slowly enhancing basic processes already. FinTech

is no exception, with a thriving industry that is hungry for reliability, ease

of access and speed waiting to see what’s next. This entails that FinTech

companies should adjust their strategies to better encompass AI and its

corresponding requirements, in anticipation of machine-leveraged future.

related articles

A New Milestone in Egypt’s FinTech Journey

The FinTech Reality Show

Egypt Shines at the FinTech Arab Challenge 2025!

Announcing the Winners of FinTech Got Talent 2025!

Why does innovation often fail in organizations, and how can we truly enable it?

How can banks successfully enable AI — safely, strategically, and at scale?

We’re excited to announce the kick-off of the FinTech Hackathon

.jpg)

Attention all FinTech/FinTech-enabled Startups and PSPs!

.jpg)

Calling all Investors!

.jpg)

Calling all the accelerators and incubators!

AI is not the future. It’s NOW.

Most important moments from FinTekrs Assiut Round!

Celebrating Innovation: Top 10 Universities in the FinTech Got Talent Competition!

Proudly Announcing Mansoura Demo Day From Fintekrs Program Round 3!

Announcement: FinTech Got Talent Competition - 2nd Edition!

Don’t miss the chance to be part of a live conversation on the latest in FinTech, right at the Central Bank of Egypt Booth during the Cairo ICT!

Thrilled to announce that FinTekrs is taking the FinTech track by storm at Techne Summit!

.png)

The Central Bank of Egypt Supports Women’s Empowerment to Expand their Businesses

Agri-FinTech Applications by Fresh Source

4th Episode of 7areef FinTech Podcast – Supply Chain Finance

3rd Episode of 7areef FinTech Podcast – Digital Payments

2nd Episode of 7areef FinTech Podcast – ROSCA

1st Episode of 7areef FinTech Podcast - FinTekrs Introduction

Are you interested to be “7areef FinTech”?!

.jpg)

“FinTech Egypt” Launches the First Digital Academy to Upskill the Workforce Skills in the Banking, Financial, and FinTech Sector

FINTECH IS EGYPT’S NEXT BIG OPPORTUNITY..Catch up with FINTEKRS

The Future is FinTech..JOIN FINTEKRS NOW!

FinTekrs’ Alex Round Sponsor

FinTech Worldwide Statistics...FINTEKRS is Not-To-Miss!

Who Can Apply to FINTEKRS

Knowledge from FINTEKRS!

4 Reasons to Join FINTEKRS!

Launching FINTEKRS

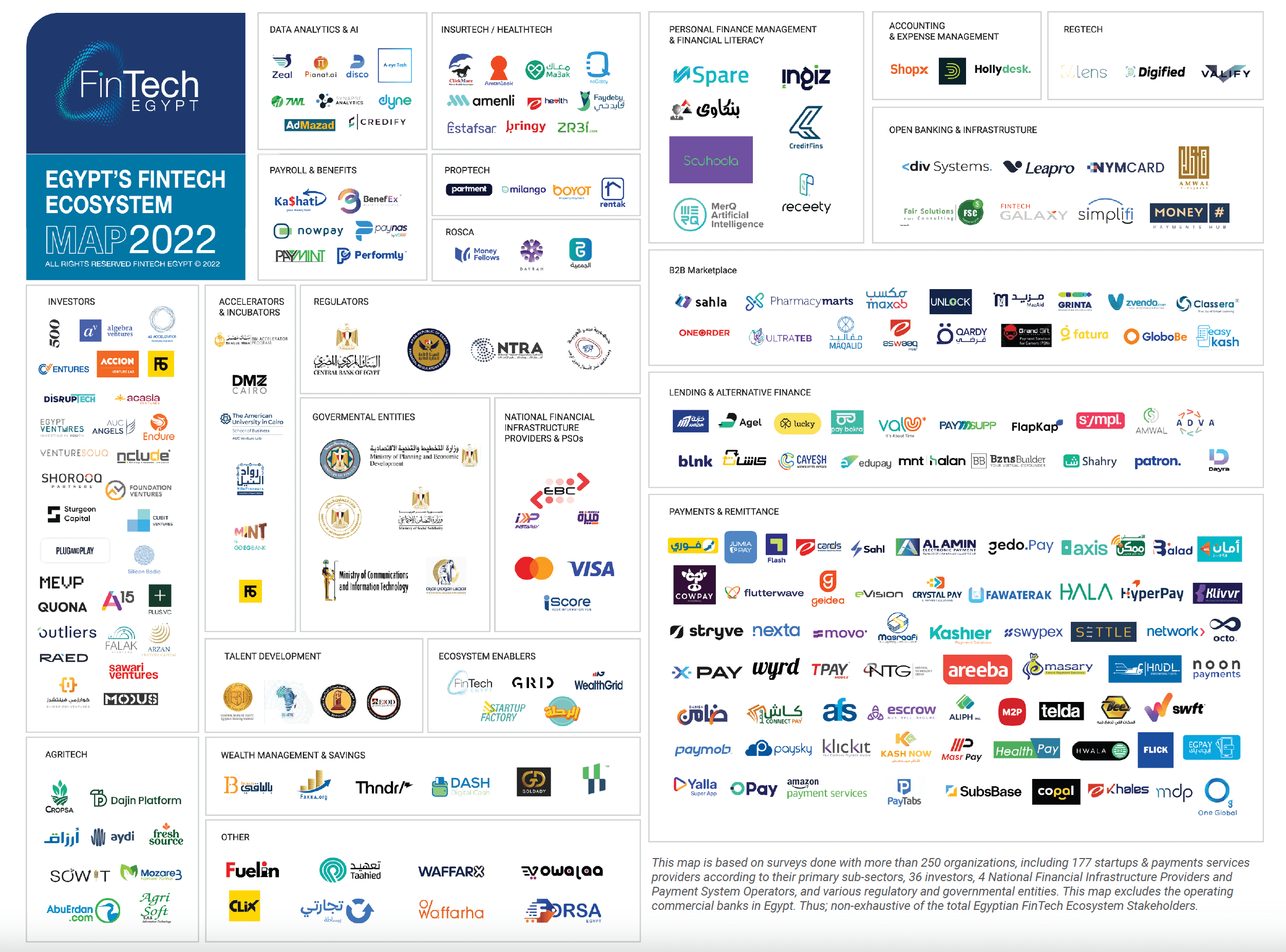

FinTech Egypt releases its FinTech Investments-focused H1 2022 Landscape Review “Why Egypt is a promising market for FinTech Investments?”

The Women Techsters Initiative Fellowship Class of 2023

We're bringing top LPs and GPs from around the world

The Egyptian FinTech ecosystem is booming

We've joined forces to bring the best LPs and GPs together

We're taking a closer look at Egypt

Come and join the key players in the Middle East & Africa’s VC market

Connect with Egypt

Frontier of Egypt, Africa & the middle East in the 2022

Egypt’s First VC Summit kicks off in partnership between GIZ Egypt, AfricaGrow and Fintech Egypt

BANQUE MISR, NATIONAL BANK OF EGYPT, AND BANQUE DU CAIRE LEAD INVESTMENT IN NEW FINTECH FUND

The Increasing Influence of Women in FinTech

FinTech Egypt is releasing the first comprehensive report of its kind providing an overview of the unprecedented growth of FinTech in the Egyptian market

5 FinTech Trends to Follow in 2022

How FinTech is Disrupting an Age-Old Industry

RESHAPING FINTECH WITH AI: TOP AI INNOVATIONS IN THE FINANCIAL INDUSTRY

Accelerate’ha’ Female-Focused Problem Statements Now Live!

Breaking Entry Barriers for Women in FinTech

Have Traditional Banks Realized the Full Potential of Fintech By Now?

Episode 5: Accelerating FinTech Innovation through Open APIs

Episode 4: Understanding Blockchain’ s Potential in Disrupting FinTech

.png)

Episode 3: Discovering FinTech Talent through “FinYology - FinTech for Youth”

Episode 2: The Current & Future state of FinTech during COVID-19

FinTech Egypt Dialogue podcast launches its first-ever session about E-KYC Regulations and Regulatory Sandbox

Critical FinTech Questions That Only the Near Future Can Answer

Special Interview With Dor-E, Winner Of The AI-Customer Experience FinTech Innovation Challenge

Egyptian Banking Institute Announces “The Future Of FinTech And Latest Digitalization Trends” Field Trip

Artificial Intelligence Is Transforming Banking As We Know It

Artificial Intelligence Is Transforming Banking As We Know It

Hub71 Partners With Techstars In Launching An Accelerator Program To Boost Startups

FINTECH IN THE SAVANNAH: Afro-Asia FinTech festival 2019 that took place in Nairobi Kenya

How Machine Learning Supports Credit Profiling

The Central Bank of Egypt’s Regulatory Sandbox started its first cohort in “e-KYC” to empower the FinTech ecosystem in Egypt.

Dubai Smart City Accelerator invites Egyptian startups to join Cairo Fast Track

Calling All Egyptian FinTech Startups To Participate In The Afro-Asia FinTech Festival!

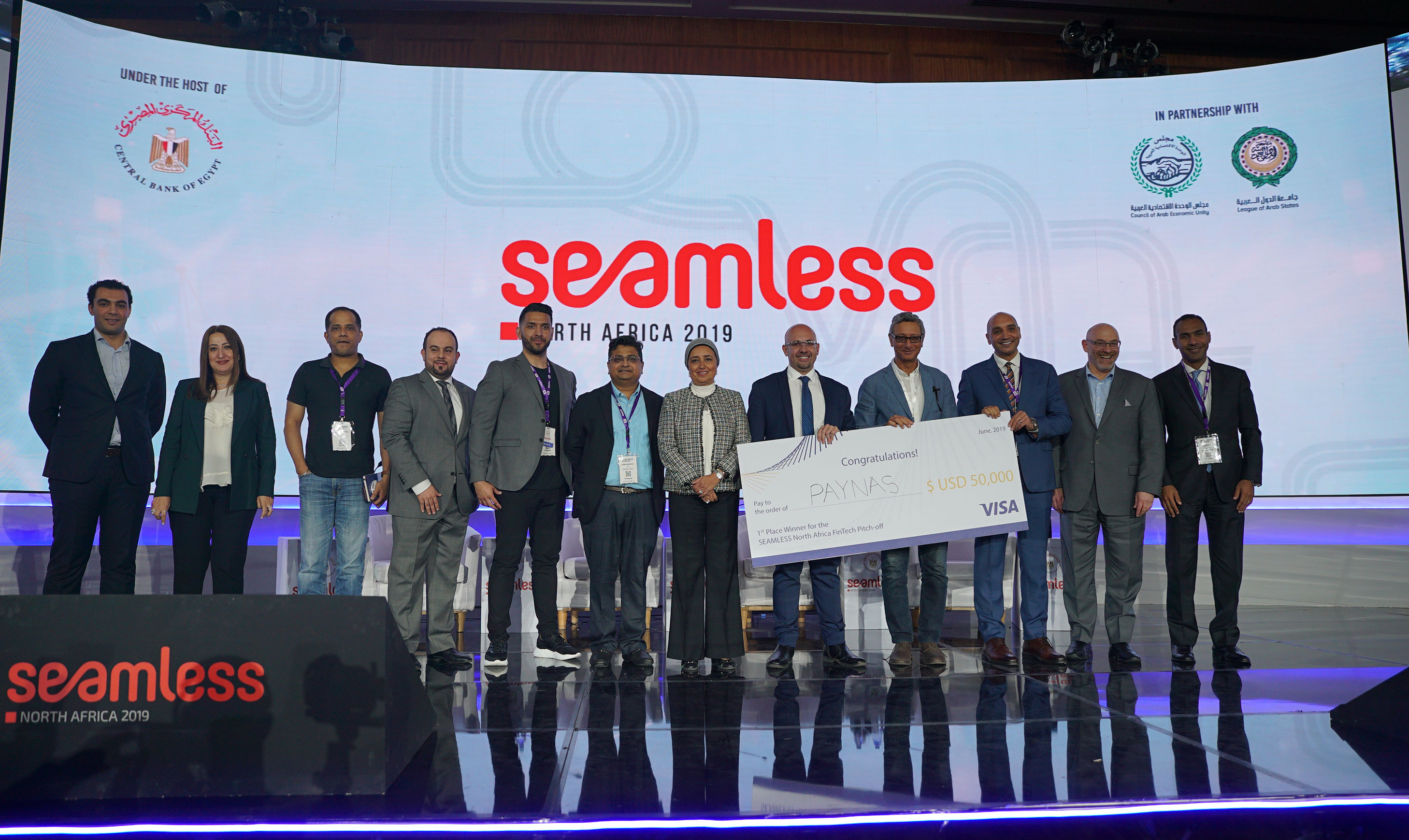

Paynas Wins Big At Seamless North Africa 2019

.jpg)

Seamless North Africa 2019

Announcing The Inaugural AFI FinTech Showcase

Fintech Trends In 2019 - Blockchain Adoption

.jpg)

Discounted Start-Up Passes

0

0

8.5k

8.5k

Comments