Fintech Trends In 2019 - Blockchain Adoption

11 June 2019

Fintech trends in 2019 Blockchain & Cryptocurrency Adoption

One of many foundational Fintech technologies that provide viable solutions to professional and personal financial transaction problems, Blockchain is expected to have a huge impact on rewiring the financial services industry in 2019. With the clear advantage of security, Blockchain technology is being adopted extensively due to its decentralized and self-sustaining nature, where it records transactions and updates via a distributed database without anyone needing access to the stored data.

The Blockchain technology basically represents a transparent digital ledger that validates, verifies and executes transactions via a decentralized, peer-to-peer network. Considering that payments typically go through a central intermediary that authenticates and authorizes transactions via several stages, Blockchain actually eliminates the need for this intermediary and additionally compresses these tedious steps in one comprehensive process that can be executed in a matter of seconds. In turn, this disruptive concept implies that it is not devoid of challenges, and Blockchain is still met with resistance from traditional financial institutions, which are defined by centralization and control of all payment transactions; many local & regional governments today are still reluctant to join the Blockchain scene, considering it a competitive technology in their industry as opposed to a complementing one.

However, PwC states that a staggering 77% of Fintech companies will adopt Blockchain by 2020, while a report by KPMG claims that 41% of tech leaders want to adopt Blockchain in business in the coming 3 years. Overall, financial experts are not giving up on its rising popularity and are adamant that Blockchain and its underlying applications will be widely accepted in 2019, with a particular emphasis on its positive contributions to Fintech products & services this year.

related articles

A New Milestone in Egypt’s FinTech Journey

The FinTech Reality Show

Egypt Shines at the FinTech Arab Challenge 2025!

Announcing the Winners of FinTech Got Talent 2025!

Why does innovation often fail in organizations, and how can we truly enable it?

How can banks successfully enable AI — safely, strategically, and at scale?

We’re excited to announce the kick-off of the FinTech Hackathon

.jpg)

Attention all FinTech/FinTech-enabled Startups and PSPs!

.jpg)

Calling all Investors!

.jpg)

Calling all the accelerators and incubators!

AI is not the future. It’s NOW.

Most important moments from FinTekrs Assiut Round!

Celebrating Innovation: Top 10 Universities in the FinTech Got Talent Competition!

Proudly Announcing Mansoura Demo Day From Fintekrs Program Round 3!

Announcement: FinTech Got Talent Competition - 2nd Edition!

Don’t miss the chance to be part of a live conversation on the latest in FinTech, right at the Central Bank of Egypt Booth during the Cairo ICT!

Thrilled to announce that FinTekrs is taking the FinTech track by storm at Techne Summit!

.png)

The Central Bank of Egypt Supports Women’s Empowerment to Expand their Businesses

Agri-FinTech Applications by Fresh Source

4th Episode of 7areef FinTech Podcast – Supply Chain Finance

3rd Episode of 7areef FinTech Podcast – Digital Payments

2nd Episode of 7areef FinTech Podcast – ROSCA

1st Episode of 7areef FinTech Podcast - FinTekrs Introduction

Are you interested to be “7areef FinTech”?!

.jpg)

“FinTech Egypt” Launches the First Digital Academy to Upskill the Workforce Skills in the Banking, Financial, and FinTech Sector

FINTECH IS EGYPT’S NEXT BIG OPPORTUNITY..Catch up with FINTEKRS

The Future is FinTech..JOIN FINTEKRS NOW!

FinTekrs’ Alex Round Sponsor

FinTech Worldwide Statistics...FINTEKRS is Not-To-Miss!

Who Can Apply to FINTEKRS

Knowledge from FINTEKRS!

4 Reasons to Join FINTEKRS!

Launching FINTEKRS

FinTech Egypt releases its FinTech Investments-focused H1 2022 Landscape Review “Why Egypt is a promising market for FinTech Investments?”

The Women Techsters Initiative Fellowship Class of 2023

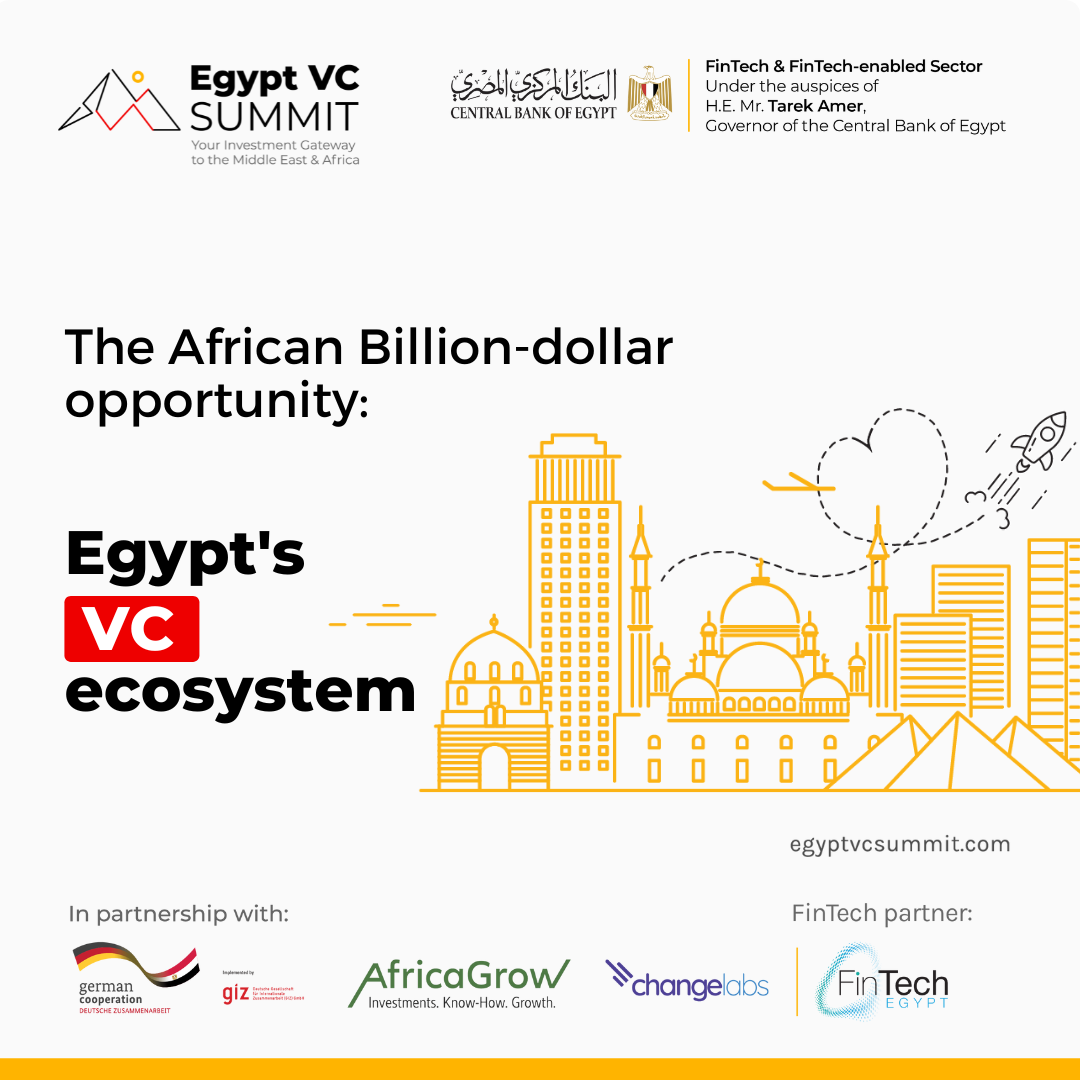

We're bringing top LPs and GPs from around the world

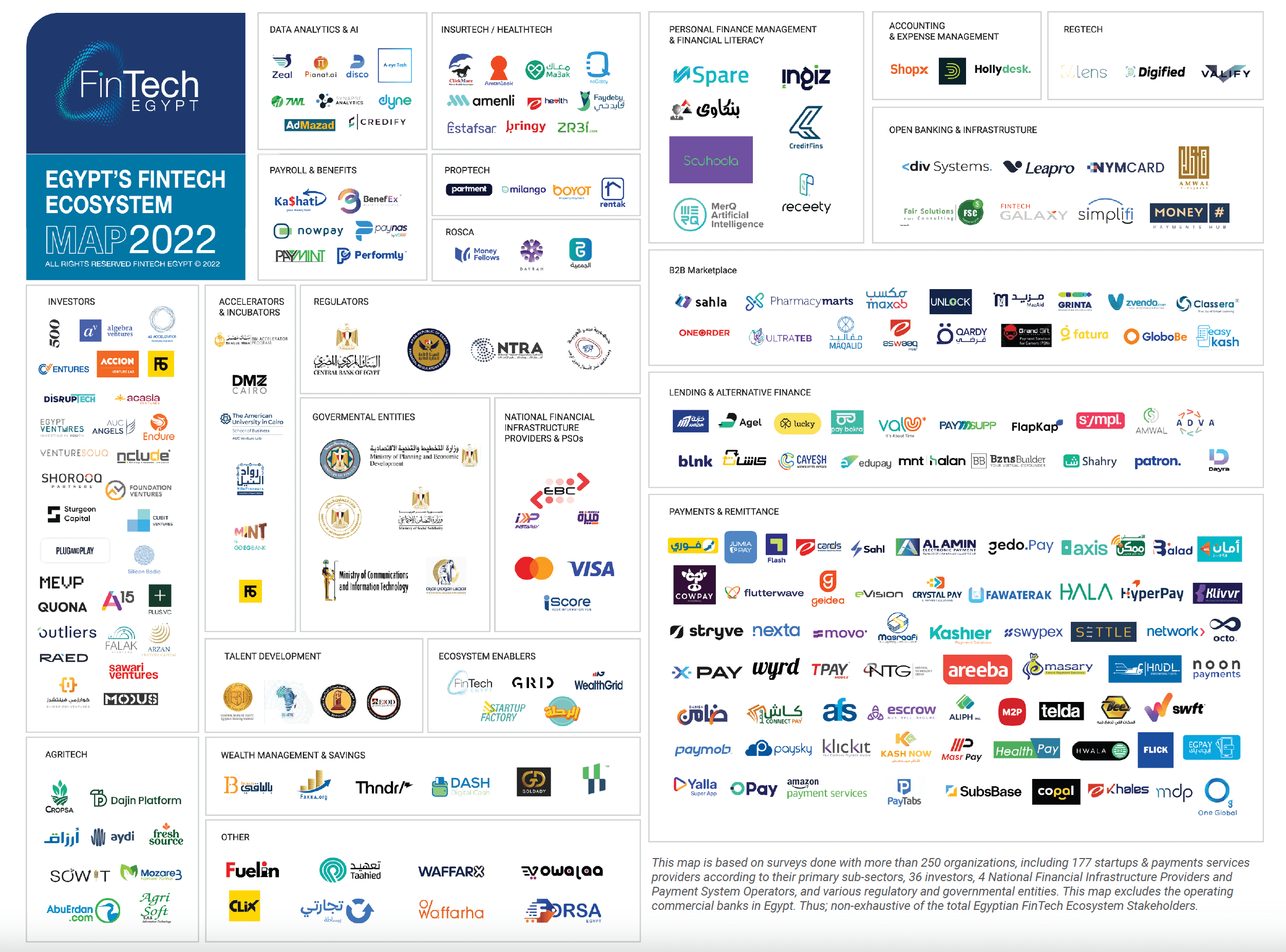

The Egyptian FinTech ecosystem is booming

We've joined forces to bring the best LPs and GPs together

We're taking a closer look at Egypt

Come and join the key players in the Middle East & Africa’s VC market

Connect with Egypt

Frontier of Egypt, Africa & the middle East in the 2022

Egypt’s First VC Summit kicks off in partnership between GIZ Egypt, AfricaGrow and Fintech Egypt

BANQUE MISR, NATIONAL BANK OF EGYPT, AND BANQUE DU CAIRE LEAD INVESTMENT IN NEW FINTECH FUND

The Increasing Influence of Women in FinTech

FinTech Egypt is releasing the first comprehensive report of its kind providing an overview of the unprecedented growth of FinTech in the Egyptian market

5 FinTech Trends to Follow in 2022

How FinTech is Disrupting an Age-Old Industry

RESHAPING FINTECH WITH AI: TOP AI INNOVATIONS IN THE FINANCIAL INDUSTRY

Accelerate’ha’ Female-Focused Problem Statements Now Live!

Breaking Entry Barriers for Women in FinTech

Have Traditional Banks Realized the Full Potential of Fintech By Now?

Episode 5: Accelerating FinTech Innovation through Open APIs

Episode 4: Understanding Blockchain’ s Potential in Disrupting FinTech

.png)

Episode 3: Discovering FinTech Talent through “FinYology - FinTech for Youth”

Episode 2: The Current & Future state of FinTech during COVID-19

FinTech Egypt Dialogue podcast launches its first-ever session about E-KYC Regulations and Regulatory Sandbox

Where does Artificial Intelligence fit in FinTech?

Critical FinTech Questions That Only the Near Future Can Answer

Special Interview With Dor-E, Winner Of The AI-Customer Experience FinTech Innovation Challenge

Egyptian Banking Institute Announces “The Future Of FinTech And Latest Digitalization Trends” Field Trip

Artificial Intelligence Is Transforming Banking As We Know It

Artificial Intelligence Is Transforming Banking As We Know It

Hub71 Partners With Techstars In Launching An Accelerator Program To Boost Startups

FINTECH IN THE SAVANNAH: Afro-Asia FinTech festival 2019 that took place in Nairobi Kenya

How Machine Learning Supports Credit Profiling

The Central Bank of Egypt’s Regulatory Sandbox started its first cohort in “e-KYC” to empower the FinTech ecosystem in Egypt.

Dubai Smart City Accelerator invites Egyptian startups to join Cairo Fast Track

Calling All Egyptian FinTech Startups To Participate In The Afro-Asia FinTech Festival!

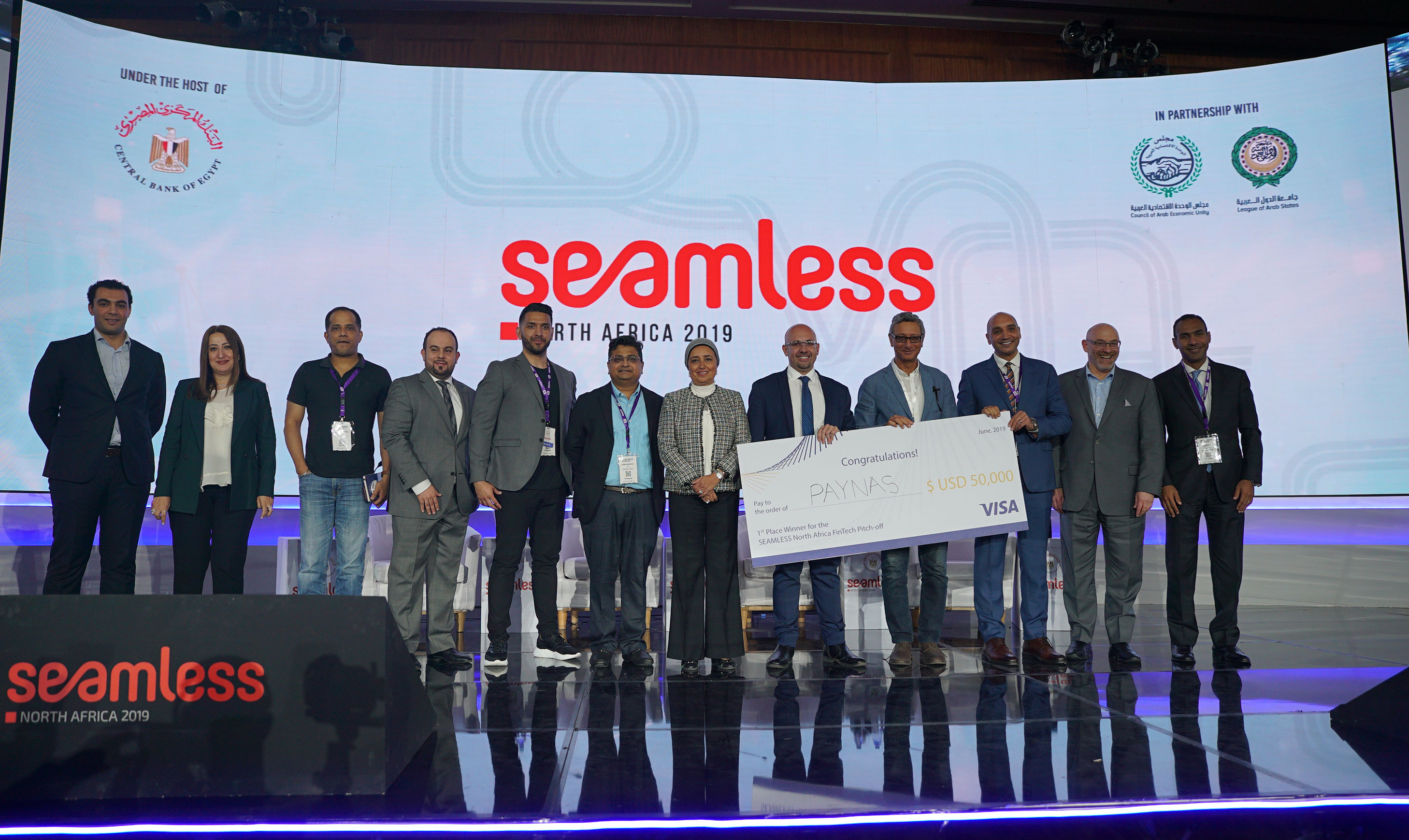

Paynas Wins Big At Seamless North Africa 2019

.jpg)

Seamless North Africa 2019

Announcing The Inaugural AFI FinTech Showcase

.jpg)

Discounted Start-Up Passes

0

0

5k

5k

Comments