Episode 3: Discovering FinTech Talent through “FinYology - FinTech for Youth”

22 March 2021.png)

Last year in February 2020, the Central Bank of Egypt launched

an initiative called “FinYology - FinTech For Youth”, in collaboration with the

Egyptian Banking Institute as its strategic partner, to raise awareness on

FinTech among university undergrad and postgrad students, in addition to

exploring young talent by encouraging and supporting the creation of innovative

FinTech solutions to modern-day financial problems in Egypt.

This ongoing initiative was the subject of the third episode

of the FinTech Egypt Dialogue podcast, and an excited audience sat listening

attentively as moderator Hossam Mahmoud, Advisor for Startup Finance, GIZ, kicked

things off and introduced the guest lineup. The three speakers attending the

third session were Dr. Lamya El Ayouby, Associate Professor of Entrepreneurship

at New Giza University, Mr Emad Shawky, Head of Digital Factory and Innovation

at Banque Misr, and Ms. Laila El Oteifi, Senior Director, Research &

Awareness Department at The Egyptian Banking Institute.

Mr Emad Shawky led the introduction phase by giving a brief

overview of his role at Banque Misr, where he has been for 3 years so far.

Being involved at the crossroads between technology and financial services for

more than 20 years, Mr Shawky has held tenure at various financial institutions

across his career, where he harnessed the power of technology to enable growth

into different markets and acquire more clients for these organizations.

The moderator went on to ask Mr Shawky to elaborate on the

gaps he thinks are found in the current FinTech talent market, as well as what

kind of talents they have now at Digital Factory and what kind of talents they

are looking to attract. He stated that, although the current team is made up of

a young, unique and agile workforce that is delivering a new generation of

FinTech services, he believes his organization is in need of a lot of fresh talent

that will do things in a different way, but that also comes with its challenges;

new graduates need to learn and research a lot to face the rapid pace of

technology and its implications on the industry, typically taking up a lot of

time and effort for them to prepare themselves, and he mentioned that this has

been facilitated by the FinYology initiative that adds FinTech to the students’

curricula, but it is still not enough to deal with the huge potential that

awaits them.

Following with Ms. Laila El Oteifi, Senior Director,

Research & Awareness Department at the Egyptian Banking Institute

introduced herself again to the audience, and highlighted her career which

spanned more than 13 years in the banking sector. She mentioned that her

research department at EBI allowed her to conduct many awareness-raising

seminars, conferences and workshops on financial literacy, and the department

also releases a series of periodical studies and publications covering a wide

selection of critical trends and themes of the industry, in addition to

organizing different training sessions and competitions for emerging bankers. When

asked about the young talent at EBI, Ms. El Oteifi mentioned the various

programs that they have for nurturing this talent, like finance certificates

and anti-money laundering programs, and other departments like IT that handle

education on FinTech, RegTech and other financial technology branches. EBI also

recently launched entrepreneurship programs and an in-house business incubator

that elevates students from ideation to incubation for the last couple of

years. These efforts that combine business knowledge and financial awareness offer

a comprehensive approach to creating the digital bankers and FinTech heroes of

tomorrow, embodied in the several seminars that EBI conducts at Egyptian

universities. Hosam Mahmoud asked about how students and interested people in

general can follow all these efforts and get updates, to what Ms. El Oteifi

replied that the EBI website contains all the information, and students can

either call the institute or contact their dedicated customer support team to

get answers to all their inquiries about any program offered.

Dr. Lamya El Ayouby, Associate Professor of Entrepreneurship

at New Giza University, then took to the digital stage to answer a question

about her journey as a FinTech educator that keeps students aware and updated

with the latest FinTech trends and practices. Dr. Lamya has been teaching

entrepreneurship for 10 years, and she stated that her main approach is to get

her students real-world case studies that they can study and understand through

a hands-on approach. Although her programs did not previously focus on FinTech

but rather the business side, she was later introduced to the FinYology

initiative by Dr. Rasha Negm, Head of FinTech & Innovation at the Central

Bank of Egypt (CBE), after which she researched FinTech as an industry and

found it to be a treasure trove for her business students. Unfortunately that

passion was implemented during the ongoing COVID-19 pandemic, which has led to

her conducting her lessons about FinTech online with her students, which proved

to be challenging in terms of having to introduce a new, somewhat complicated

topic like FinTech remotely.

Dr. Lamya also emphasized that although the current FinTech

ecosystem in Egypt has been addressing many pending problems and has been

greatly empowering and supporting startups, banks and financial institutions,

FinTech education tends to focus on those entities while leaving out two

important elements that will complete the cycle once addressed; the current

level of financial literacy needs to be raised quickly, as she believes these

will be the early adopters of new technologies, and also the gap in talent

availability in Egypt as Mr. Shawky mentioned.

The “FinYology - FinTech for Youth” initiative has been

getting traction with university students across Egypt, with more than 600

students participating in creating over 280 projects and resulting in 35

awarded internships won by students. The third episode of the FinTech Egypt

Dialogue has certainly yielded some great insights and information from leading

experts that can help bridge the gap between FinTech-passionate students and

the required talent pool that will eventually spearhead the digital change into

the next phase of FinTech solutions in Egypt.

related articles

A New Milestone in Egypt’s FinTech Journey

The FinTech Reality Show

Egypt Shines at the FinTech Arab Challenge 2025!

Announcing the Winners of FinTech Got Talent 2025!

Why does innovation often fail in organizations, and how can we truly enable it?

How can banks successfully enable AI — safely, strategically, and at scale?

We’re excited to announce the kick-off of the FinTech Hackathon

.jpg)

Attention all FinTech/FinTech-enabled Startups and PSPs!

.jpg)

Calling all Investors!

.jpg)

Calling all the accelerators and incubators!

AI is not the future. It’s NOW.

Most important moments from FinTekrs Assiut Round!

Celebrating Innovation: Top 10 Universities in the FinTech Got Talent Competition!

Proudly Announcing Mansoura Demo Day From Fintekrs Program Round 3!

Announcement: FinTech Got Talent Competition - 2nd Edition!

Don’t miss the chance to be part of a live conversation on the latest in FinTech, right at the Central Bank of Egypt Booth during the Cairo ICT!

Thrilled to announce that FinTekrs is taking the FinTech track by storm at Techne Summit!

.png)

The Central Bank of Egypt Supports Women’s Empowerment to Expand their Businesses

Agri-FinTech Applications by Fresh Source

4th Episode of 7areef FinTech Podcast – Supply Chain Finance

3rd Episode of 7areef FinTech Podcast – Digital Payments

2nd Episode of 7areef FinTech Podcast – ROSCA

1st Episode of 7areef FinTech Podcast - FinTekrs Introduction

Are you interested to be “7areef FinTech”?!

.jpg)

“FinTech Egypt” Launches the First Digital Academy to Upskill the Workforce Skills in the Banking, Financial, and FinTech Sector

FINTECH IS EGYPT’S NEXT BIG OPPORTUNITY..Catch up with FINTEKRS

The Future is FinTech..JOIN FINTEKRS NOW!

FinTekrs’ Alex Round Sponsor

FinTech Worldwide Statistics...FINTEKRS is Not-To-Miss!

Who Can Apply to FINTEKRS

Knowledge from FINTEKRS!

4 Reasons to Join FINTEKRS!

Launching FINTEKRS

FinTech Egypt releases its FinTech Investments-focused H1 2022 Landscape Review “Why Egypt is a promising market for FinTech Investments?”

The Women Techsters Initiative Fellowship Class of 2023

We're bringing top LPs and GPs from around the world

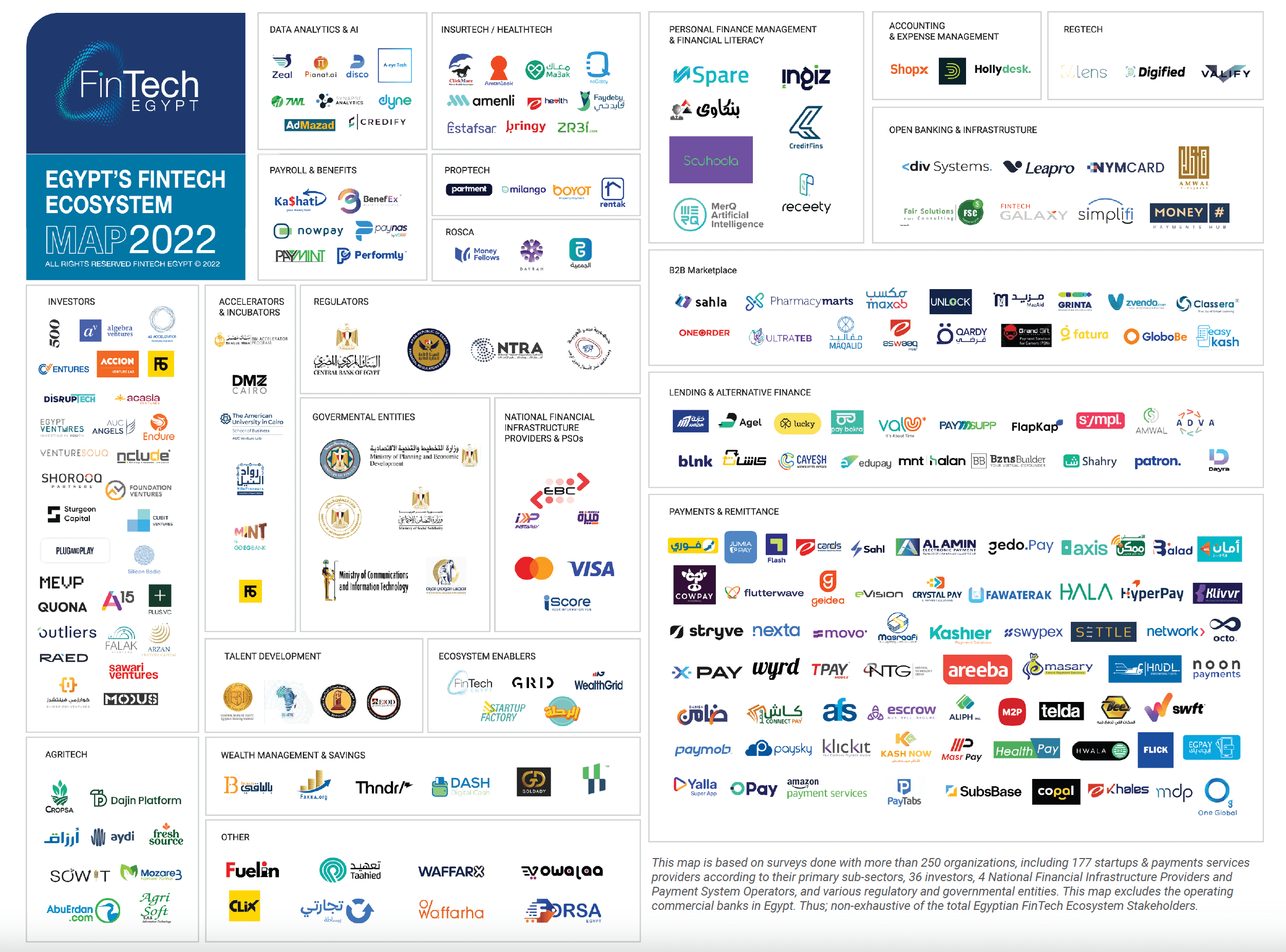

The Egyptian FinTech ecosystem is booming

We've joined forces to bring the best LPs and GPs together

We're taking a closer look at Egypt

Come and join the key players in the Middle East & Africa’s VC market

Connect with Egypt

Frontier of Egypt, Africa & the middle East in the 2022

Egypt’s First VC Summit kicks off in partnership between GIZ Egypt, AfricaGrow and Fintech Egypt

BANQUE MISR, NATIONAL BANK OF EGYPT, AND BANQUE DU CAIRE LEAD INVESTMENT IN NEW FINTECH FUND

The Increasing Influence of Women in FinTech

FinTech Egypt is releasing the first comprehensive report of its kind providing an overview of the unprecedented growth of FinTech in the Egyptian market

5 FinTech Trends to Follow in 2022

How FinTech is Disrupting an Age-Old Industry

RESHAPING FINTECH WITH AI: TOP AI INNOVATIONS IN THE FINANCIAL INDUSTRY

Accelerate’ha’ Female-Focused Problem Statements Now Live!

Breaking Entry Barriers for Women in FinTech

Have Traditional Banks Realized the Full Potential of Fintech By Now?

Episode 5: Accelerating FinTech Innovation through Open APIs

Episode 4: Understanding Blockchain’ s Potential in Disrupting FinTech

Episode 2: The Current & Future state of FinTech during COVID-19

FinTech Egypt Dialogue podcast launches its first-ever session about E-KYC Regulations and Regulatory Sandbox

Where does Artificial Intelligence fit in FinTech?

Critical FinTech Questions That Only the Near Future Can Answer

Special Interview With Dor-E, Winner Of The AI-Customer Experience FinTech Innovation Challenge

Egyptian Banking Institute Announces “The Future Of FinTech And Latest Digitalization Trends” Field Trip

Artificial Intelligence Is Transforming Banking As We Know It

Artificial Intelligence Is Transforming Banking As We Know It

Hub71 Partners With Techstars In Launching An Accelerator Program To Boost Startups

FINTECH IN THE SAVANNAH: Afro-Asia FinTech festival 2019 that took place in Nairobi Kenya

How Machine Learning Supports Credit Profiling

The Central Bank of Egypt’s Regulatory Sandbox started its first cohort in “e-KYC” to empower the FinTech ecosystem in Egypt.

Dubai Smart City Accelerator invites Egyptian startups to join Cairo Fast Track

Calling All Egyptian FinTech Startups To Participate In The Afro-Asia FinTech Festival!

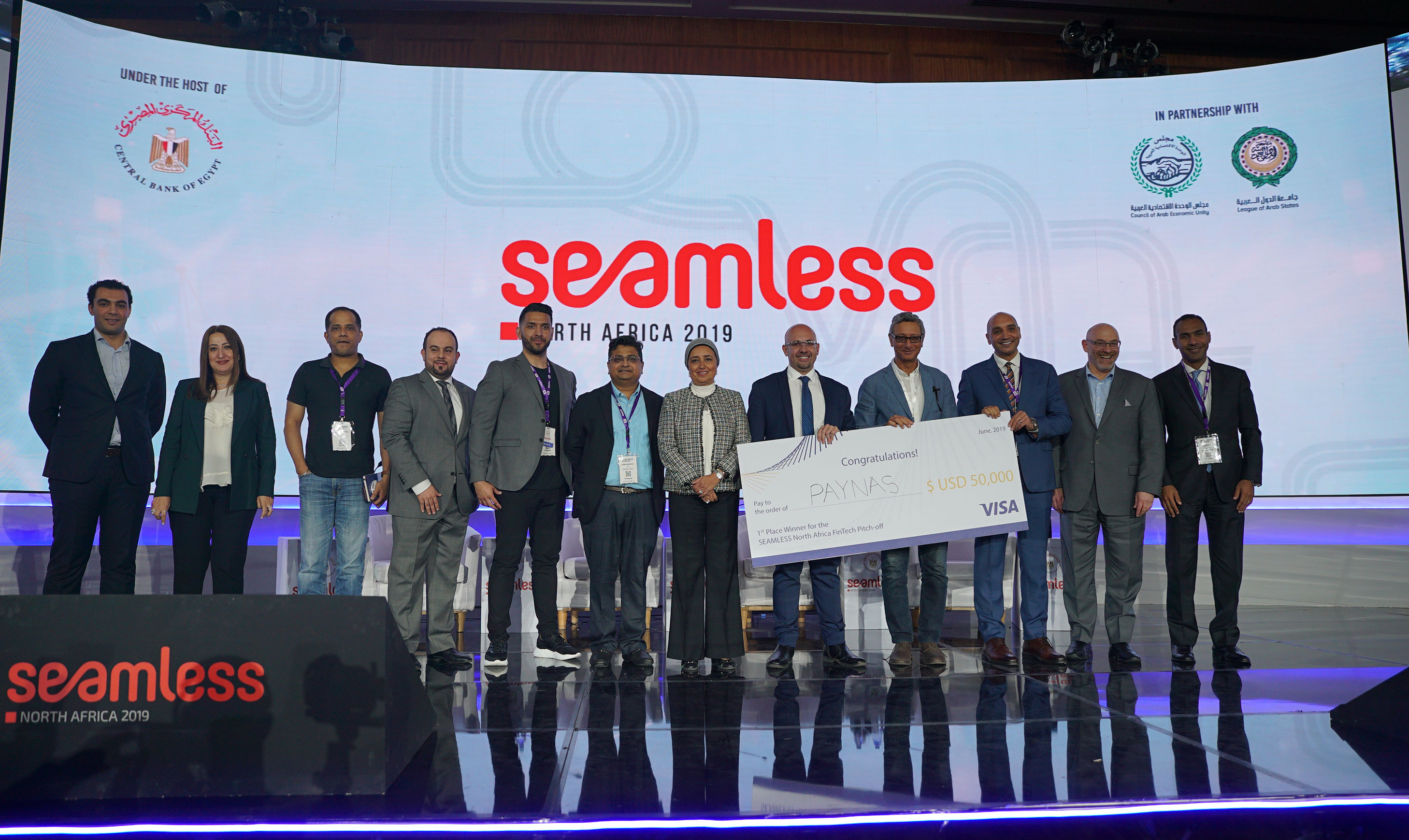

Paynas Wins Big At Seamless North Africa 2019

.jpg)

Seamless North Africa 2019

Announcing The Inaugural AFI FinTech Showcase

Fintech Trends In 2019 - Blockchain Adoption

.jpg)

Discounted Start-Up Passes

0

0

12.1k

12.1k

Comments