Episode 4: Understanding Blockchain’ s Potential in Disrupting FinTech

21 April 2021

Most people by now have heard

increasingly popular terms like Blockchain and digital currencies at least in

their lives, but that doesn’t necessarily mean that they grasp the full

potential of this extensive technology and its applications in the FinTech

industry.

In its fourth podcast, FinTech

Egypt Dialogue tackled the mysterious and controversial topic of Blockchain technology

and how the world is slowly but surely understanding its impact across finance

and beyond. Information Technology expert and moderator Dr. Mohamed El Gendy

led the conversation as he dissected the various aspects of Blockchain in the

company of his three guests: the Head of International Cooperation at the

Egyptian Money Laundering & Terrorist Financing Combating Unit (EMLCU) Dr

Amr Rashed, the Secretary General at Egypt Post Mr. Ahmed Mansour, and the Head

of Business Development at Flare Networks Mr. Mohamed Taysir.

The webinar kicked off in

excitement as the moderator introduced his guests to the audience and mentioned

that they’re addressing FinTech and Blockchain specifically today. Mr. Ahmed

Mansour inaugurated the talk when asked about the history of Blockchain and his

general perspective of it to better break down the complicated subject for the

audience. The first point he made was that Blockchain technology research was already

being done since 1991, when it was better known as Distributed Ledger

Technology (DLT) which could be seen in the form of torrents or various

applications of cloud technology at the time. Mr. Mansour mentioned that a few

years after Bitcoin emerged, Blockchain technology started gaining traction in

the commercial world and the term was increasingly used in a variety of use

cases by employing its infrastructure in different sectors, such as finance,

medical, and even elections.

When asked by Dr.Mohamed El Gendy

about the origin of the term ‘Blockchain’ and how it came to be the

revolutionary technology it is becoming today, Mr. Mansour elaborated that it’s

basically the same concept of DLT which evolved over time; the concept of a

shared database between several nodes that relies on heavy encryption and tight

digital security. He said there are more than one types of Blockchain, like private

Permissioned Blockchain which relies on permission-based access which adds an access

control layer to allow specific actions to only be performed by clearly

identifiable participants, and Public (Permission-less) Blockchain which is

more widely used for cryptocurrencies like Bitcoin and is based on distribution

by consent of the involved parties and without any presiding authority.

He gave a great analogy of how it

works by comparing the Blockchain concept to the ongoing FinTech Egypt Dialogue

podcast, in that the audience members were listening in on the conversation and

taking down notes and sharing information, which implies that all answers and

information told on the podcast are now made available to anyone listening, and

that this information has become automatically distributed among any and all

participants in the FinTech Egypt Dialogue podcast, very similar to the idea of

Blockchain as a decentralized network that verifies and validates the shared

information in a way that defies any manipulation of that information.

Dr. Mohamed El Gendy then moved

on to ask Mr. Mohamed Taysir to chip in and explain how Blockchain can enable

the existence of startups and what role it plays at his company Flare Networks.

He started off by explaining that Flare Networks is currently one of the most

publicly supported Blockchain projects that connects Blockchain ecosystems

together, and that his company uses smart contract functionality, therefore running

smart contracts as a scalable e-network that uses modern types of architecture.

At this point, Mohamed El Gendy pitched in to ask about what smart contracts

mean exactly, and what their relevance and relationship to Blockchain is. Mohamed

Taysir explained that smart contracts are automated processes that are

programmable to execute any set of orders and that they are non-changeable when

published on Blockchain technology, emphasizing that this notion is the key

element of all decentralized applications as it means that smart contracts will

always remain locked and execute the orders for which they were programmed initially,

and that no one has the power to alter any aspect of it when deployed on any

Blockchain, and any future change shall be through a new connected block with

new consensus

Dr. Amr Rashed pitched in to

elaborate on the nature of Blockchain and its relation to cryptocurrencies,

starting off with a brief introduction on a specific problem that Bitcoin

inventor Satoshi Nakamoto faced when he (or they) created the world-famous cryptocurrency.

Double-spending had been an issue that threatened Bitcoin at the time because

there was a need for verification that any amount of Bitcoin was spent and that

it cannot be duplicated, an issue which was eventually solved by stamping,

meaning that every single Bitcoin now had a timestamp or signature that was

published when that specific coin was spent, creating a decentralized public

record containing the time, location and more details of how that coin was

spent for everyone to see and validate through the shared database that is

Blockchain.

Dr. Rashed mentioned that, as

they spoke on the podcast, there were about 9,109 cryptocurrencies in existence

and circulating around the world at that very moment. He also said that,

although most cryptocurrencies depend on Blockchain as their infrastructure,

there are a few of them that operate independently of Blockchain technology,

such as IOTA. When asked about the different types of cryptocurrencies, Dr.

Rashed explained that every currency has its promise and defined purpose. When

Bitcoin started out, he said, it aimed to become an encrypted digital coin that

would be traded between individuals, whereas Ethereum is based on smart

contracts and the execution of specifically programmed instructions. Some

currencies are focused on the individual privacy of its owners such as Zcash as

opposed to currencies like Bitcoin that are considered ‘pseudo-anonymous’,

which means there is a possibility to determine who their owners are. Dr. Rashed clearly mentioned that Central Bank

of Egypt has banned the use and trading of all cryptocurrencies in Egypt,

through a press note issued in Jan 2018.

The conversation then shifted to

the relevance and importance of Blockchain in FinTech, and Mr. Ahmed Mansour

started off with talking about how Blockchain started to transform the

financial sector in 2016. He said that although the potential of Blockchain’s

use in the infrastructure of financial technology applications has been evident

for some time now, there have been challenges along the way and some of those

challenges still persist today, such as the lack of technical knowledge in the

financial workforce to actually develop and build on Blockchain technology. Another

challenge he mentioned is the lack of regulatory processes concerned not with

Blockchain itself, but with the building of use cases on the Blockchain.

As the guests continued to dive

deeper into the specifics of applying Blockchain technology to new and existing

FinTech products & services, the big picture started to become clearer and

more answers to pending questions came to light. As the financial experts

engaged with each other and shed more light on what the future of Blockchain

holds, the conversation encompassed everything from regulation and law to

on-ground applications and futuristic scenarios, all in hopes of harnessing the

power of Blockchain at some point and using it to empower an already-thriving

and very promising FinTech ecosystem.

related articles

A New Milestone in Egypt’s FinTech Journey

The FinTech Reality Show

Egypt Shines at the FinTech Arab Challenge 2025!

Announcing the Winners of FinTech Got Talent 2025!

Why does innovation often fail in organizations, and how can we truly enable it?

How can banks successfully enable AI — safely, strategically, and at scale?

We’re excited to announce the kick-off of the FinTech Hackathon

.jpg)

Attention all FinTech/FinTech-enabled Startups and PSPs!

.jpg)

Calling all Investors!

.jpg)

Calling all the accelerators and incubators!

AI is not the future. It’s NOW.

Most important moments from FinTekrs Assiut Round!

Celebrating Innovation: Top 10 Universities in the FinTech Got Talent Competition!

Proudly Announcing Mansoura Demo Day From Fintekrs Program Round 3!

Announcement: FinTech Got Talent Competition - 2nd Edition!

Don’t miss the chance to be part of a live conversation on the latest in FinTech, right at the Central Bank of Egypt Booth during the Cairo ICT!

Thrilled to announce that FinTekrs is taking the FinTech track by storm at Techne Summit!

.png)

The Central Bank of Egypt Supports Women’s Empowerment to Expand their Businesses

Agri-FinTech Applications by Fresh Source

4th Episode of 7areef FinTech Podcast – Supply Chain Finance

3rd Episode of 7areef FinTech Podcast – Digital Payments

2nd Episode of 7areef FinTech Podcast – ROSCA

1st Episode of 7areef FinTech Podcast - FinTekrs Introduction

Are you interested to be “7areef FinTech”?!

.jpg)

“FinTech Egypt” Launches the First Digital Academy to Upskill the Workforce Skills in the Banking, Financial, and FinTech Sector

FINTECH IS EGYPT’S NEXT BIG OPPORTUNITY..Catch up with FINTEKRS

The Future is FinTech..JOIN FINTEKRS NOW!

FinTekrs’ Alex Round Sponsor

FinTech Worldwide Statistics...FINTEKRS is Not-To-Miss!

Who Can Apply to FINTEKRS

Knowledge from FINTEKRS!

4 Reasons to Join FINTEKRS!

Launching FINTEKRS

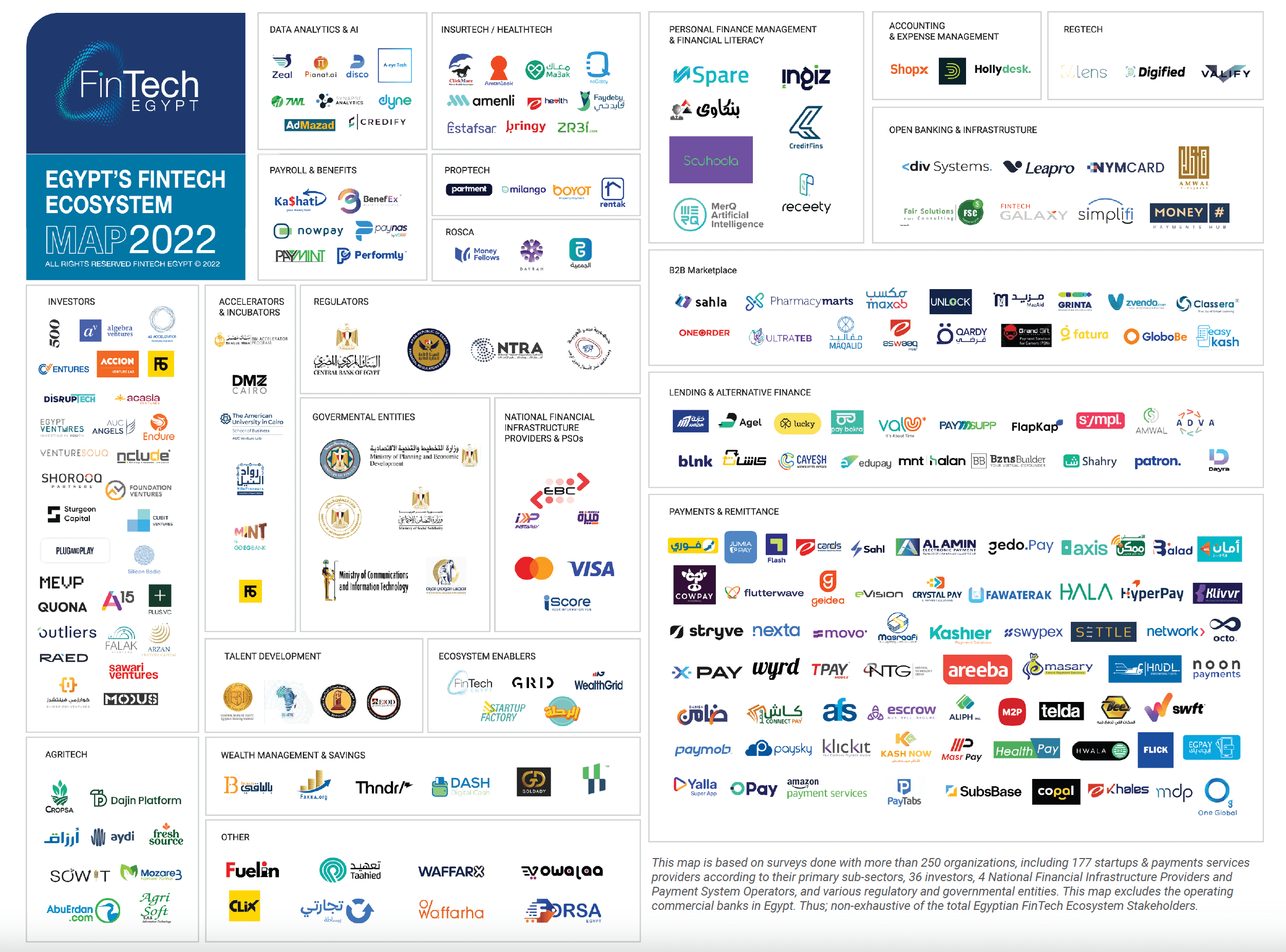

FinTech Egypt releases its FinTech Investments-focused H1 2022 Landscape Review “Why Egypt is a promising market for FinTech Investments?”

The Women Techsters Initiative Fellowship Class of 2023

We're bringing top LPs and GPs from around the world

The Egyptian FinTech ecosystem is booming

We've joined forces to bring the best LPs and GPs together

We're taking a closer look at Egypt

Come and join the key players in the Middle East & Africa’s VC market

Connect with Egypt

Frontier of Egypt, Africa & the middle East in the 2022

Egypt’s First VC Summit kicks off in partnership between GIZ Egypt, AfricaGrow and Fintech Egypt

BANQUE MISR, NATIONAL BANK OF EGYPT, AND BANQUE DU CAIRE LEAD INVESTMENT IN NEW FINTECH FUND

The Increasing Influence of Women in FinTech

FinTech Egypt is releasing the first comprehensive report of its kind providing an overview of the unprecedented growth of FinTech in the Egyptian market

5 FinTech Trends to Follow in 2022

How FinTech is Disrupting an Age-Old Industry

RESHAPING FINTECH WITH AI: TOP AI INNOVATIONS IN THE FINANCIAL INDUSTRY

Accelerate’ha’ Female-Focused Problem Statements Now Live!

Breaking Entry Barriers for Women in FinTech

Have Traditional Banks Realized the Full Potential of Fintech By Now?

Episode 5: Accelerating FinTech Innovation through Open APIs

.png)

Episode 3: Discovering FinTech Talent through “FinYology - FinTech for Youth”

Episode 2: The Current & Future state of FinTech during COVID-19

FinTech Egypt Dialogue podcast launches its first-ever session about E-KYC Regulations and Regulatory Sandbox

Where does Artificial Intelligence fit in FinTech?

Critical FinTech Questions That Only the Near Future Can Answer

Special Interview With Dor-E, Winner Of The AI-Customer Experience FinTech Innovation Challenge

Egyptian Banking Institute Announces “The Future Of FinTech And Latest Digitalization Trends” Field Trip

Artificial Intelligence Is Transforming Banking As We Know It

Artificial Intelligence Is Transforming Banking As We Know It

Hub71 Partners With Techstars In Launching An Accelerator Program To Boost Startups

FINTECH IN THE SAVANNAH: Afro-Asia FinTech festival 2019 that took place in Nairobi Kenya

How Machine Learning Supports Credit Profiling

The Central Bank of Egypt’s Regulatory Sandbox started its first cohort in “e-KYC” to empower the FinTech ecosystem in Egypt.

Dubai Smart City Accelerator invites Egyptian startups to join Cairo Fast Track

Calling All Egyptian FinTech Startups To Participate In The Afro-Asia FinTech Festival!

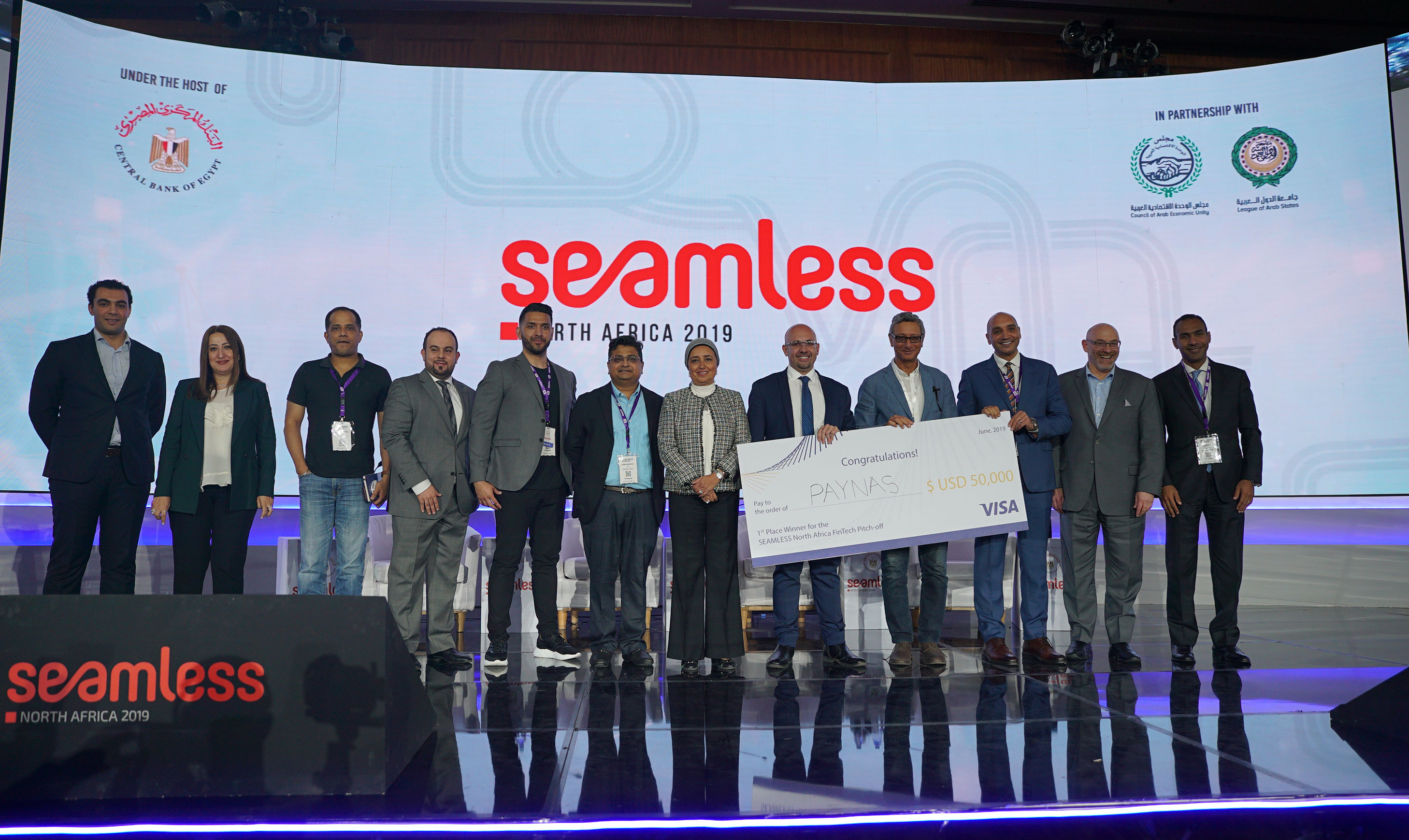

Paynas Wins Big At Seamless North Africa 2019

.jpg)

Seamless North Africa 2019

Announcing The Inaugural AFI FinTech Showcase

Fintech Trends In 2019 - Blockchain Adoption

.jpg)

Discounted Start-Up Passes

0

0

9.9k

9.9k

Comments