The Increasing Influence of Women in FinTech

21 March 2022

Women entrepreneurs and owners of small to mid-sized enterprises (WSMEs) are at an all-time high on a global level, and they are significantly making a difference in terms of creating job opportunities, driving change in their respective communities, and fueling innovation at an unprecedented level. However this is more prevalent in high-income countries, as low-income regions still present certain barriers that women have yet to overcome as opposed to their male counterparts. Taking a look at the Middle East & Africa region, we find some of the highest rates of women’s entrepreneurial intentions in the world; a fact that is supported by the one of the highest ratios of female-to-male Established Business Ownership around the globe. However there is also a contradiction in that region, as some countries have some of the lowest rates as well in that regard, which is largely due to factors like cultural gender beliefs and imposed constraints on women’s participation in the labor market and, subsequently, business ownership.

Today, these constraints are subject to change more than ever.

Although they represent the largest and fastest-growing market in the world, women are still largely considered underserved when it comes to digital finance; even unserved in some cases. There are very few FinTech products & services that were created with women’s specific needs in mind when FinTech first took off, and today these companies are rectifying this notion by listening to their female customers and tailoring their FinTech solutions much more than before. This is primarily because gender diversity and inclusivity are much-needed to make a more balanced business world, but also there are trillions of dollars that are left untapped by these solutions because they have hardly adapted to women’s distinct preferences so far.

The female economy is growing at an accelerating rate, and this is due to a variety of factors. Let’s look at these drivers and some facts & figures that reflect this tremendous growth.

Education

One of the main drivers of the female economy today is the fast and easy access to online education, especially after the pandemic has paved the way for more free time and high dependence on online tools & resources. Women are pursuing their passion through taking a variety of online courses and aiming for higher paying careers, and FinTech is one of those industries that women are taking more and more interest in. Digital financial education and skill building through online tools provide a great opportunity and framework for women to close the gender gap.

Untapped Potential

This factor applies both ways, in that there is untapped potential in catering to women’s specific needs and requirements for FinTech solutions, and also the employment aspect of FinTech which is seeing tremendous growth in that industry. The female population is growing fast and is largely underserved when compared to the male economy, and this provides ample room for improvement on different scales.

Gender Bias

There is a prevalent lack of women in key roles in FinTech, in terms of founders, product management, technology teams and other areas, and this has resulted in FinTech startups and entrepreneurs being unconsciously biased at different stages, such as business modelling, product development or even services offered. Although research has shown that there is a somewhat balanced ratio between female and male employees in general, that is not the case when it comes to key strategic roles. With a significantly rising female economy, this skewed view needs to change, and this can be achieved by building gender-diverse and non-biased organizations as a priority for FinTech companies.

After exploring the challenges faced by women in the workforce today, let’s explore some research-based supporting facts and figures that win the argument of behavioral traits, gender diversity and inclusion:

-

• Companies with gender-diverse C-Suites are 21% more likely to have above-average profitability and 27% more likely to have greater long-term value creation (McKinsey & Company).

• Adding one more woman in senior management or on the corporate board leads to an 8 to 13 basis point higher return on assets (IMF).

• Teams are 158% more likely to understand their market when team members represent the end user (CTI).

• 57% of companies found that diversity and inclusion programs strongly impact customer satisfaction, and 69% found they improved brand image (European Commission).

Times have shown that women are more likely than men to favor a potential advantage or benefit in exchange for lower risk or less debt. This is especially pervasive in times of uncertainty, such as the COVID-19 pandemic, when women were shown to take more time in gathering relevant information to make significant financial actions. Investment News has reported that 72% of wealth advisors believe women take more time to make decisions, while LPL Financial has stated that 44% of women say that learning more about planning and investing is their top priority when working with an advisor.

So, what are the recommendations for empowering more women to get into FinTech, start their own business, and not feel left out due to gender gaps?

1) Focus on supporting women’s high-growth business activity.

As mentioned above, the female economy is thriving today in their remarkable contributions to the global economy and international societies. Entrepreneurship is seeing many women-led innovative solutions that can solve a multitude of problems, and on a global scale there is a slow but steady shift in narrative about women entrepreneurs and their high-growth potential. This shift needs a robust effort to be elevated to new heights and reap the tremendous impact that women are having on international markets.

2) Encourage, enable and empower women investors.

There are several female business owners that are met with resistance, whether it be difficulty to access information, education, networking opportunities or straight up finance. For several years, women that own companies have struggled to get access to equity funding, and recently there are three indications that this is poised to change very soon. The first one is the emergence of female angel networks, where women are learning by experience to evaluate and invest in the products and services that they see value in, while the second is impact investing where investment is made into companies to make a significant social or environmental impact while reaping the benefits. Thirdly, women-focused investing is a trend that’s on the rise to provide ample opportunity without the hindrance of common market barriers.

3) Support female business owners in male-dominated sectors.

There are many training programs and curriculums that target female entrepreneurship to cater to market sectors where women are already well represented, but it is critical to also pay attention to women that are working in male-dominated market sectors, such as incubator and accelerator programs that focus on technology and engineering firms, or other areas where most of the gender inequality happens and women are overlooked. An increasing number of accelerators - which provide early-stage companies with training, mentorship and financing - and venture capital firms are now shifting focus to women-led businesses.

And today, we are at a time when diversity and inclusion at the workplace is imperative for the development and growth of a business, a sector and an industry. FinTech is no exception, and there are several women-led FinTech initiatives that are making an impact in Egypt today.

We at FinTech Egypt fully acknowledge the above challenges and recommendations when it comes to women, and as such have given birth to the Accelerat’Ha program as a means to drive and raise awareness on gender equality to reduce the gap, promote STEM Education for women, and ideally build a FinTech female entrepreneurs pipeline for the benefit of the economy and the future of work. This, following a Virtual Market Here2Hear Roundtable Discussion that gathered the Egyptian FinTech & Women Empowerment Ecosystem to brainstorm and come up with top accelerated Female Specific FinTech Problem Statements, tackling the major pain points and challenges faced by financially excluded and underserved women as well as women FinTech entrepreneurs. You can explore the Accelerate’Ha’ Female Specific Problem Statements here.

related articles

A New Milestone in Egypt’s FinTech Journey

The FinTech Reality Show

Egypt Shines at the FinTech Arab Challenge 2025!

Announcing the Winners of FinTech Got Talent 2025!

Why does innovation often fail in organizations, and how can we truly enable it?

How can banks successfully enable AI — safely, strategically, and at scale?

We’re excited to announce the kick-off of the FinTech Hackathon

.jpg)

Attention all FinTech/FinTech-enabled Startups and PSPs!

.jpg)

Calling all Investors!

.jpg)

Calling all the accelerators and incubators!

AI is not the future. It’s NOW.

Most important moments from FinTekrs Assiut Round!

Celebrating Innovation: Top 10 Universities in the FinTech Got Talent Competition!

Proudly Announcing Mansoura Demo Day From Fintekrs Program Round 3!

Announcement: FinTech Got Talent Competition - 2nd Edition!

Don’t miss the chance to be part of a live conversation on the latest in FinTech, right at the Central Bank of Egypt Booth during the Cairo ICT!

Thrilled to announce that FinTekrs is taking the FinTech track by storm at Techne Summit!

.png)

The Central Bank of Egypt Supports Women’s Empowerment to Expand their Businesses

Agri-FinTech Applications by Fresh Source

4th Episode of 7areef FinTech Podcast – Supply Chain Finance

3rd Episode of 7areef FinTech Podcast – Digital Payments

2nd Episode of 7areef FinTech Podcast – ROSCA

1st Episode of 7areef FinTech Podcast - FinTekrs Introduction

Are you interested to be “7areef FinTech”?!

.jpg)

“FinTech Egypt” Launches the First Digital Academy to Upskill the Workforce Skills in the Banking, Financial, and FinTech Sector

FINTECH IS EGYPT’S NEXT BIG OPPORTUNITY..Catch up with FINTEKRS

The Future is FinTech..JOIN FINTEKRS NOW!

FinTekrs’ Alex Round Sponsor

FinTech Worldwide Statistics...FINTEKRS is Not-To-Miss!

Who Can Apply to FINTEKRS

Knowledge from FINTEKRS!

4 Reasons to Join FINTEKRS!

Launching FINTEKRS

FinTech Egypt releases its FinTech Investments-focused H1 2022 Landscape Review “Why Egypt is a promising market for FinTech Investments?”

The Women Techsters Initiative Fellowship Class of 2023

We're bringing top LPs and GPs from around the world

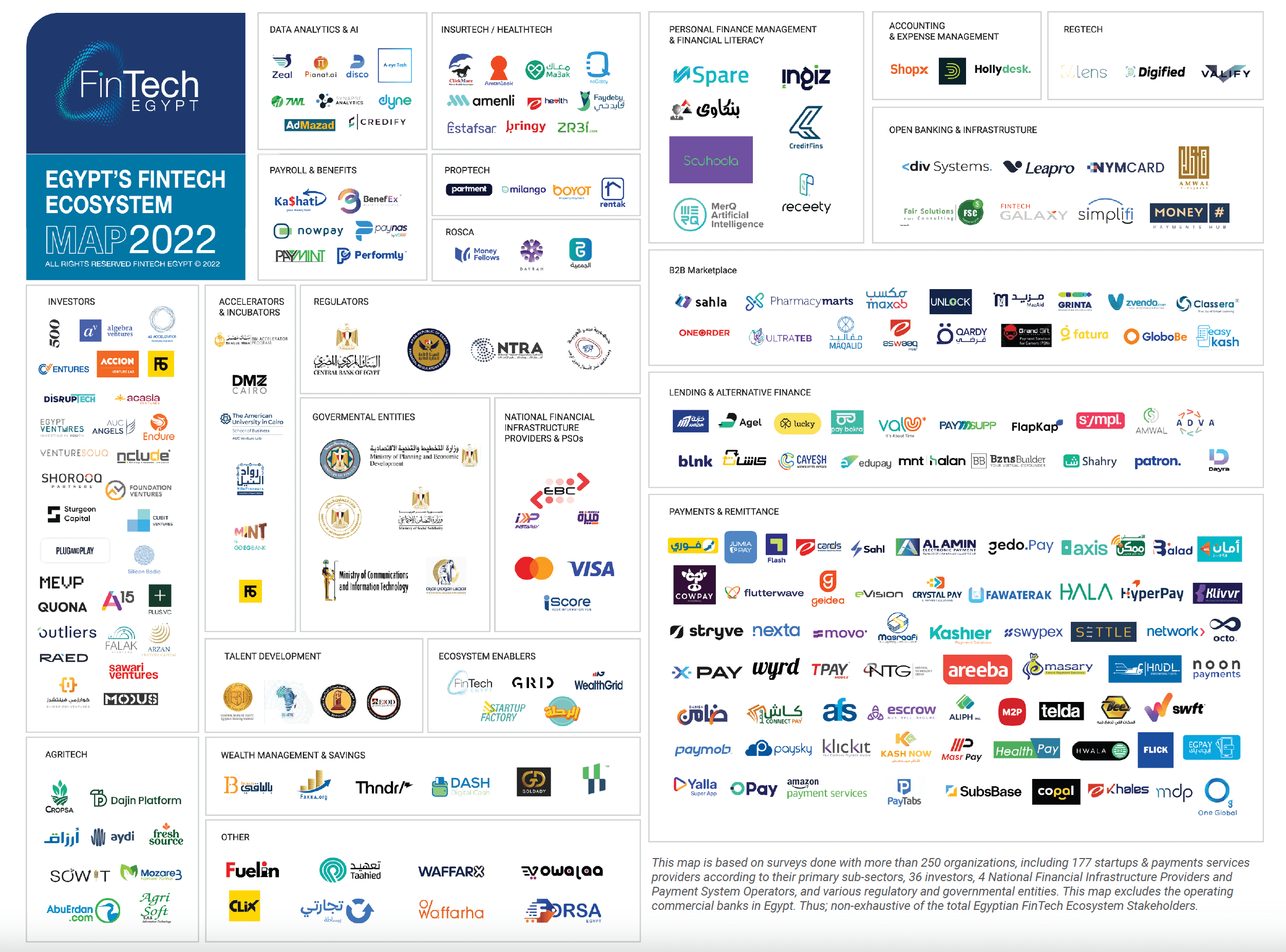

The Egyptian FinTech ecosystem is booming

We've joined forces to bring the best LPs and GPs together

We're taking a closer look at Egypt

Come and join the key players in the Middle East & Africa’s VC market

Connect with Egypt

Frontier of Egypt, Africa & the middle East in the 2022

Egypt’s First VC Summit kicks off in partnership between GIZ Egypt, AfricaGrow and Fintech Egypt

BANQUE MISR, NATIONAL BANK OF EGYPT, AND BANQUE DU CAIRE LEAD INVESTMENT IN NEW FINTECH FUND

FinTech Egypt is releasing the first comprehensive report of its kind providing an overview of the unprecedented growth of FinTech in the Egyptian market

5 FinTech Trends to Follow in 2022

How FinTech is Disrupting an Age-Old Industry

RESHAPING FINTECH WITH AI: TOP AI INNOVATIONS IN THE FINANCIAL INDUSTRY

Accelerate’ha’ Female-Focused Problem Statements Now Live!

Breaking Entry Barriers for Women in FinTech

Have Traditional Banks Realized the Full Potential of Fintech By Now?

Episode 5: Accelerating FinTech Innovation through Open APIs

Episode 4: Understanding Blockchain’ s Potential in Disrupting FinTech

.png)

Episode 3: Discovering FinTech Talent through “FinYology - FinTech for Youth”

Episode 2: The Current & Future state of FinTech during COVID-19

FinTech Egypt Dialogue podcast launches its first-ever session about E-KYC Regulations and Regulatory Sandbox

Where does Artificial Intelligence fit in FinTech?

Critical FinTech Questions That Only the Near Future Can Answer

Special Interview With Dor-E, Winner Of The AI-Customer Experience FinTech Innovation Challenge

Egyptian Banking Institute Announces “The Future Of FinTech And Latest Digitalization Trends” Field Trip

Artificial Intelligence Is Transforming Banking As We Know It

Artificial Intelligence Is Transforming Banking As We Know It

Hub71 Partners With Techstars In Launching An Accelerator Program To Boost Startups

FINTECH IN THE SAVANNAH: Afro-Asia FinTech festival 2019 that took place in Nairobi Kenya

How Machine Learning Supports Credit Profiling

The Central Bank of Egypt’s Regulatory Sandbox started its first cohort in “e-KYC” to empower the FinTech ecosystem in Egypt.

Dubai Smart City Accelerator invites Egyptian startups to join Cairo Fast Track

Calling All Egyptian FinTech Startups To Participate In The Afro-Asia FinTech Festival!

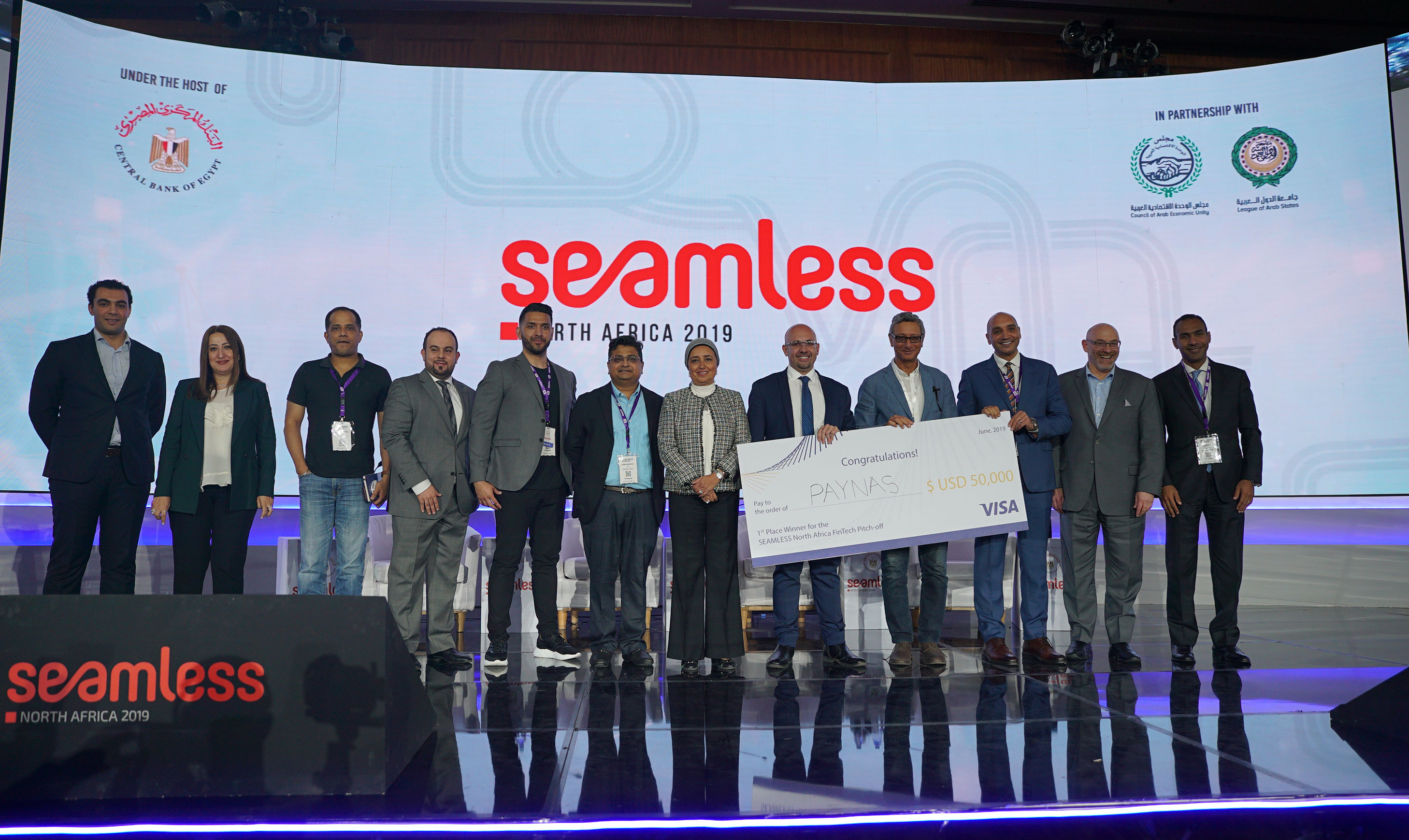

Paynas Wins Big At Seamless North Africa 2019

.jpg)

Seamless North Africa 2019

Announcing The Inaugural AFI FinTech Showcase

Fintech Trends In 2019 - Blockchain Adoption

.jpg)

Discounted Start-Up Passes

0

0

6.9k

6.9k

Comments