Have Traditional Banks Realized the Full Potential of Fintech By Now?

6 September 2021

There was a time when traditional financial institutions

were skeptical of financial technology, partly due to the industry’s disruptive

nature and competitive position in terms of conventional finance. Today, as the

world is still dealing with the consequences of the COVID-19 pandemic, FinTech

has become a cornerstone of the ‘new normal’, and banking customers are finding

it increasingly appealing on a global level. This radical change in how we

manage our finances has convinced traditional FIs over time that the future

lies in digital, and that this inevitable change is better accommodated by

their infrastructure sooner than later, if they wish to stay afloat in this

raging sea of economic uncertainty.

FinTech companies and neobanks have seized the opportunity

to fill in the gaps left behind by traditional finance; gaps that only widened

with the onset of Coronavirus, but were ultimately filled by the

almost-exponential adoption of FinTech around the world due to its convenient

offering: no physical contact, instant financial access, remote account

management, and much more.

As more FinTech companies and neobanks managed to cater to

the needs of a post-pandemic world, their popularity rose and they became major

contenders for the modern banking customer. With significant cuts to physical

cost, these new players injected their capital in new emerging technologies

that helped position them as disruptors of the digital era, delivering customer-centric,

tailor-made experiences that delighted consumers and basically eliminated the risks

associated with branch visits, saving a lot of time and effort in the process.

This consumer-first approach has resulted in a banking

population that expects everything to be available ‘right now’, with rising

expectations of ease, speed and convenience from their banks. While all this

was happening, traditional financial institutions were relatively late to

acknowledge FinTech’s potential for satisfying the modern customer, and even

today as they adapt to the situation, they are still encumbered by their legacy

processes and infrastructure. However, banks today have also prioritized their

digital processes and are swiftly jumping on the speeding train that is

FinTech. They are actively trying to guide customers away from slow,

traditional processes through launching mobile banking wallets and apps, and

perhaps more importantly, banks are actually partnering up with various

innovative FinTech companies and startups that smoothly complement their

offering, whether in the backend of frontend. They are trying hard to

streamline the customer journey, using digital ID verification solutions and

similar technologies that are big on speed, reliability, security, and ease of

use.

Although FIs were aware of the need to digitize their

approach even before COVID-19, the pandemic has really accelerated this need as

physical branches were unable to open for the better part of a whole year,

resulting in an unprecedented need to finalize their digital offering. This

swift change sparked the digital journey for many traditional FIs, and they

realized that they were already poised to make an impact in that area due to

several existing factors:

Banks have the financial capabilities to digitize their

strategies and offerings and practically eliminate physical processes. They

also have an extensive knowledge database filled with customer profiles and

demographics, and this rich history can be leveraged to reach the digital

customer and maintain a healthy relationship with them. Finally, banks have

their brands solidified in their customers’ mind which offers a great

competitive advantage over emerging FinTech companies that are still making

themselves known. These existing advantages can be exploited by banks to

quickly gain ground in the digital finance ecosystem.

These capabilities are a great starting point for banks to

go digital, but there are many more questions that need to be answered, if they

are to catch up and compete with trendy FinTech organizations. Here are some

critical questions that leading traditional FIs need to contemplate before

making their digital transformation:

-

Are all digital processes

seamless and without interruption for customers? In other words, every single

digital service needs to be easy, intuitive and without hiccups in order for

customers to get (and stay) on board.

-

Are all the bank’s digital

channels aligned with physical processes and ready to accommodate the dynamic

needs of modern customers? Websites, mobile apps, branches, customer service

departments and any other relevant entities need to communicate and execute

seamlessly between each other, so in turn the customer experience becomes

flawless.

These are important questions to ponder, but the process of

digital transformation is nowhere near as simple for traditional banks and FIs;

this is why the time is now to invest in digital technologies and optimize

digital channels to reflect all physical processes as much as possible, which

allows for banks to perform their core offering in the background while maintaining

their modernity and relevance with the digital crowd to keep the modern

customer and acquire new ones along the way. The road is long but traditional

FIs are greatly positioned to catch up with established FinTech companies if

they adapt their strategy to the digital age.

related articles

A New Milestone in Egypt’s FinTech Journey

The FinTech Reality Show

Egypt Shines at the FinTech Arab Challenge 2025!

Announcing the Winners of FinTech Got Talent 2025!

Why does innovation often fail in organizations, and how can we truly enable it?

How can banks successfully enable AI — safely, strategically, and at scale?

We’re excited to announce the kick-off of the FinTech Hackathon

.jpg)

Attention all FinTech/FinTech-enabled Startups and PSPs!

.jpg)

Calling all Investors!

.jpg)

Calling all the accelerators and incubators!

AI is not the future. It’s NOW.

Most important moments from FinTekrs Assiut Round!

Celebrating Innovation: Top 10 Universities in the FinTech Got Talent Competition!

Proudly Announcing Mansoura Demo Day From Fintekrs Program Round 3!

Announcement: FinTech Got Talent Competition - 2nd Edition!

Don’t miss the chance to be part of a live conversation on the latest in FinTech, right at the Central Bank of Egypt Booth during the Cairo ICT!

Thrilled to announce that FinTekrs is taking the FinTech track by storm at Techne Summit!

.png)

The Central Bank of Egypt Supports Women’s Empowerment to Expand their Businesses

Agri-FinTech Applications by Fresh Source

4th Episode of 7areef FinTech Podcast – Supply Chain Finance

3rd Episode of 7areef FinTech Podcast – Digital Payments

2nd Episode of 7areef FinTech Podcast – ROSCA

1st Episode of 7areef FinTech Podcast - FinTekrs Introduction

Are you interested to be “7areef FinTech”?!

.jpg)

“FinTech Egypt” Launches the First Digital Academy to Upskill the Workforce Skills in the Banking, Financial, and FinTech Sector

FINTECH IS EGYPT’S NEXT BIG OPPORTUNITY..Catch up with FINTEKRS

The Future is FinTech..JOIN FINTEKRS NOW!

FinTekrs’ Alex Round Sponsor

FinTech Worldwide Statistics...FINTEKRS is Not-To-Miss!

Who Can Apply to FINTEKRS

Knowledge from FINTEKRS!

4 Reasons to Join FINTEKRS!

Launching FINTEKRS

FinTech Egypt releases its FinTech Investments-focused H1 2022 Landscape Review “Why Egypt is a promising market for FinTech Investments?”

The Women Techsters Initiative Fellowship Class of 2023

We're bringing top LPs and GPs from around the world

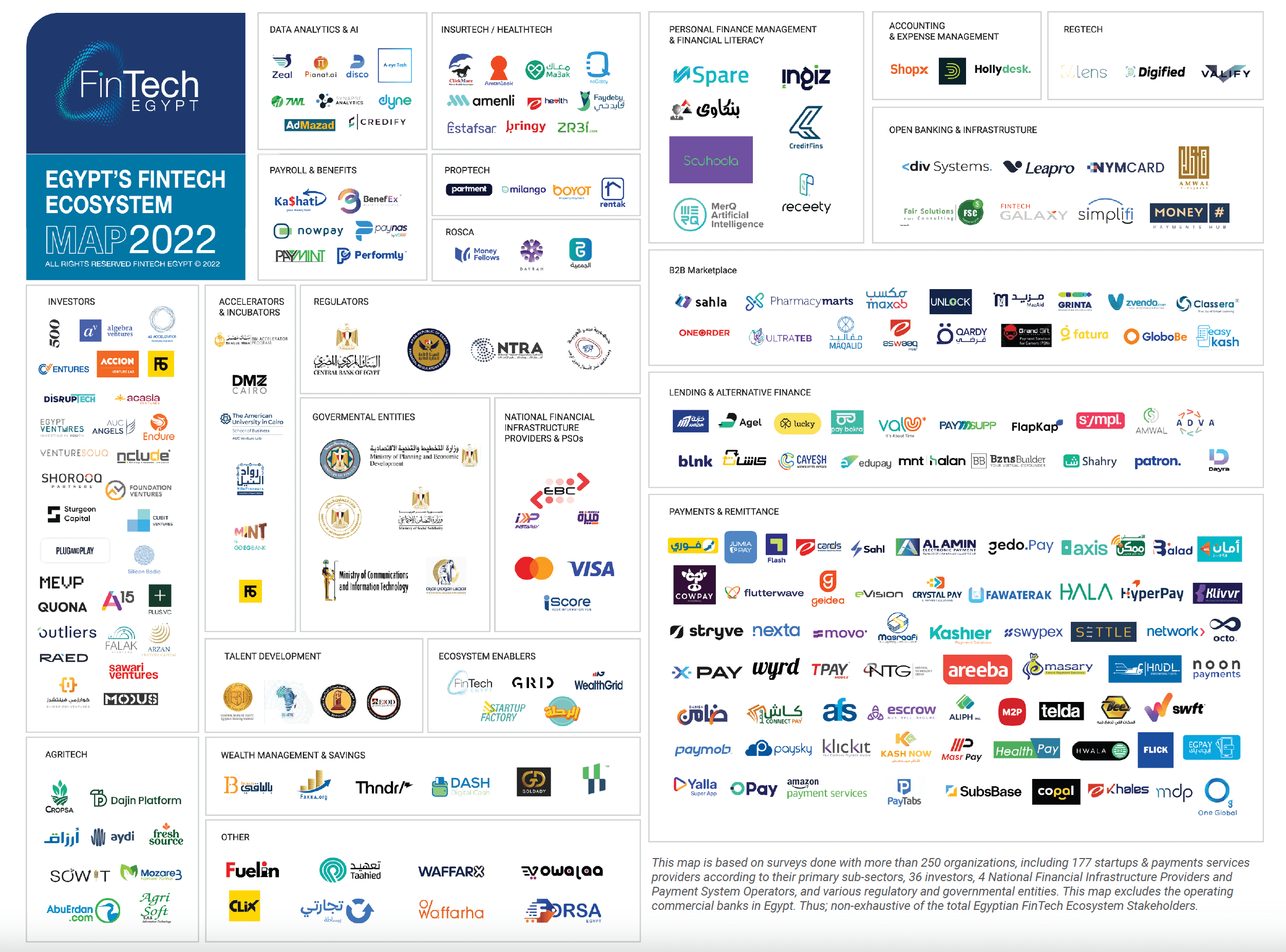

The Egyptian FinTech ecosystem is booming

We've joined forces to bring the best LPs and GPs together

We're taking a closer look at Egypt

Come and join the key players in the Middle East & Africa’s VC market

Connect with Egypt

Frontier of Egypt, Africa & the middle East in the 2022

Egypt’s First VC Summit kicks off in partnership between GIZ Egypt, AfricaGrow and Fintech Egypt

BANQUE MISR, NATIONAL BANK OF EGYPT, AND BANQUE DU CAIRE LEAD INVESTMENT IN NEW FINTECH FUND

The Increasing Influence of Women in FinTech

FinTech Egypt is releasing the first comprehensive report of its kind providing an overview of the unprecedented growth of FinTech in the Egyptian market

5 FinTech Trends to Follow in 2022

How FinTech is Disrupting an Age-Old Industry

RESHAPING FINTECH WITH AI: TOP AI INNOVATIONS IN THE FINANCIAL INDUSTRY

Accelerate’ha’ Female-Focused Problem Statements Now Live!

Breaking Entry Barriers for Women in FinTech

Episode 5: Accelerating FinTech Innovation through Open APIs

Episode 4: Understanding Blockchain’ s Potential in Disrupting FinTech

.png)

Episode 3: Discovering FinTech Talent through “FinYology - FinTech for Youth”

Episode 2: The Current & Future state of FinTech during COVID-19

FinTech Egypt Dialogue podcast launches its first-ever session about E-KYC Regulations and Regulatory Sandbox

Where does Artificial Intelligence fit in FinTech?

Critical FinTech Questions That Only the Near Future Can Answer

Special Interview With Dor-E, Winner Of The AI-Customer Experience FinTech Innovation Challenge

Egyptian Banking Institute Announces “The Future Of FinTech And Latest Digitalization Trends” Field Trip

Artificial Intelligence Is Transforming Banking As We Know It

Artificial Intelligence Is Transforming Banking As We Know It

Hub71 Partners With Techstars In Launching An Accelerator Program To Boost Startups

FINTECH IN THE SAVANNAH: Afro-Asia FinTech festival 2019 that took place in Nairobi Kenya

How Machine Learning Supports Credit Profiling

The Central Bank of Egypt’s Regulatory Sandbox started its first cohort in “e-KYC” to empower the FinTech ecosystem in Egypt.

Dubai Smart City Accelerator invites Egyptian startups to join Cairo Fast Track

Calling All Egyptian FinTech Startups To Participate In The Afro-Asia FinTech Festival!

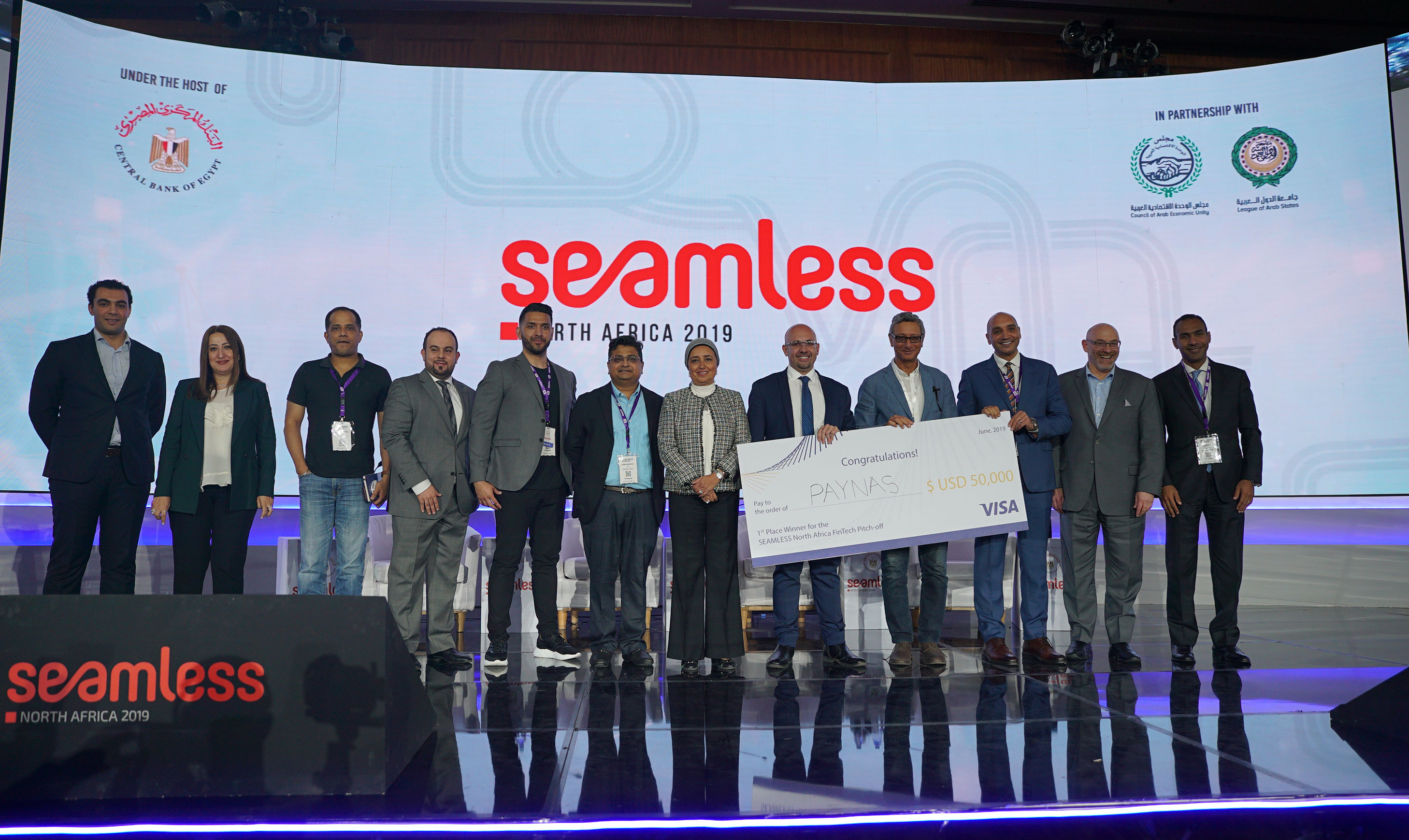

Paynas Wins Big At Seamless North Africa 2019

.jpg)

Seamless North Africa 2019

Announcing The Inaugural AFI FinTech Showcase

Fintech Trends In 2019 - Blockchain Adoption

.jpg)

Discounted Start-Up Passes

0

0

5.3k

5.3k

Comments