Episode 5: Accelerating FinTech Innovation through Open APIs

9 June 2021

In the fifth webinar by FinTech Egypt Dialogue, Open Banking

and its importance during the ongoing pandemic was the topic of interest this

time, with Mirna Sleiman, Founder of FinTech Galaxy, acting as the moderator

for the podcast’s esteemed guests: Akram Abdou, Founder of Egypt-based Underlie

Startup, and Mehdi Tazi, Vice President of Saudi-based Lean Technologies.

The conversation kicked off with Mirna giving a brief

introduction on what Open Banking and Open APIs mean in the FinTech world,

using a good analogy that the most important Chief Digital Officer today is

actually COVID-19, due to it forcing the world of finance to direct its efforts

towards digital enablers, open API connectivity, and similar approaches. Open

banking is the secure way of giving providers like banks and financial

institutions access to people’s financial information, achieved by giving

customers the ownership of their own information as opposed to FIs handling

them in a pre-COVID-19 era.

So how has the ongoing pandemic affected this shift in the

financial market? It’s obvious by now that customers are at the center of the

whole banking experience, and offering them a seamless digital journey has now

become the core of modern banking because they are the primary drivers of open

banking as a concept. Add to that the increasing pace of regulatory authorities

to keep up with FinTech as an industry, as well as the thriving technological

developments in many innovative areas such as artificial intelligence, machine

learning, KYC technologies and much more, and you get a ripe ecosystem for open

banking to fully grow its potential.

Many real-world use-cases exist for Open Banking, and Mirna went

on to explain five of them during the webinar. She started off with talking

about Account Aggregation, the practice of offering customers the option to

consolidate all their financial information on one platform for their

convenience. Personal finance management tools are also important today so that

third-party providers can provide customers with easy-to-use and fast tools to

manage their finances, including but not limited to investments, automated

savings, and product switching. Seamless payments is also an important cornerstone

of Open Banking, allowing simple and direct account-to-account transfers. Product

comparison and lending & credit risk are also critical aspects of Open

Banking, where financial data offers the required insights to make an informed

decision and therefore minimize risk.

The conversation moved on to Akram Abdou when he was asked

about the standards that govern the Open Banking API scene, and the importance

of having a global framework for standards in Open Banking today. Akram

introduced Underlie as vertical-centric startup that has been focusing on the

Egyptian market since it launched about a year ago, offering tailored products

to Egyptian consumers. Underlie took a top-down approach and started talking

with regulators followed by FinTech companies, banks and other FIs to try and

understand their needs and pain points, as well as what gaps exist and how they

can be filled using the customized products and services offered by the young

startup. They have had good success so far in understanding the FIs’

infrastructures and providing them with new proposed revenue streams that can

benefit these institutions, said Akram.

He said that Egypt having a total of 39 banks nationwide

presents an opportunity for fast-tracking the implementation of Open API

standards, and he feels optimistic about the willingness of FIs to implement

such standards to get them potential revenue streams. Akram also said that

FinTech companies also need to go through a rigorous compliance checklist in

order to determine just how exactly consumer data will be shared, among other

things, so that the consumer-centric model is clear and transparent to

customers that are willingly authorizing their data to be used for whatever

purpose.

Mehdi then took other to introduce Lean Technologies, which

he said I similar to Underlie in the sense that they also aim to bridge

existing gaps between FIs and FinTech companies, and also aim to provide a

universal API that lowers entry barriers for developers to venture into FinTech

products & services. Mehdi stated

that this is one of the standout differences between Lean Technologies and

Underlie because they are taking a more horizontal, pan-regional approach by

creating this global API for any interested entity to use.

Mirna then proceeded to ask Mehdi about how Open Banking can

transform finance as we know it, to which he replied that Open Banking is

already in the process of taking over the finance scene, referring to the FinTech

market in the United States that already has a bigger market cap than incumbent

banks currently. He elaborated on what APIs mean by taking himself as an

example; as the owner of 3 bank accounts in 3 different countries, Mehdi

previously needed to keep an Excel sheet with all his financial data to have it

all in one place. Today with Open APIs, he can easily use a third-party

application, much like Lean Technologies does, to connect all his accounts and consolidate

all his data in one mobile app that he can access at anytime and anywhere.

related articles

A New Milestone in Egypt’s FinTech Journey

The FinTech Reality Show

Egypt Shines at the FinTech Arab Challenge 2025!

Announcing the Winners of FinTech Got Talent 2025!

Why does innovation often fail in organizations, and how can we truly enable it?

How can banks successfully enable AI — safely, strategically, and at scale?

We’re excited to announce the kick-off of the FinTech Hackathon

.jpg)

Attention all FinTech/FinTech-enabled Startups and PSPs!

.jpg)

Calling all Investors!

.jpg)

Calling all the accelerators and incubators!

AI is not the future. It’s NOW.

Most important moments from FinTekrs Assiut Round!

Celebrating Innovation: Top 10 Universities in the FinTech Got Talent Competition!

Proudly Announcing Mansoura Demo Day From Fintekrs Program Round 3!

Announcement: FinTech Got Talent Competition - 2nd Edition!

Don’t miss the chance to be part of a live conversation on the latest in FinTech, right at the Central Bank of Egypt Booth during the Cairo ICT!

Thrilled to announce that FinTekrs is taking the FinTech track by storm at Techne Summit!

.png)

The Central Bank of Egypt Supports Women’s Empowerment to Expand their Businesses

Agri-FinTech Applications by Fresh Source

4th Episode of 7areef FinTech Podcast – Supply Chain Finance

3rd Episode of 7areef FinTech Podcast – Digital Payments

2nd Episode of 7areef FinTech Podcast – ROSCA

1st Episode of 7areef FinTech Podcast - FinTekrs Introduction

Are you interested to be “7areef FinTech”?!

.jpg)

“FinTech Egypt” Launches the First Digital Academy to Upskill the Workforce Skills in the Banking, Financial, and FinTech Sector

FINTECH IS EGYPT’S NEXT BIG OPPORTUNITY..Catch up with FINTEKRS

The Future is FinTech..JOIN FINTEKRS NOW!

FinTekrs’ Alex Round Sponsor

FinTech Worldwide Statistics...FINTEKRS is Not-To-Miss!

Who Can Apply to FINTEKRS

Knowledge from FINTEKRS!

4 Reasons to Join FINTEKRS!

Launching FINTEKRS

FinTech Egypt releases its FinTech Investments-focused H1 2022 Landscape Review “Why Egypt is a promising market for FinTech Investments?”

The Women Techsters Initiative Fellowship Class of 2023

We're bringing top LPs and GPs from around the world

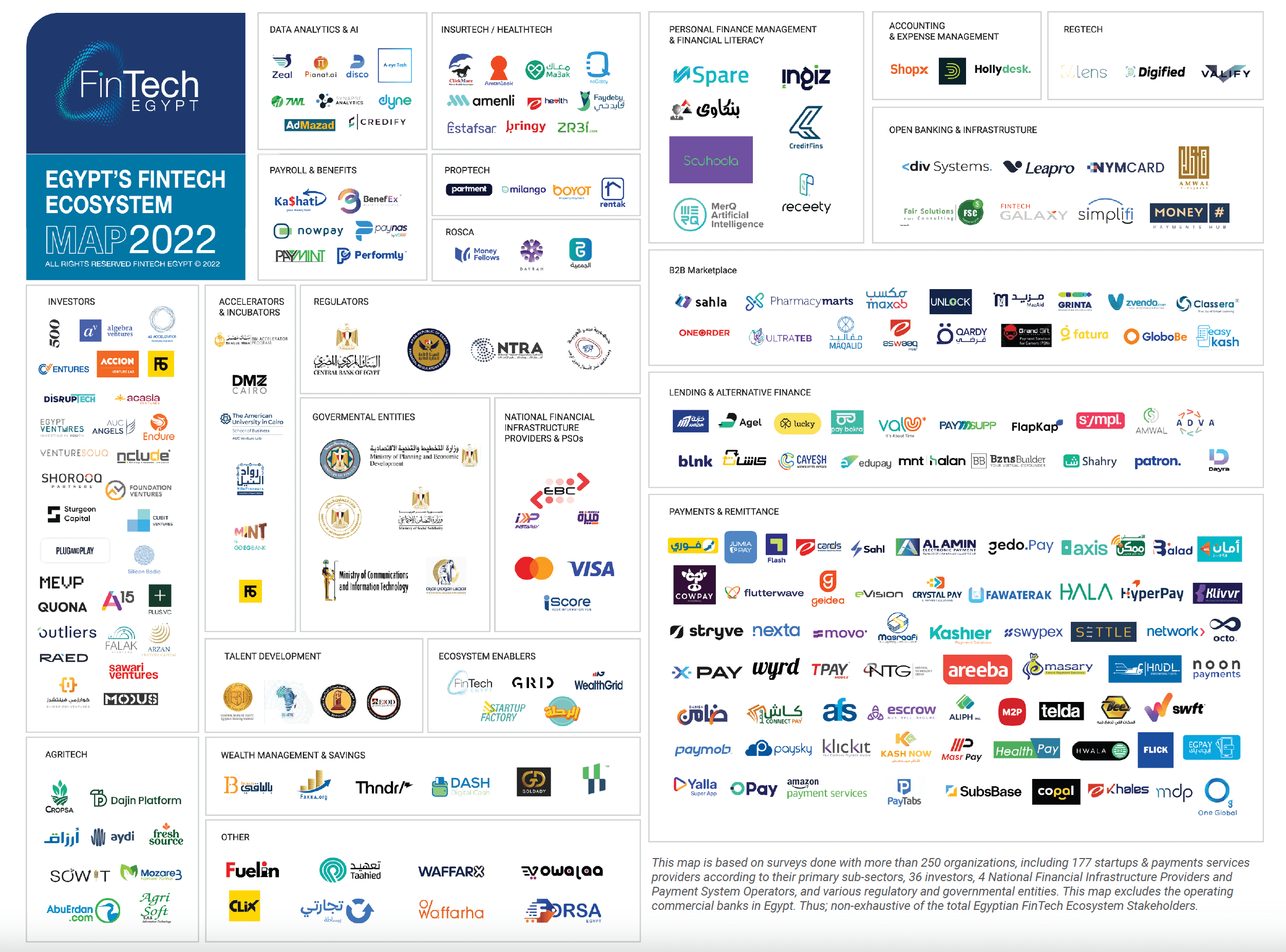

The Egyptian FinTech ecosystem is booming

We've joined forces to bring the best LPs and GPs together

We're taking a closer look at Egypt

Come and join the key players in the Middle East & Africa’s VC market

Connect with Egypt

Frontier of Egypt, Africa & the middle East in the 2022

Egypt’s First VC Summit kicks off in partnership between GIZ Egypt, AfricaGrow and Fintech Egypt

BANQUE MISR, NATIONAL BANK OF EGYPT, AND BANQUE DU CAIRE LEAD INVESTMENT IN NEW FINTECH FUND

The Increasing Influence of Women in FinTech

FinTech Egypt is releasing the first comprehensive report of its kind providing an overview of the unprecedented growth of FinTech in the Egyptian market

5 FinTech Trends to Follow in 2022

How FinTech is Disrupting an Age-Old Industry

RESHAPING FINTECH WITH AI: TOP AI INNOVATIONS IN THE FINANCIAL INDUSTRY

Accelerate’ha’ Female-Focused Problem Statements Now Live!

Breaking Entry Barriers for Women in FinTech

Have Traditional Banks Realized the Full Potential of Fintech By Now?

Episode 4: Understanding Blockchain’ s Potential in Disrupting FinTech

.png)

Episode 3: Discovering FinTech Talent through “FinYology - FinTech for Youth”

Episode 2: The Current & Future state of FinTech during COVID-19

FinTech Egypt Dialogue podcast launches its first-ever session about E-KYC Regulations and Regulatory Sandbox

Where does Artificial Intelligence fit in FinTech?

Critical FinTech Questions That Only the Near Future Can Answer

Special Interview With Dor-E, Winner Of The AI-Customer Experience FinTech Innovation Challenge

Egyptian Banking Institute Announces “The Future Of FinTech And Latest Digitalization Trends” Field Trip

Artificial Intelligence Is Transforming Banking As We Know It

Artificial Intelligence Is Transforming Banking As We Know It

Hub71 Partners With Techstars In Launching An Accelerator Program To Boost Startups

FINTECH IN THE SAVANNAH: Afro-Asia FinTech festival 2019 that took place in Nairobi Kenya

How Machine Learning Supports Credit Profiling

The Central Bank of Egypt’s Regulatory Sandbox started its first cohort in “e-KYC” to empower the FinTech ecosystem in Egypt.

Dubai Smart City Accelerator invites Egyptian startups to join Cairo Fast Track

Calling All Egyptian FinTech Startups To Participate In The Afro-Asia FinTech Festival!

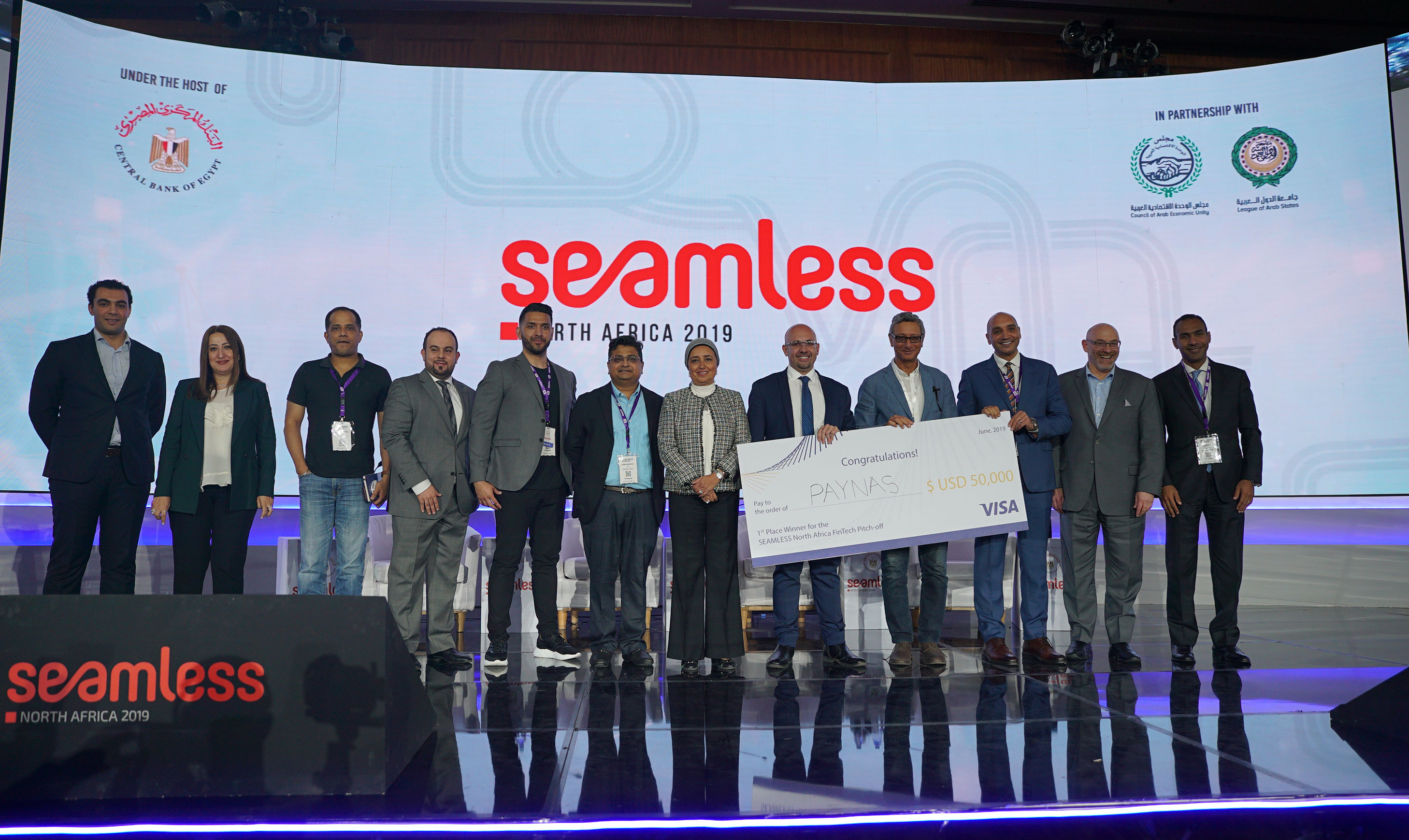

Paynas Wins Big At Seamless North Africa 2019

.jpg)

Seamless North Africa 2019

Announcing The Inaugural AFI FinTech Showcase

Fintech Trends In 2019 - Blockchain Adoption

.jpg)

Discounted Start-Up Passes

0

0

6k

6k

Comments