RESHAPING FINTECH WITH AI: TOP AI INNOVATIONS IN THE FINANCIAL INDUSTRY

13 December 2021

Artificial intelligence has given the world of financial industry as a whole a way to meet the demands of customers who want smarter, more convenient, safer ways to access, spend, save and invest their money. Financial procedures have been made easier because of the use of AI and machine learning. FinTech companies are particularly interested in AI, either to develop it or to utilize it themselves, because it has so many useful applications. AI development solutions are aimed at meeting the critical needs of today’s financial sector, such as improved client experience, cost-effectiveness, real-time data connectivity, and increased security. This article lists the top 10 AI innovations in the financial industry.

1) Credit Scoring Model: The credit scoring model reduces credit risk with the ability to increase pass rates while maintaining or reducing current default risk. It takes manual underwriting to the next level through AI automated decision-making and recommendations that are transparent and explainable to the end-user.

2) Data Lake: The Data Lake is a large storage repository that holds a huge amount of “raw data” in its original format until data scientists need it. This approach is different from “Data Warehouse” that deal with “processed data” and for decades, foundation for business intelligence and data discovery/storage rested on data warehouses. Data Lake provide great extent of scalability at reasonable cost, fast, and integration with emerging trends such as Internet of Things (IoT). Data Lake can play major role in driving innovative FinTech models that rely on predictive AI and collection of huge amount of insights yet, data integrity and storage location might impose regulatory constraints and challenges. Thus, Data Lake can be positioned for the research purpose but not the ultimate data storage.

3) Robo-Advisors: Robo-advisors are not only low-cost alternatives to traditional financial advisors but they can also facilitate financial counseling for a large group of people, helping to make more informed financial decisions. Besides, data-driven AI-powered Robo-advisors can also recommend investors on scaling their portfolio, retirement, estate planning, etc., which in turn can make the account opening process an interactive experience.

4) AI-Based Reporting and Analysis: Now with mobile banking apps and web portals, financial service AI can analyze consumers’ account data to see what they have, how they’re performing financially, make recommendations on future actions based on the results, and then help with automation for savings and budgeting for better financial health and behavior. In the finance industry, AI can be used to examine cash accounts, credit accounts, and investment accounts to look at a person’s overall financial health, keep up with real-time changes, and then create customized advice based on new incoming data.

5) Advanced Analytics: The use of advanced analytics for financial institutions through data aggregation and data analytics platforms, enable financial institutions to easily get answers in real-time to key business questions across desktop, mobile devices. Providing interactive, predictive, and conversational capabilities, advanced analytics platforms extracts information from comprehensive financial data sets to ensure financial institutions have an easy way to answer crucial questions anywhere, anytime, on any device. It also, identify cross-sell and upsell opportunities; decide how to competitively position products and services; choose which marketing campaigns to run; determine how to segment customers; and know how to engage those customers.

6) Chatbots: Chatbots in banking are not only a money-saving tool, they can automate simple tasks. Companies that want to use them only need to install them on their existing websites rather than create a separate chatbot app. And they’re always on, so even a customer who visits your website at 3:00 AM can get answers to their questions and assistance with their problems. Programming a chatbot means starting with specific tasks it can perform, such as paying a bill or processing an account application.

7) Quick and Scalable Graph Platforms: The graph platforms are the next level in AI software and machine learning tools for graph databases. Where it combines features such as Massively Parallel Processing, MapReduce, and fast data compression and decompression with new approaches. Combining these features creates a scalable, quick, and reliable means of deep exploration. This allows the user to get the maximum value from their data. Graph Platforms utilize analytics, machine learning, and AI algorithms to help analyze complex data sets. Leading financial service providers to enhance their fraud detection processes.

8) Potential Future Simulator in Virtual Environment: This solution allow financial service providers to efficiently simulate potential future scenarios in a secure, virtual environment. This AI software can be applied across trading, lending, and risk management areas. This AI tool allows banks to simulate a range of scenarios, such as modeling the actions of a fraudster.

9) Software Robotics: The software robots are configured to capture and interpret information from systems, recognize patterns, and run business processes across multiple applications to execute activities, including data entry and validation, automated formatting, multi-format message creation, text mining, workflow acceleration, reconciliations and currency exchange rate processing among others.

10) Predictive Analytics and Predictive Banking: The predictive banking features include alerting customers of higher-than-average recurring billing payments, reminding a customer to transfer money into their savings account if they have more money than average in their checking account, and prompting customers to set up a travel plan for their account after they’ve purchased a plane ticket. Predictive banking can provide mobile app users with different prompts for various scenarios. For example, if a customer receives an incoming deposit that is not in their usual pattern of transactions and is not needed to meet their normal expenses or scheduled payments, the system can highlight the deposit and suggest the customer save the funds.

related articles

A New Milestone in Egypt’s FinTech Journey

The FinTech Reality Show

Egypt Shines at the FinTech Arab Challenge 2025!

Announcing the Winners of FinTech Got Talent 2025!

Why does innovation often fail in organizations, and how can we truly enable it?

How can banks successfully enable AI — safely, strategically, and at scale?

We’re excited to announce the kick-off of the FinTech Hackathon

.jpg)

Attention all FinTech/FinTech-enabled Startups and PSPs!

.jpg)

Calling all Investors!

.jpg)

Calling all the accelerators and incubators!

AI is not the future. It’s NOW.

Most important moments from FinTekrs Assiut Round!

Celebrating Innovation: Top 10 Universities in the FinTech Got Talent Competition!

Proudly Announcing Mansoura Demo Day From Fintekrs Program Round 3!

Announcement: FinTech Got Talent Competition - 2nd Edition!

Don’t miss the chance to be part of a live conversation on the latest in FinTech, right at the Central Bank of Egypt Booth during the Cairo ICT!

Thrilled to announce that FinTekrs is taking the FinTech track by storm at Techne Summit!

.png)

The Central Bank of Egypt Supports Women’s Empowerment to Expand their Businesses

Agri-FinTech Applications by Fresh Source

4th Episode of 7areef FinTech Podcast – Supply Chain Finance

3rd Episode of 7areef FinTech Podcast – Digital Payments

2nd Episode of 7areef FinTech Podcast – ROSCA

1st Episode of 7areef FinTech Podcast - FinTekrs Introduction

Are you interested to be “7areef FinTech”?!

.jpg)

“FinTech Egypt” Launches the First Digital Academy to Upskill the Workforce Skills in the Banking, Financial, and FinTech Sector

FINTECH IS EGYPT’S NEXT BIG OPPORTUNITY..Catch up with FINTEKRS

The Future is FinTech..JOIN FINTEKRS NOW!

FinTekrs’ Alex Round Sponsor

FinTech Worldwide Statistics...FINTEKRS is Not-To-Miss!

Who Can Apply to FINTEKRS

Knowledge from FINTEKRS!

4 Reasons to Join FINTEKRS!

Launching FINTEKRS

FinTech Egypt releases its FinTech Investments-focused H1 2022 Landscape Review “Why Egypt is a promising market for FinTech Investments?”

The Women Techsters Initiative Fellowship Class of 2023

We're bringing top LPs and GPs from around the world

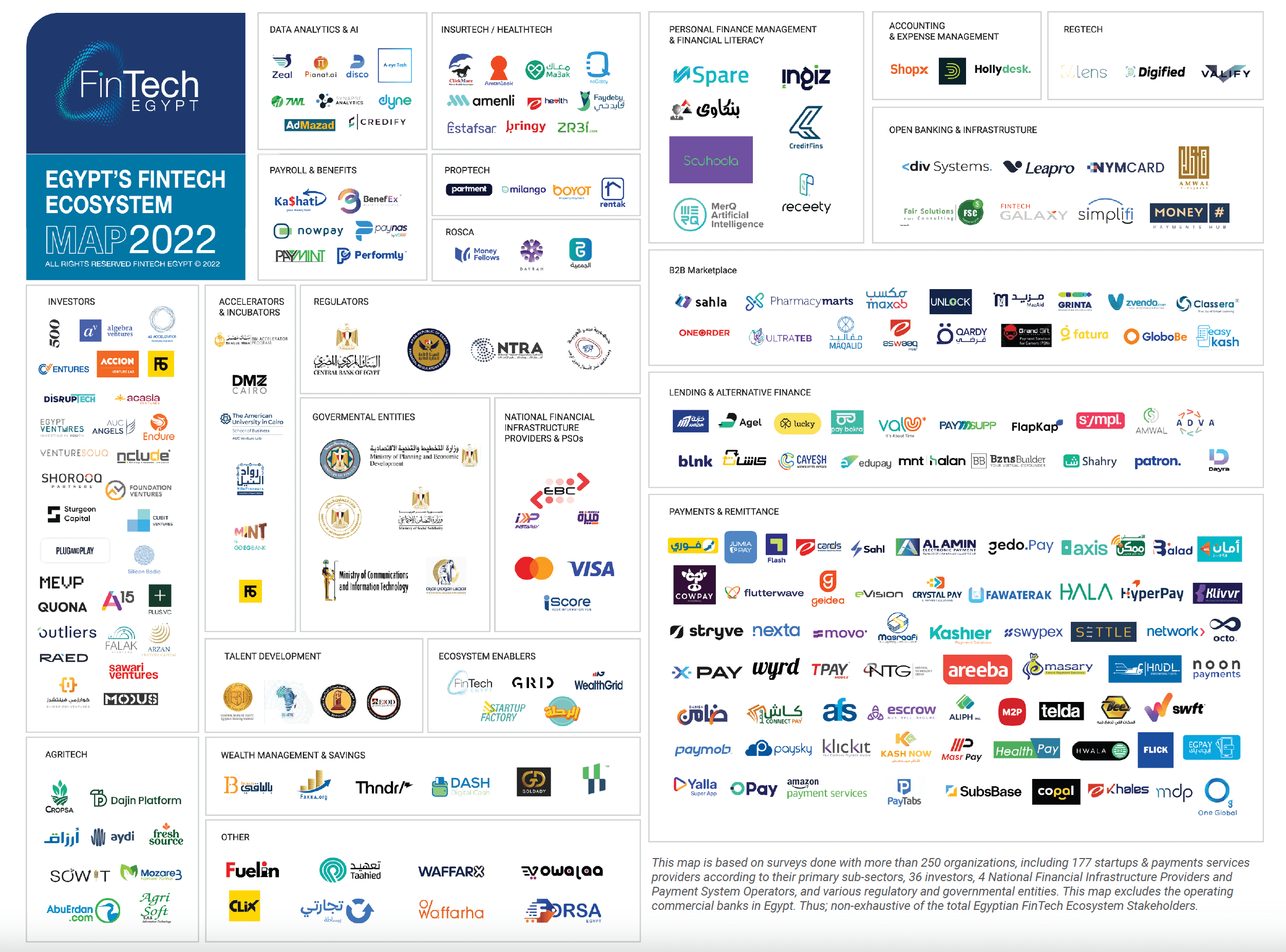

The Egyptian FinTech ecosystem is booming

We've joined forces to bring the best LPs and GPs together

We're taking a closer look at Egypt

Come and join the key players in the Middle East & Africa’s VC market

Connect with Egypt

Frontier of Egypt, Africa & the middle East in the 2022

Egypt’s First VC Summit kicks off in partnership between GIZ Egypt, AfricaGrow and Fintech Egypt

BANQUE MISR, NATIONAL BANK OF EGYPT, AND BANQUE DU CAIRE LEAD INVESTMENT IN NEW FINTECH FUND

The Increasing Influence of Women in FinTech

FinTech Egypt is releasing the first comprehensive report of its kind providing an overview of the unprecedented growth of FinTech in the Egyptian market

5 FinTech Trends to Follow in 2022

How FinTech is Disrupting an Age-Old Industry

Accelerate’ha’ Female-Focused Problem Statements Now Live!

Breaking Entry Barriers for Women in FinTech

Have Traditional Banks Realized the Full Potential of Fintech By Now?

Episode 5: Accelerating FinTech Innovation through Open APIs

Episode 4: Understanding Blockchain’ s Potential in Disrupting FinTech

.png)

Episode 3: Discovering FinTech Talent through “FinYology - FinTech for Youth”

Episode 2: The Current & Future state of FinTech during COVID-19

FinTech Egypt Dialogue podcast launches its first-ever session about E-KYC Regulations and Regulatory Sandbox

Where does Artificial Intelligence fit in FinTech?

Critical FinTech Questions That Only the Near Future Can Answer

Special Interview With Dor-E, Winner Of The AI-Customer Experience FinTech Innovation Challenge

Egyptian Banking Institute Announces “The Future Of FinTech And Latest Digitalization Trends” Field Trip

Artificial Intelligence Is Transforming Banking As We Know It

Artificial Intelligence Is Transforming Banking As We Know It

Hub71 Partners With Techstars In Launching An Accelerator Program To Boost Startups

FINTECH IN THE SAVANNAH: Afro-Asia FinTech festival 2019 that took place in Nairobi Kenya

How Machine Learning Supports Credit Profiling

The Central Bank of Egypt’s Regulatory Sandbox started its first cohort in “e-KYC” to empower the FinTech ecosystem in Egypt.

Dubai Smart City Accelerator invites Egyptian startups to join Cairo Fast Track

Calling All Egyptian FinTech Startups To Participate In The Afro-Asia FinTech Festival!

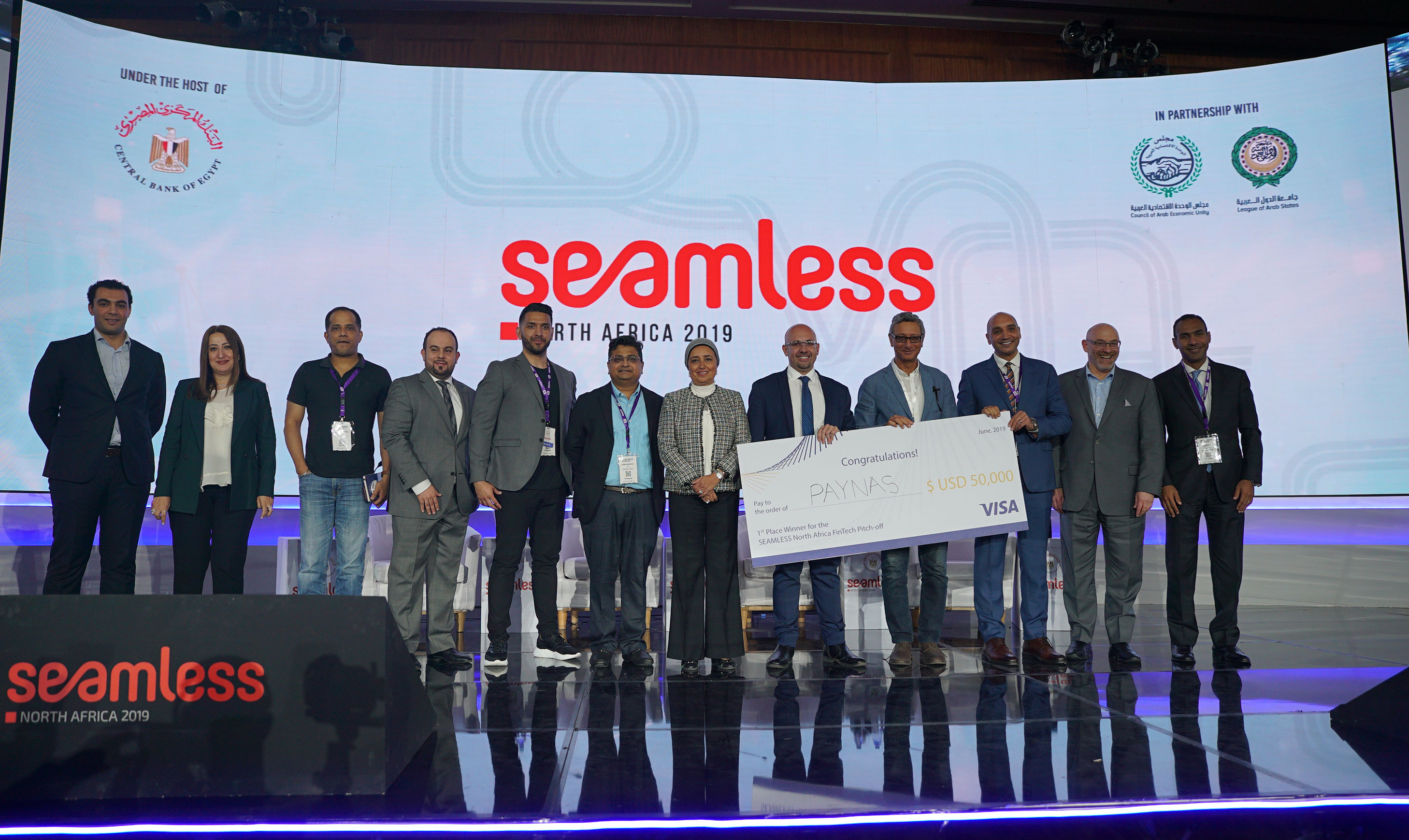

Paynas Wins Big At Seamless North Africa 2019

.jpg)

Seamless North Africa 2019

Announcing The Inaugural AFI FinTech Showcase

Fintech Trends In 2019 - Blockchain Adoption

.jpg)

Discounted Start-Up Passes

0

0

6.2k

6.2k

Comments