The Central Bank of Egypt’s Regulatory Sandbox started its first cohort in “e-KYC” to empower the FinTech ecosystem in Egypt.

10 July 2019

Aiming to cope with rapid developments in the financial technology ecosystem, the Central Bank of Egypt (CBE)’s Regulatory Sandbox acts as a live testing ground for FinTech startups that are developing new business models but are currently hindered by stringent authorization requirements and regulatory uncertainty.

The CBE’s Regulatory Sandbox aims to pave the way for faster and easier access to new financial solutions and embed compliance within the FinTech ecosystem at an early stage. This will not only allow FinTech innovators to focus on their core offering, but also ensure that consumers and other players in the market are not adversely affected by the regulatory uncertainty of disruptive FinTech activities.

Since June 2019, the regulatory sandbox has been active and it started its first cohort. All FinTech startups and companies specializing in e-KYC solutions are invited to apply and experiment the digital onboarding of mobile payments subscriber solutions, under the CBE Regulatory Sandbox principles and eligibility criteria.

The application deadline for startups to participate in the first cohort “e-KYC” is on the 15th of July 2019.

https://fintech.cbe.org.eg/home/sandbox?en

related articles

A New Milestone in Egypt’s FinTech Journey

The FinTech Reality Show

Egypt Shines at the FinTech Arab Challenge 2025!

Announcing the Winners of FinTech Got Talent 2025!

Why does innovation often fail in organizations, and how can we truly enable it?

How can banks successfully enable AI — safely, strategically, and at scale?

We’re excited to announce the kick-off of the FinTech Hackathon

.jpg)

Attention all FinTech/FinTech-enabled Startups and PSPs!

.jpg)

Calling all Investors!

.jpg)

Calling all the accelerators and incubators!

AI is not the future. It’s NOW.

Most important moments from FinTekrs Assiut Round!

Celebrating Innovation: Top 10 Universities in the FinTech Got Talent Competition!

Proudly Announcing Mansoura Demo Day From Fintekrs Program Round 3!

Announcement: FinTech Got Talent Competition - 2nd Edition!

Don’t miss the chance to be part of a live conversation on the latest in FinTech, right at the Central Bank of Egypt Booth during the Cairo ICT!

Thrilled to announce that FinTekrs is taking the FinTech track by storm at Techne Summit!

.png)

The Central Bank of Egypt Supports Women’s Empowerment to Expand their Businesses

Agri-FinTech Applications by Fresh Source

4th Episode of 7areef FinTech Podcast – Supply Chain Finance

3rd Episode of 7areef FinTech Podcast – Digital Payments

2nd Episode of 7areef FinTech Podcast – ROSCA

1st Episode of 7areef FinTech Podcast - FinTekrs Introduction

Are you interested to be “7areef FinTech”?!

.jpg)

“FinTech Egypt” Launches the First Digital Academy to Upskill the Workforce Skills in the Banking, Financial, and FinTech Sector

FINTECH IS EGYPT’S NEXT BIG OPPORTUNITY..Catch up with FINTEKRS

The Future is FinTech..JOIN FINTEKRS NOW!

FinTekrs’ Alex Round Sponsor

FinTech Worldwide Statistics...FINTEKRS is Not-To-Miss!

Who Can Apply to FINTEKRS

Knowledge from FINTEKRS!

4 Reasons to Join FINTEKRS!

Launching FINTEKRS

FinTech Egypt releases its FinTech Investments-focused H1 2022 Landscape Review “Why Egypt is a promising market for FinTech Investments?”

The Women Techsters Initiative Fellowship Class of 2023

We're bringing top LPs and GPs from around the world

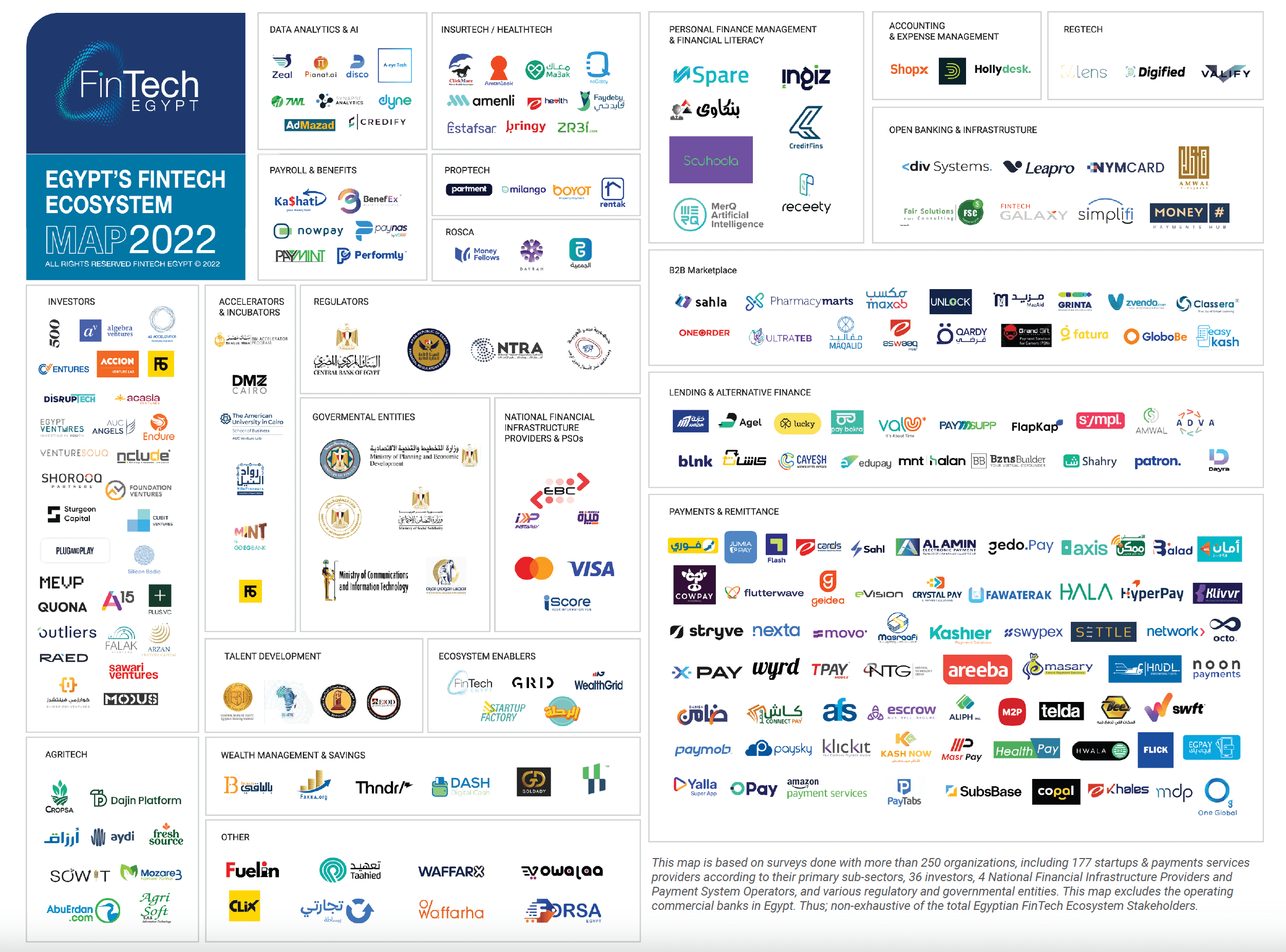

The Egyptian FinTech ecosystem is booming

We've joined forces to bring the best LPs and GPs together

We're taking a closer look at Egypt

Come and join the key players in the Middle East & Africa’s VC market

Connect with Egypt

Frontier of Egypt, Africa & the middle East in the 2022

Egypt’s First VC Summit kicks off in partnership between GIZ Egypt, AfricaGrow and Fintech Egypt

BANQUE MISR, NATIONAL BANK OF EGYPT, AND BANQUE DU CAIRE LEAD INVESTMENT IN NEW FINTECH FUND

The Increasing Influence of Women in FinTech

FinTech Egypt is releasing the first comprehensive report of its kind providing an overview of the unprecedented growth of FinTech in the Egyptian market

5 FinTech Trends to Follow in 2022

How FinTech is Disrupting an Age-Old Industry

RESHAPING FINTECH WITH AI: TOP AI INNOVATIONS IN THE FINANCIAL INDUSTRY

Accelerate’ha’ Female-Focused Problem Statements Now Live!

Breaking Entry Barriers for Women in FinTech

Have Traditional Banks Realized the Full Potential of Fintech By Now?

Episode 5: Accelerating FinTech Innovation through Open APIs

Episode 4: Understanding Blockchain’ s Potential in Disrupting FinTech

.png)

Episode 3: Discovering FinTech Talent through “FinYology - FinTech for Youth”

Episode 2: The Current & Future state of FinTech during COVID-19

FinTech Egypt Dialogue podcast launches its first-ever session about E-KYC Regulations and Regulatory Sandbox

Where does Artificial Intelligence fit in FinTech?

Critical FinTech Questions That Only the Near Future Can Answer

Special Interview With Dor-E, Winner Of The AI-Customer Experience FinTech Innovation Challenge

Egyptian Banking Institute Announces “The Future Of FinTech And Latest Digitalization Trends” Field Trip

Artificial Intelligence Is Transforming Banking As We Know It

Artificial Intelligence Is Transforming Banking As We Know It

Hub71 Partners With Techstars In Launching An Accelerator Program To Boost Startups

FINTECH IN THE SAVANNAH: Afro-Asia FinTech festival 2019 that took place in Nairobi Kenya

How Machine Learning Supports Credit Profiling

Dubai Smart City Accelerator invites Egyptian startups to join Cairo Fast Track

Calling All Egyptian FinTech Startups To Participate In The Afro-Asia FinTech Festival!

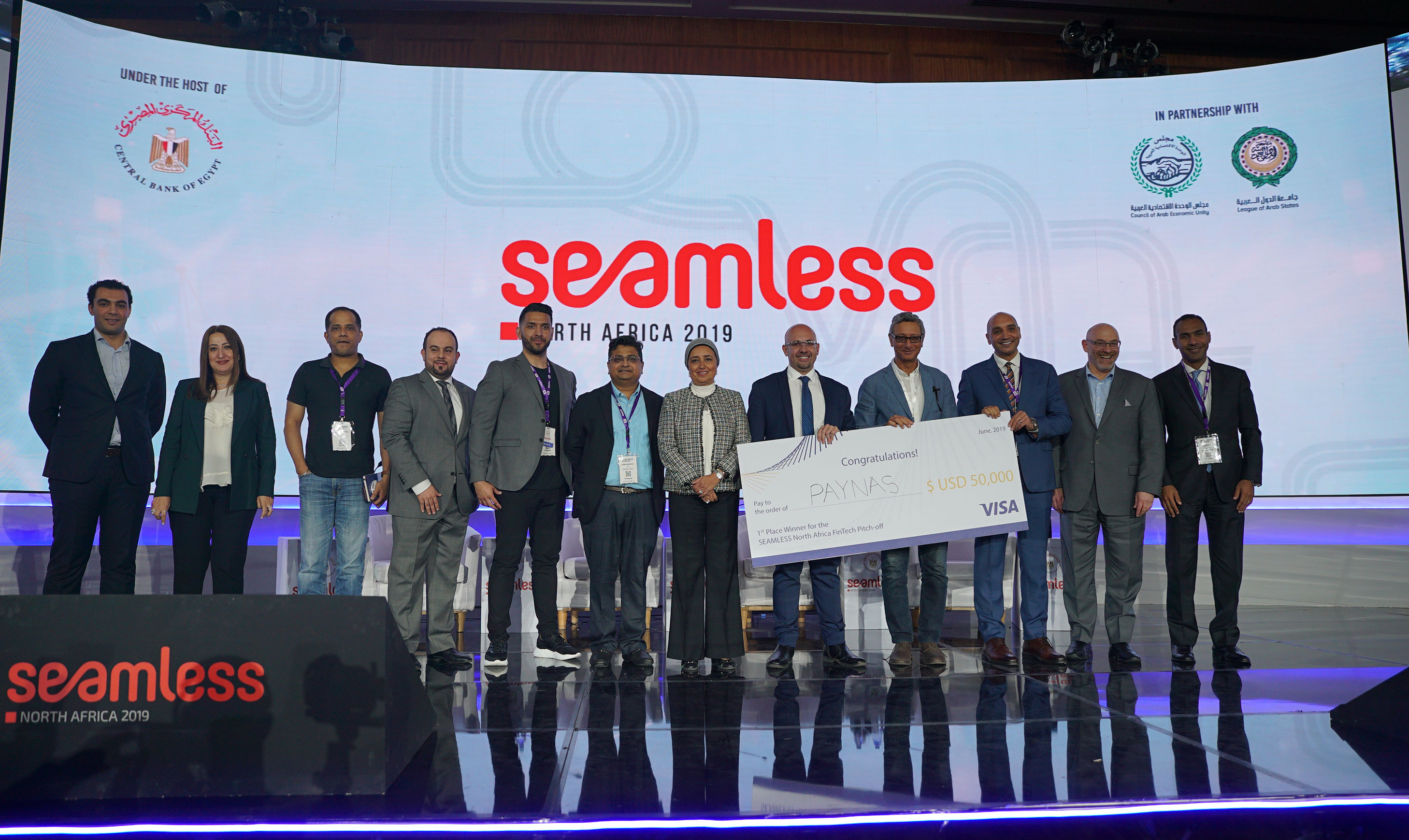

Paynas Wins Big At Seamless North Africa 2019

.jpg)

Seamless North Africa 2019

Announcing The Inaugural AFI FinTech Showcase

Fintech Trends In 2019 - Blockchain Adoption

.jpg)

Discounted Start-Up Passes

5

5

16k

16k

Comments

06:53:53 PM 21 February 2021

08:11:39 AM 05 July 2022

08:24:42 AM 27 November 2022

05:50:01 PM 27 November 2022

04:16:11 PM 08 January 2023