Episode 2: The Current & Future state of FinTech during COVID-19

25 February 2021

In its second episode, FinTech Egypt Dialogue tackled the

impact of COVID-19 and its influence on economies, people, and FinTech as an

industry, with the presence of three distinct guests that brought thought

diversity to the conversation; Dr. Rasha Negm, Head of FinTech & innovation

at the Central Bank of Egypt (CBE), Ramy Taha, Head of Digital Banking and

Marketing at Alex Bank, and Stephen Deng, Co-founder and Partner at DFS Lab, a FinTech

and digital commerce investor and advisory firm that’s primarily focused on

Africa and early-stage startups.

Podcast host Hossam Mahmoud, advisor at GIZ Egypt, greeted

the 3 guests as they gave a brief introduction about themselves. Dr. Rasha Negm

kicked off the session as she was asked about the ripple effect of the FinTech

landscape happening today since the launch of the CBE’s FinTech arm, and what

her ambitions and expectations are for the future of FinTech in Egypt. Dr.

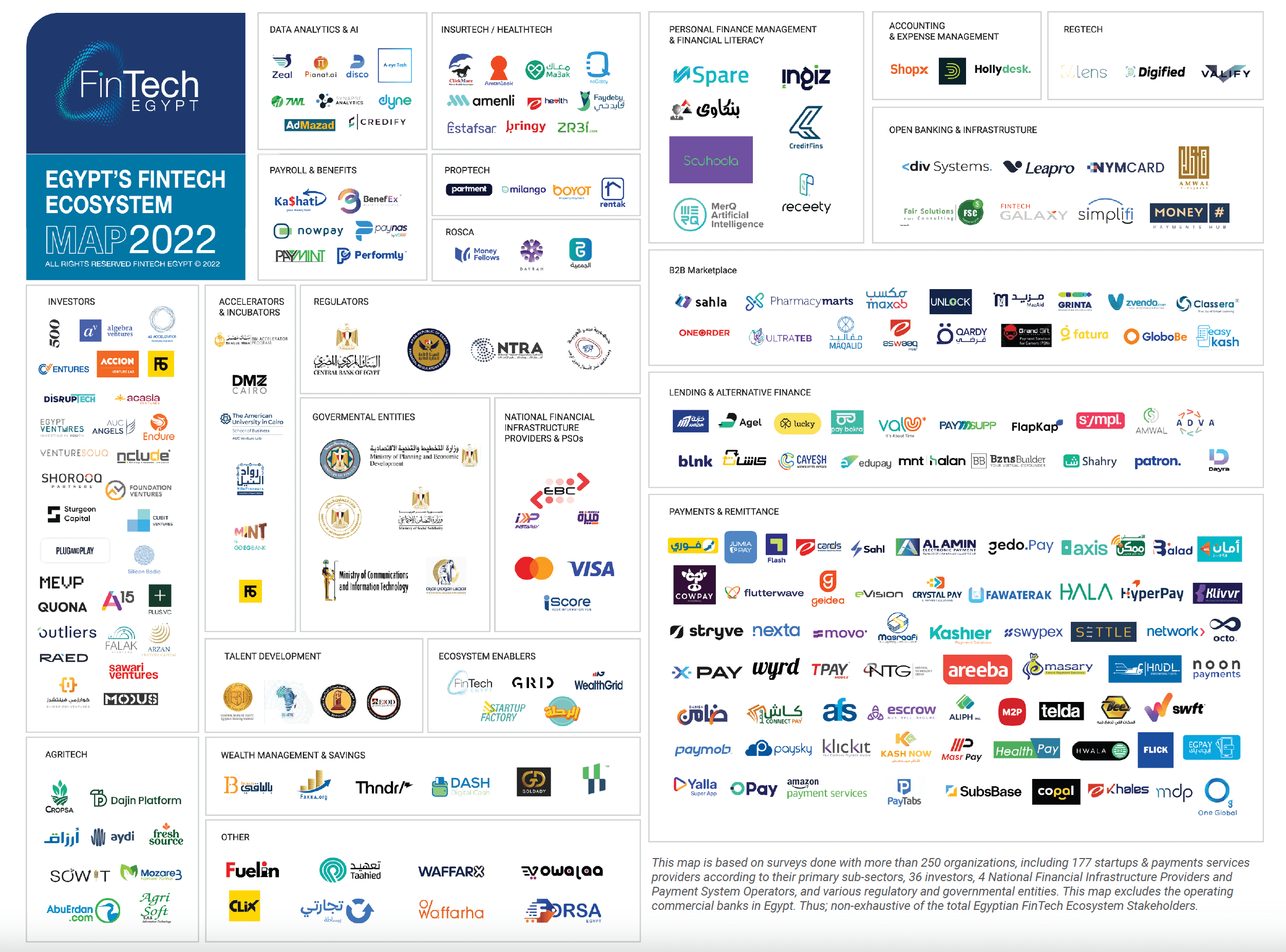

Rasha explained that the FinTech Ecosystem witnessed great progress since the

CBE launched the national strategy for FinTech innovation in Q1 2019, a

pre-pandemic time when just 17 FinTech startups were in the visible scope, as

opposed to today reaching more than 50 FinTech startups as per the figures

reported by GIZ Egypt in 2020, bringing a diverse collective offering as these

young companies cover many FinTech areas that are in need of attention in 2021.

She also stated that the focus was previously on mostly digital payments,

however now these rising startups are venturing into lending, market places,

RegTech, and more areas that contribute to the success of the very promising

FinTech ecosystem in Egypt. On the investment side, she said that FinTech is

reported to be in the top 3 industries in terms of investment opportunities and

startup funding efforts today in Egypt, as the country is also reported to be

one of the fastest growing FinTech ecosystems in the MENA region, with a few others

having a nationwide FinTech innovation strategy that acts as a cornerstone of

the ongoing digital transformation happening across the country. Moreover, she

said that Egypt is currently in the top 5 interesting African FinTech

ecosystems to watch listed among the world’s top “Ecosystems to watch” in 2020,

which makes for a very optimistic future for the Egyptian digital economy.

Hossam then moved on

to ask Ramy Taha about what “digital” means to him in general and how its popularity

has altered the strategies and priorities of Alex Bank as a prominent financial

institution in the digital field. Ramy started off by saying that for them,

it’s all about providing a comprehensive ecosystem that is based on customer

data and the deep analytics that provide valuable insights into their clients’

post-pandemic behavior and digital preferences, and this is achieved by having

a perfect blend between how they optimize their existing customer data and how

they develop and deliver their digital platforms to make the best use of their

existing data. He mentioned that at the beginning of 2020 when the Coronavirus

was just starting to make an impact on the real world, people referred to

digital in terms of just mobile banking solutions, but for digital

professionals such as himself, it means so much more than that, in terms of

analyzing data and significant investments in digital infrastructure. He said

that organizations that have not defined their digital strategy or invested in

their digital infrastructure as of yet, are at risk of becoming obsolete in

terms of their offering and market reach at this point, emphasizing the need

for digital awareness to stay afloat in these highly digitized times. Ultimately,

Ramy said, it’s about how Alex Bank enhances and optimizes the customer

experience, and FinTech startups will have a critical role in supporting

digital banking initiatives, which is why the best thing established financial institutions

like Alex Bank can do for emerging FinTech companies is to provide them with

mentorship and advisory services for the benefit of all parties involved.

Hossam went on to address Stephen Deng and inquired about

his keen interest in Egypt and what has attracted him to it today as opposed to

other countries in Africa, a place in which he has worked in for a long time.

Stephen Deng was joining in from California and was passionate to share his

view of the country’s rising potential and promising outlook. He said that COVID-19

contributed greatly to the adoption of digital products due to its radical

implications and universal shift in trends across the continent. He mentioned

that he’s excited to work with CBE and Egyptian entrepreneurs to elevate the

FinTech ecosystem to new heights, and that Egypt’s tremendous growth in terms

of venture capital and the number of startups, especially replacing South

Africa’s 3rd spot in the continent, is a clear indicator of what’s

to come and what to expect.

He also said that the diversification of the current FinTech

arena in Egypt is also placing the nation in a competitive position with other

international markets and global FinTech ecosystems. He mentioned that,

although COVID-19 has greatly accelerated the rate of digital adoption, Egypt

already had a jumpstart on other fellow countries in Africa pre-pandemic in

terms of the amount and quality of digital offerings, further emphasizing the

fact that the nation is rapidly and successfully achieving its ongoing digital

transformation.

Going back to Dr. Rasha, she elaborated on how she sees FinTech startups can help banks to grow and scale into the digital sphere, saying that collaboration is key between these new and traditional entities to produce viable solutions that address specific problem statements that need to be solved in the Egyptian market, such as only having 33% financial inclusion across the nation, for instance. She stated that the nation’s aim is to eventually become a less cash society, enabled by FinTechs and further propelled by the “new norm” and highly digitized behavior imposed by COVID-19 that consumers are experiencing, making digital no longer an option in these times.

“This can only

happen when everyone is going to collaborate; the banks and incumbents

collaborating with FinTech solutions that have ready-made, easier, quicker,

cheaper, frictionless solutions that can actually help us go through the new

changes and the new norms of the consumer behavior.”

She said that this not only pertains to the financial institutions and banks on the private level, but also extends to regulators; CBE (Central Bank of Egypt) and the FRA (Financial Regulatory Authority) where the regulators collaborate with each other to find comprehensive solutions that satisfy all parties. Dr. Negm emphasized that the new law issued by the CBE that focuses on FinTech adoption and provides a regulatory framework is for them to endorse more FinTech companies and digital finance solutions across the market, and this makes for fertile ground to address the issues raised by the ongoing COVVID-19 pandemic and cater to the digital consumer.

Hossam went on to ask Stephen about the COVID-19 Innovation Sprint program and what it aims to achieve. Stephen stated that the Sprint program – hosted by the Central Bank of Egypt in collaboration with Financial Regulatory Authority, and organized by DFS Lab and FSD Africa – is a matchmaking initative between banks and startups with a 3-day sprint in which startups can apply for, and their selection will allow them to work on prototype solutions that address actual problem statements found in Egypt. Banks and non-bank FIs were invited to join as collaborators in the process to keep a high level of engagement from these Egyptian financial entities with the aim of putting their difference with startups aside for the duration of that program, and actually come together to tackle the real problems that Egyptian consumers are facing today, in hopes of coming with collaborative solutions to solve these issues. Stephen also mentioned that there will be a demo day at the end of the program, where candidates can showcase their prototype to many banks and other participants. He said that the COVID-19 Innovation Sprint is a callout to all local, regional and global startups as he considers it to be a great opportunity for FinTech startups to gain exposure, meet and work with collaborators, helping themselves define their own future and work towards a more inclusive process to grant the best possible outcomes for them, while benefitting from experienced collaborators to bring the best solutions to the rising digital finance ecosystem.

The COVID-19 Innovation Sprint’s main objective is to

unearth, develop, and refine existing FinTech solutions that directly address

the COVID-19 pandemic-related problem statements in the banking and the

financial sectors.

Watch the full session of FinTech Egypt Dialogue’s second

episode here: https://fintech-egypt.com/webinar/

related articles

A New Milestone in Egypt’s FinTech Journey

The FinTech Reality Show

Egypt Shines at the FinTech Arab Challenge 2025!

Announcing the Winners of FinTech Got Talent 2025!

Why does innovation often fail in organizations, and how can we truly enable it?

How can banks successfully enable AI — safely, strategically, and at scale?

We’re excited to announce the kick-off of the FinTech Hackathon

.jpg)

Attention all FinTech/FinTech-enabled Startups and PSPs!

.jpg)

Calling all Investors!

.jpg)

Calling all the accelerators and incubators!

AI is not the future. It’s NOW.

Most important moments from FinTekrs Assiut Round!

Celebrating Innovation: Top 10 Universities in the FinTech Got Talent Competition!

Proudly Announcing Mansoura Demo Day From Fintekrs Program Round 3!

Announcement: FinTech Got Talent Competition - 2nd Edition!

Don’t miss the chance to be part of a live conversation on the latest in FinTech, right at the Central Bank of Egypt Booth during the Cairo ICT!

Thrilled to announce that FinTekrs is taking the FinTech track by storm at Techne Summit!

.png)

The Central Bank of Egypt Supports Women’s Empowerment to Expand their Businesses

Agri-FinTech Applications by Fresh Source

4th Episode of 7areef FinTech Podcast – Supply Chain Finance

3rd Episode of 7areef FinTech Podcast – Digital Payments

2nd Episode of 7areef FinTech Podcast – ROSCA

1st Episode of 7areef FinTech Podcast - FinTekrs Introduction

Are you interested to be “7areef FinTech”?!

.jpg)

“FinTech Egypt” Launches the First Digital Academy to Upskill the Workforce Skills in the Banking, Financial, and FinTech Sector

FINTECH IS EGYPT’S NEXT BIG OPPORTUNITY..Catch up with FINTEKRS

The Future is FinTech..JOIN FINTEKRS NOW!

FinTekrs’ Alex Round Sponsor

FinTech Worldwide Statistics...FINTEKRS is Not-To-Miss!

Who Can Apply to FINTEKRS

Knowledge from FINTEKRS!

4 Reasons to Join FINTEKRS!

Launching FINTEKRS

FinTech Egypt releases its FinTech Investments-focused H1 2022 Landscape Review “Why Egypt is a promising market for FinTech Investments?”

The Women Techsters Initiative Fellowship Class of 2023

We're bringing top LPs and GPs from around the world

The Egyptian FinTech ecosystem is booming

We've joined forces to bring the best LPs and GPs together

We're taking a closer look at Egypt

Come and join the key players in the Middle East & Africa’s VC market

Connect with Egypt

Frontier of Egypt, Africa & the middle East in the 2022

Egypt’s First VC Summit kicks off in partnership between GIZ Egypt, AfricaGrow and Fintech Egypt

BANQUE MISR, NATIONAL BANK OF EGYPT, AND BANQUE DU CAIRE LEAD INVESTMENT IN NEW FINTECH FUND

The Increasing Influence of Women in FinTech

FinTech Egypt is releasing the first comprehensive report of its kind providing an overview of the unprecedented growth of FinTech in the Egyptian market

5 FinTech Trends to Follow in 2022

How FinTech is Disrupting an Age-Old Industry

RESHAPING FINTECH WITH AI: TOP AI INNOVATIONS IN THE FINANCIAL INDUSTRY

Accelerate’ha’ Female-Focused Problem Statements Now Live!

Breaking Entry Barriers for Women in FinTech

Have Traditional Banks Realized the Full Potential of Fintech By Now?

Episode 5: Accelerating FinTech Innovation through Open APIs

Episode 4: Understanding Blockchain’ s Potential in Disrupting FinTech

.png)

Episode 3: Discovering FinTech Talent through “FinYology - FinTech for Youth”

FinTech Egypt Dialogue podcast launches its first-ever session about E-KYC Regulations and Regulatory Sandbox

Where does Artificial Intelligence fit in FinTech?

Critical FinTech Questions That Only the Near Future Can Answer

Special Interview With Dor-E, Winner Of The AI-Customer Experience FinTech Innovation Challenge

Egyptian Banking Institute Announces “The Future Of FinTech And Latest Digitalization Trends” Field Trip

Artificial Intelligence Is Transforming Banking As We Know It

Artificial Intelligence Is Transforming Banking As We Know It

Hub71 Partners With Techstars In Launching An Accelerator Program To Boost Startups

FINTECH IN THE SAVANNAH: Afro-Asia FinTech festival 2019 that took place in Nairobi Kenya

How Machine Learning Supports Credit Profiling

The Central Bank of Egypt’s Regulatory Sandbox started its first cohort in “e-KYC” to empower the FinTech ecosystem in Egypt.

Dubai Smart City Accelerator invites Egyptian startups to join Cairo Fast Track

Calling All Egyptian FinTech Startups To Participate In The Afro-Asia FinTech Festival!

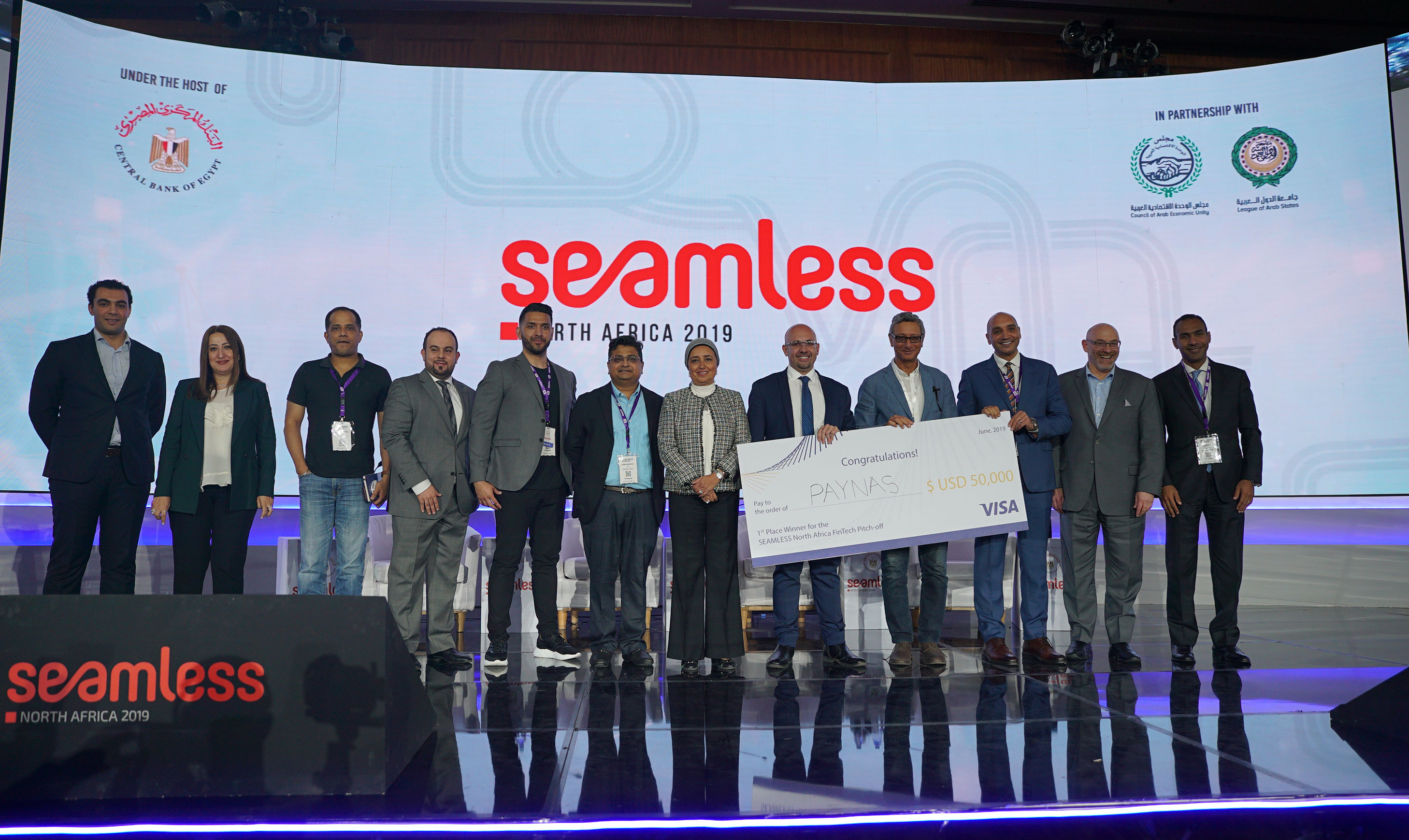

Paynas Wins Big At Seamless North Africa 2019

.jpg)

Seamless North Africa 2019

Announcing The Inaugural AFI FinTech Showcase

Fintech Trends In 2019 - Blockchain Adoption

.jpg)

Discounted Start-Up Passes

0

0

9.7k

9.7k

Comments