BANQUE MISR, NATIONAL BANK OF EGYPT, AND BANQUE DU CAIRE LEAD INVESTMENT IN NEW FINTECH FUND

21 March 2022

Launch of ‘Nclude’ by Global Ventures to accelerate Egypt’s Fintech innovation

Other investors include eFinance Investment Group and the Egyptian Banks Company

Cairo, Egypt – 20 March 2022: Egypt's largest national banks - Banque Misr, National Bank of Egypt, and Banque du Caire – and Global Ventures, a leading MEA-focused venture capital firm - announce the launch of Nclude by Global Ventures, following approval by the Central Bank of Egypt (“CBE”).

This bold and unprecedented step is an implementation of the country’s strategic vision to support young innovators who will build the Egyptian Economy of the future, Nclude by Global Ventures will focus on accelerating Fintech Innovation and driving Financial Inclusion. The initial amount, equivalent to $85 million investment in the Fund, is led by Banque Misr as an Anchor Investor and National Bank of Egypt and Banque du Caire as Strategic Investors. Other investors include eFinance Investment Group and Egyptian Banks Company. The Fund is also set to attract further investment from prominent regional and international investors.

The Fund has already made its first investments in four companies. These are:

- Khazna: A financial Super App that offers convenient, technology-driven financial solutions to underserved consumers.

- Lucky: Egypt’s leading consumer fintech app, offering instalments, offers, cashback rewards and credit.

- Mozare3: meaning farmer in Arabic, is an Agri-fintech platform that provides smallholder farmers with direct access to inputs financing, markets, and hands-on technical support.

- Paymob: A leading digital payment service provider.

Mr. Tarek Amer, Governor of the Central Bank of Egypt, said:

“This step is an implementation of the directives of President Abdel Fattah El-Sisi to support innovative youth in Fintech and Fintech-enabled sector, as well as CBE’s FinTech & Innovation Strategy which aims to create an enabling environment for the FinTech industry and adopt more innovative FinTech solutions capable of delivering banking and financial services to all segments of society more easily and at less cost, as a crucial step to transform Egypt into a regional center for the FinTech industry in the Arab World and Africa.

“The aforementioned strategy is based on key integrated pillars, which are represented in supporting FinTech talents and young entrepreneurs, providing a stimulating legislative and regulatory environment for the FinTech industry, in a way that achieves a balance between financial stability and unleashing innovation. In addition to meeting the market Fintech demand areas and adoption of new FinTech solutions, and increasing investments directed to FinTech & FinTech-enabled solutions which is considered as one of the top priority pillars.”

Mr. Mohamed El-Etreby, Chairman of Banque Misr, said:

"Banque Misr's contribution to this Fund is a reflection of our commitment to keeping up with the pace of global developments in Fintech – as it is the future of banking and financial services in Egypt and the world. This Fund will achieve many gains for the Egyptian Economy by supporting the country's young Fintech talent and creating the ideal environment for them to develop innovative solutions that will help deliver banking and financial services to all segments of society in a more efficient and affordable manner.

"This is an important step to transform Egypt into a Regional center for the Arab and African Fintech industry. It will also help raise financial inclusion rates and accelerate Egypt's digital transformation, which is integral to delivering the Egypt Vision 2030."

Mr. Hisham Okasha, Chairman of the National Bank of Egypt, commented:

“The Nclude Fund aims to sponsor early-stage Fintech startups, and young Fintech talent, who will help build the Egyptian economy of the future. In addition, the Fund targets creating an appropriate environment to attract, nurture, and localize talent in the Egyptian market to build creative Fintech solutions, while promoting innovation in the digital banking and financial services sector, to reach all segments of society with ease and efficiency.

This strategy will accelerate digital transformation and drive financial inclusion, in line with the Central Bank of Egypt's pioneering vision to foster innovation in Fintech and Fintech-enabled sectors to ultimately achieve the goals of Egypt’s Vision 2030 and aligns with NBE’s strategy on digital transformation."

Mr. Tarek Fayed, Chairman and CEO of the Banque du Caire added:

"The launch of this Fund creates a unique opportunity for investors, and entrepreneurs to come together and create a scalable and affordable financial technology solutions. Such solutions will not only improve the quality of current services but will also create new services using cutting edge technology that leverages a data-driven approach to attract the underbanked and financially excluded segments of society."

"This Fund has a strategic developmental angle that will benefit the Egyptian economy as a whole and position the country as a Regional Fintech Innovation hub, in line with the CBE's strategy."

Basil Moftah, Partner at Global Ventures, commented:

"We are delighted to have the overwhelming support of all our investors in this Fund, and thankful for their trust. Over the past few years, we have had the privilege of being part of the journey of many entrepreneurs across MEA, with a particular focus on the Fintech sector and Egypt as a key priority market.

"Egypt's huge unbanked, young population and cash-dominated economy offers strong opportunities for local and regional Fintech and Fintech enabled companies who continue to witness exponential growth in the market. We look forward to partnering with all stakeholders in the ecosystem to continue to fuel this growth and transform Egypt into a Regional center of excellence for Fintech innovation.”

Eslam Darwish, General Partner of the Nclude FinTech Fund, added:

"Over the past few years, Egypt made a quantum leap forward by becoming home to a vibrant entrepreneurial ecosystem with Fintech at its heart. Thanks to progressive government regulation, and an increasing partnership with financial institutions, Fintech startups, are playing a pivotal role in transforming Egypt into a financially inclusive digital economy via Fintech innovation.

"We are incredibly grateful for the opportunity to partner with the local and international investor community to provide ambitious founders the tools they need to succeed and compete at local, regional and global levels, while contributing to Egypt's socio-economic development and prosperity."

related articles

A New Milestone in Egypt’s FinTech Journey

The FinTech Reality Show

Egypt Shines at the FinTech Arab Challenge 2025!

Announcing the Winners of FinTech Got Talent 2025!

Why does innovation often fail in organizations, and how can we truly enable it?

How can banks successfully enable AI — safely, strategically, and at scale?

We’re excited to announce the kick-off of the FinTech Hackathon

.jpg)

Attention all FinTech/FinTech-enabled Startups and PSPs!

.jpg)

Calling all Investors!

.jpg)

Calling all the accelerators and incubators!

AI is not the future. It’s NOW.

Most important moments from FinTekrs Assiut Round!

Celebrating Innovation: Top 10 Universities in the FinTech Got Talent Competition!

Proudly Announcing Mansoura Demo Day From Fintekrs Program Round 3!

Announcement: FinTech Got Talent Competition - 2nd Edition!

Don’t miss the chance to be part of a live conversation on the latest in FinTech, right at the Central Bank of Egypt Booth during the Cairo ICT!

Thrilled to announce that FinTekrs is taking the FinTech track by storm at Techne Summit!

.png)

The Central Bank of Egypt Supports Women’s Empowerment to Expand their Businesses

Agri-FinTech Applications by Fresh Source

4th Episode of 7areef FinTech Podcast – Supply Chain Finance

3rd Episode of 7areef FinTech Podcast – Digital Payments

2nd Episode of 7areef FinTech Podcast – ROSCA

1st Episode of 7areef FinTech Podcast - FinTekrs Introduction

Are you interested to be “7areef FinTech”?!

.jpg)

“FinTech Egypt” Launches the First Digital Academy to Upskill the Workforce Skills in the Banking, Financial, and FinTech Sector

FINTECH IS EGYPT’S NEXT BIG OPPORTUNITY..Catch up with FINTEKRS

The Future is FinTech..JOIN FINTEKRS NOW!

FinTekrs’ Alex Round Sponsor

FinTech Worldwide Statistics...FINTEKRS is Not-To-Miss!

Who Can Apply to FINTEKRS

Knowledge from FINTEKRS!

4 Reasons to Join FINTEKRS!

Launching FINTEKRS

FinTech Egypt releases its FinTech Investments-focused H1 2022 Landscape Review “Why Egypt is a promising market for FinTech Investments?”

The Women Techsters Initiative Fellowship Class of 2023

We're bringing top LPs and GPs from around the world

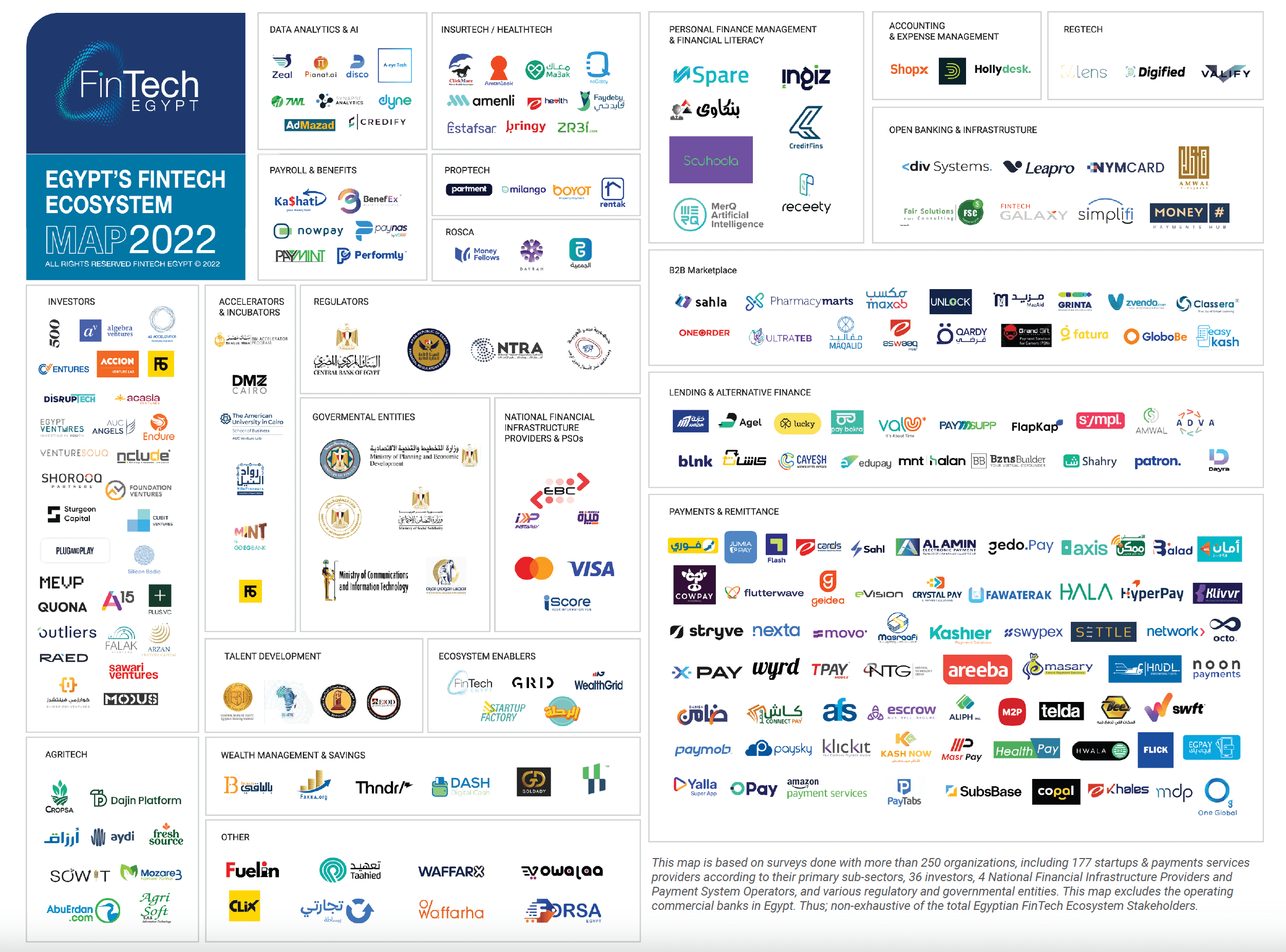

The Egyptian FinTech ecosystem is booming

We've joined forces to bring the best LPs and GPs together

We're taking a closer look at Egypt

Come and join the key players in the Middle East & Africa’s VC market

Connect with Egypt

Frontier of Egypt, Africa & the middle East in the 2022

Egypt’s First VC Summit kicks off in partnership between GIZ Egypt, AfricaGrow and Fintech Egypt

The Increasing Influence of Women in FinTech

FinTech Egypt is releasing the first comprehensive report of its kind providing an overview of the unprecedented growth of FinTech in the Egyptian market

5 FinTech Trends to Follow in 2022

How FinTech is Disrupting an Age-Old Industry

RESHAPING FINTECH WITH AI: TOP AI INNOVATIONS IN THE FINANCIAL INDUSTRY

Accelerate’ha’ Female-Focused Problem Statements Now Live!

Breaking Entry Barriers for Women in FinTech

Have Traditional Banks Realized the Full Potential of Fintech By Now?

Episode 5: Accelerating FinTech Innovation through Open APIs

Episode 4: Understanding Blockchain’ s Potential in Disrupting FinTech

.png)

Episode 3: Discovering FinTech Talent through “FinYology - FinTech for Youth”

Episode 2: The Current & Future state of FinTech during COVID-19

FinTech Egypt Dialogue podcast launches its first-ever session about E-KYC Regulations and Regulatory Sandbox

Where does Artificial Intelligence fit in FinTech?

Critical FinTech Questions That Only the Near Future Can Answer

Special Interview With Dor-E, Winner Of The AI-Customer Experience FinTech Innovation Challenge

Egyptian Banking Institute Announces “The Future Of FinTech And Latest Digitalization Trends” Field Trip

Artificial Intelligence Is Transforming Banking As We Know It

Artificial Intelligence Is Transforming Banking As We Know It

Hub71 Partners With Techstars In Launching An Accelerator Program To Boost Startups

FINTECH IN THE SAVANNAH: Afro-Asia FinTech festival 2019 that took place in Nairobi Kenya

How Machine Learning Supports Credit Profiling

The Central Bank of Egypt’s Regulatory Sandbox started its first cohort in “e-KYC” to empower the FinTech ecosystem in Egypt.

Dubai Smart City Accelerator invites Egyptian startups to join Cairo Fast Track

Calling All Egyptian FinTech Startups To Participate In The Afro-Asia FinTech Festival!

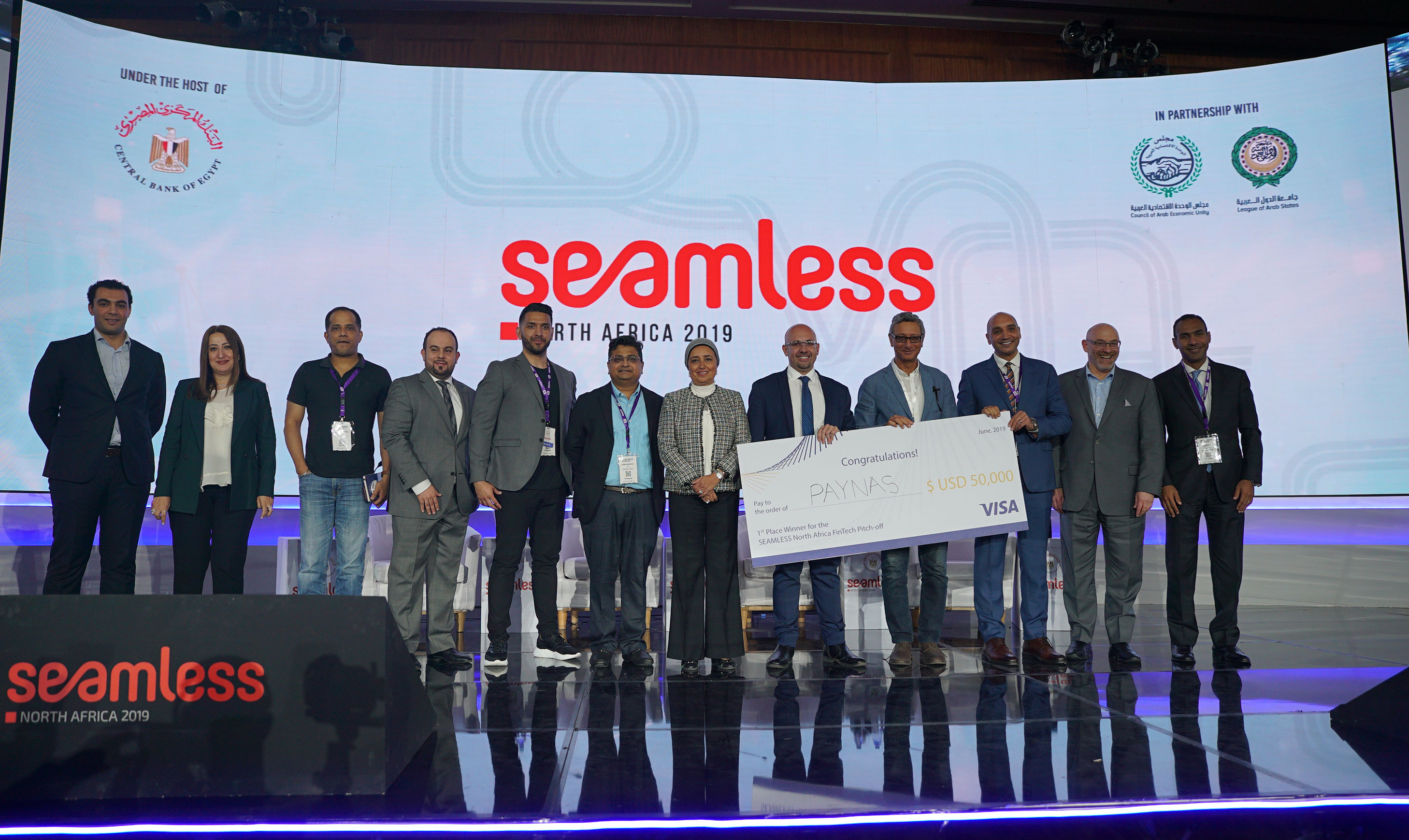

Paynas Wins Big At Seamless North Africa 2019

.jpg)

Seamless North Africa 2019

Announcing The Inaugural AFI FinTech Showcase

Fintech Trends In 2019 - Blockchain Adoption

.jpg)

Discounted Start-Up Passes

0

0

11.3k

11.3k

Comments