5 FinTech Trends to Follow in 2022

4 January 2022

The sheer volume of FinTech products and services that have risen to existence over the past few years has explicitly shown that the digitization of finance is an extremely desirable industry that has demonstrated huge adoption rates, especially in light of the onset of the COVID-19 pandemic that has affected the traditional finance industry.

The high-demand nature of contactless, cashless payments and transactions has directed the finance world into a highly innovative FinTech ecosystem that keeps on evolving with time. This has led to the need to identify key game-changing trends in FinTech that promise even more innovation and convenience to customers around the world. Here are some key trends to look out for in 2022:

1) Digital-First Banking

Banking services have taken a big turn during 2020 as the impact of COVID-19 was felt across all industries worldwide, and the finance sector was one that was already poised to deliver contactless solutions to its customers during a critical time. Customers were urged to not engage in physical contact and avoid making physical visits to their local branches, which further accelerated the shift to digital inside and outside of financial institutions. Fast forward to 2021, and we find that basic services like signing documents, queueing for hours, receiving receipts and dealing with bankers were all digitized and made more convenient by financial institutions themselves or through partnering up with relevant FinTech companies.

This has led to the emergence of digital-first banks, or neobanks, that are solely dependent on the digitization of finance in terms of all its processes and operations. These new banks are seizing the finance market and acquiring customers at an unprecedented pace, as they deliver fast, easy, secure and convenient tailor-made solutions that business and customers alike can enjoy in the safety and comfort of their homes.

The benefits of neobanks are obvious to everyone involved, where clients get the convenience, speed and security of conducting their financial needs at home, and the banks cut down their workforce expenses significantly while enabling the automation of a large number of transactions hassle-free. With a seamless online experience, lower fees and real-time access to bank accounts, neobanks and digital-first banks are here to stay.

2) Big Data

The digitization of a whole industry entails the generation of a tremendous amount of data that needs its own set of related services, such as storage, processing power, and high security and privacy measures. Big Data technology has been on the rise over the past few years, and it is showing no signs of slowing down as more and more users make the shift from physical to digital over time. Both modern and traditional financial institutions are in need of big data technologies in their operations, in order to cope with the rising demand of innovative Fintech products and services that are largely dependent on the collection of user data to create customized solutions and safe digital banking. This user data is also useful for creating rich client profiles that grant better, faster and more efficient insights to develop cutting-edge marketing strategies for FIs that are looking to grow their customer base and deliver better personalized services down the line. Big data is an ever-growing trend that promises to keep on evolving as the FinTech industry increases its demand for the storage and processing of huge amounts of data, and this symbiotic relationship leads to FIs improve their business model, adapting different customer-oriented strategies, and achieve better results.

3) AI-Based Solutions

Artificial intelligence (AI) was a scrutinized innovative concept during its humble beginnings, but the evolution of AI across a variety of industries has proven time and again that it simply makes everything better, faster and more manageable. That being said, AI is still considered in its development stage in terms of complete reliance on it, but its current use cases have proven to be greatly beneficial in specific contexts and uses. Financial services for instance have experienced amazing benefits from AI-based approaches, from instant communication to the automation of secure financial processes within the back offices of financial institutions and much more. AI is slowly changing the way FIs are conducting their business, safely automating certain aspects of digital finance that leaves room for human labor to make use of their skills and expertise in other, more meaningful aspects of FinTech.

As a rising trend in FinTech for a few years now, AI technology allows the almost-instant processing of information across the board, providing quick and reliable solutions that greatly reduce the possibilities of risk and fraudulent activities in the banking sector. The automation aspect of AI also helps to eliminate human errors in their corresponding processes, which leads to a significant decrease in operating costs. Furthermore, the deployment of chatbots has streamlined the communication process between customers and their banks, allowing for saving time and effort while providing quick support and answering frequently asked questions in little to no time. All these trendy applications of AI in financial companies ultimately lead to personalized services and a seamless tailor-made experience for each individual customer, further optimizing the user experience and solidifying the company’s image in the mind of its clients.

4) Biometric Cybersecurity

In the age of digitization, people have one big general concern when it comes to adopting technology; the privacy and security of their personal data. As cybercrime becomes an unavoidable byproduct of digitization, modern banks and FIs are adamant on cementing the security aspect of technology as they continue to evolve their operations. Cutting-edge security measures are used to minimize cyberattack risks and fraudulent activities, and perhaps the most prominent of those measures is the use of biometrics to secure customer data.

Biometric security such as KYC (Know Your Customer) and facial recognition algorithms allow for customers to authenticate their identities by standing in front of a device and scan their faces through a remote sensor without any contact whatsoever. Another way to employ biometrics is to implement fingerprint identification, an aspect of cybersecurity that is already available in commercial devices such as smartphones. Overall, there is a huge interest in the best cybersecurity trends that are a critical component of the digitization of finance as FinTech continues to evolve, and this trend will likely continue to rise in popularity as the global population continues to adopt FinTech as a viable alternative to traditional finance.

5) The Emergence of WealthTech

FinTech has opened up gateways for the digitization of more intricate financial services such as InsurTech, and one of those aspects that promise to be a rising trend is WealthTech, and more specifically robo-advisors in that popular innovative concept.

Robo-advisors in WealthTech are the advanced automated platforms that use Machine Learning and various algorithms to support its users in managing personal and corporate finances of individuals and businesses by enabling them to make data-driven financial decisions.

Offering exclusive personalized experiences and recommendations based on market data analysis and the user’s personal goals, robo-advisors today are poised to replace traditional financial advisors in the future, in the opinion of several industry experts. At the current time, they are ML-based automations that help investors make sound decisions to generate better results and eliminate potential market risks.

Promising to become much more than digitally enabled brokerage platforms, WealthTech services are industry trends to watch out for as they continue to “learn” and evolve as time passes by. The most prominent benefits of WealthTech as an increasingly popular trend are providing personalized customer service, granting advanced transparency in operations, developing tech-enhanced workflows across the board, and perhaps most importantly making use of data-driven insights to generate recommendations based on individual preferences coupled with market data.

All in all, 2021 has been a very promising year for FinTech, and the happening trends during that year are almost certainly going to increase in popularity as 2022 unfolds. Traditional financial institutions and rising FinTech companies should keep track of those trends to gain a competitive edge over the rising competition and sustain their customer base while striving to grow in an ever-digitized world.

related articles

A New Milestone in Egypt’s FinTech Journey

The FinTech Reality Show

Egypt Shines at the FinTech Arab Challenge 2025!

Announcing the Winners of FinTech Got Talent 2025!

Why does innovation often fail in organizations, and how can we truly enable it?

How can banks successfully enable AI — safely, strategically, and at scale?

We’re excited to announce the kick-off of the FinTech Hackathon

.jpg)

Attention all FinTech/FinTech-enabled Startups and PSPs!

.jpg)

Calling all Investors!

.jpg)

Calling all the accelerators and incubators!

AI is not the future. It’s NOW.

Most important moments from FinTekrs Assiut Round!

Celebrating Innovation: Top 10 Universities in the FinTech Got Talent Competition!

Proudly Announcing Mansoura Demo Day From Fintekrs Program Round 3!

Announcement: FinTech Got Talent Competition - 2nd Edition!

Don’t miss the chance to be part of a live conversation on the latest in FinTech, right at the Central Bank of Egypt Booth during the Cairo ICT!

Thrilled to announce that FinTekrs is taking the FinTech track by storm at Techne Summit!

.png)

The Central Bank of Egypt Supports Women’s Empowerment to Expand their Businesses

Agri-FinTech Applications by Fresh Source

4th Episode of 7areef FinTech Podcast – Supply Chain Finance

3rd Episode of 7areef FinTech Podcast – Digital Payments

2nd Episode of 7areef FinTech Podcast – ROSCA

1st Episode of 7areef FinTech Podcast - FinTekrs Introduction

Are you interested to be “7areef FinTech”?!

.jpg)

“FinTech Egypt” Launches the First Digital Academy to Upskill the Workforce Skills in the Banking, Financial, and FinTech Sector

FINTECH IS EGYPT’S NEXT BIG OPPORTUNITY..Catch up with FINTEKRS

The Future is FinTech..JOIN FINTEKRS NOW!

FinTekrs’ Alex Round Sponsor

FinTech Worldwide Statistics...FINTEKRS is Not-To-Miss!

Who Can Apply to FINTEKRS

Knowledge from FINTEKRS!

4 Reasons to Join FINTEKRS!

Launching FINTEKRS

FinTech Egypt releases its FinTech Investments-focused H1 2022 Landscape Review “Why Egypt is a promising market for FinTech Investments?”

The Women Techsters Initiative Fellowship Class of 2023

We're bringing top LPs and GPs from around the world

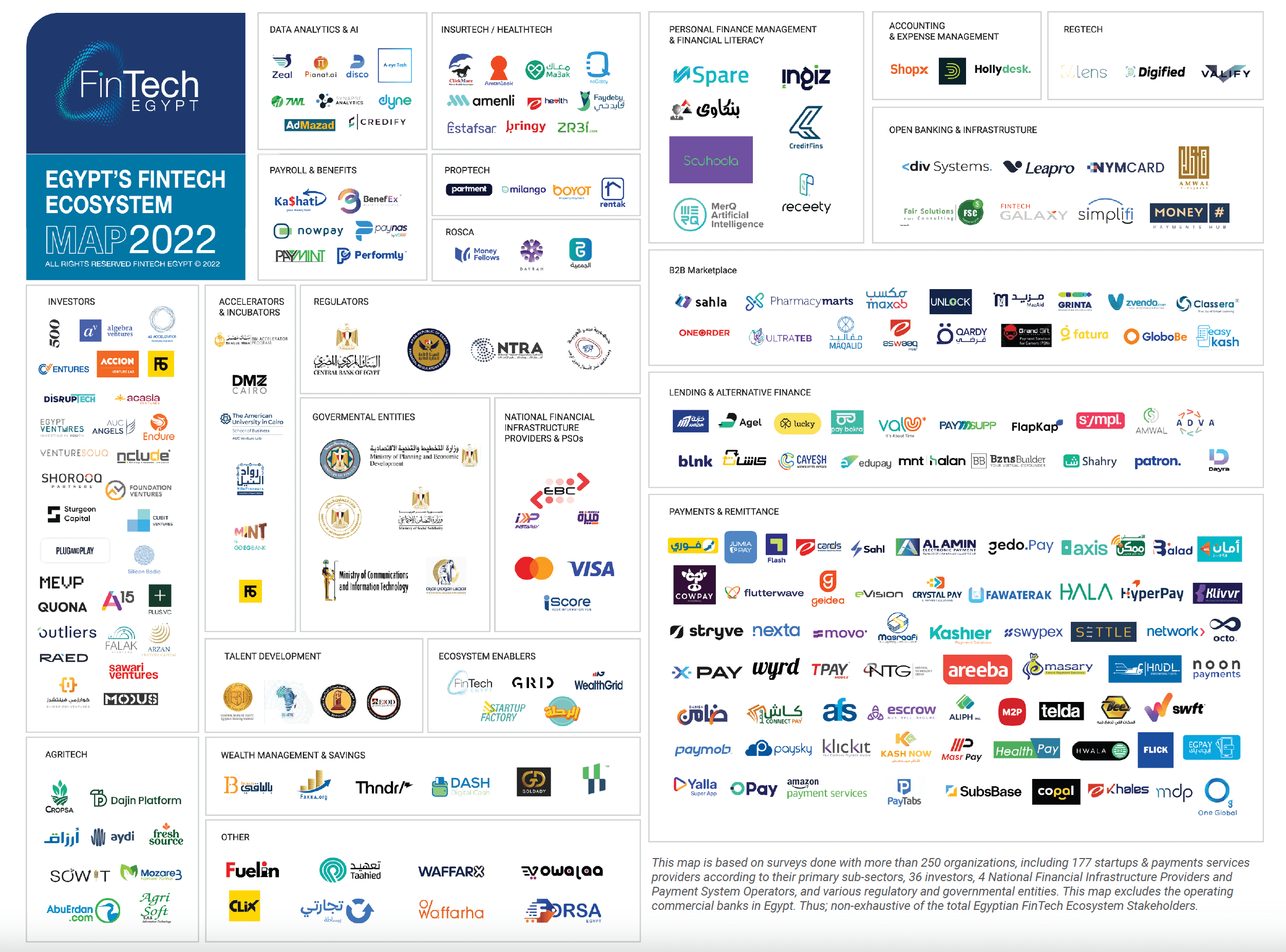

The Egyptian FinTech ecosystem is booming

We've joined forces to bring the best LPs and GPs together

We're taking a closer look at Egypt

Come and join the key players in the Middle East & Africa’s VC market

Connect with Egypt

Frontier of Egypt, Africa & the middle East in the 2022

Egypt’s First VC Summit kicks off in partnership between GIZ Egypt, AfricaGrow and Fintech Egypt

BANQUE MISR, NATIONAL BANK OF EGYPT, AND BANQUE DU CAIRE LEAD INVESTMENT IN NEW FINTECH FUND

The Increasing Influence of Women in FinTech

FinTech Egypt is releasing the first comprehensive report of its kind providing an overview of the unprecedented growth of FinTech in the Egyptian market

How FinTech is Disrupting an Age-Old Industry

RESHAPING FINTECH WITH AI: TOP AI INNOVATIONS IN THE FINANCIAL INDUSTRY

Accelerate’ha’ Female-Focused Problem Statements Now Live!

Breaking Entry Barriers for Women in FinTech

Have Traditional Banks Realized the Full Potential of Fintech By Now?

Episode 5: Accelerating FinTech Innovation through Open APIs

Episode 4: Understanding Blockchain’ s Potential in Disrupting FinTech

.png)

Episode 3: Discovering FinTech Talent through “FinYology - FinTech for Youth”

Episode 2: The Current & Future state of FinTech during COVID-19

FinTech Egypt Dialogue podcast launches its first-ever session about E-KYC Regulations and Regulatory Sandbox

Where does Artificial Intelligence fit in FinTech?

Critical FinTech Questions That Only the Near Future Can Answer

Special Interview With Dor-E, Winner Of The AI-Customer Experience FinTech Innovation Challenge

Egyptian Banking Institute Announces “The Future Of FinTech And Latest Digitalization Trends” Field Trip

Artificial Intelligence Is Transforming Banking As We Know It

Artificial Intelligence Is Transforming Banking As We Know It

Hub71 Partners With Techstars In Launching An Accelerator Program To Boost Startups

FINTECH IN THE SAVANNAH: Afro-Asia FinTech festival 2019 that took place in Nairobi Kenya

How Machine Learning Supports Credit Profiling

The Central Bank of Egypt’s Regulatory Sandbox started its first cohort in “e-KYC” to empower the FinTech ecosystem in Egypt.

Dubai Smart City Accelerator invites Egyptian startups to join Cairo Fast Track

Calling All Egyptian FinTech Startups To Participate In The Afro-Asia FinTech Festival!

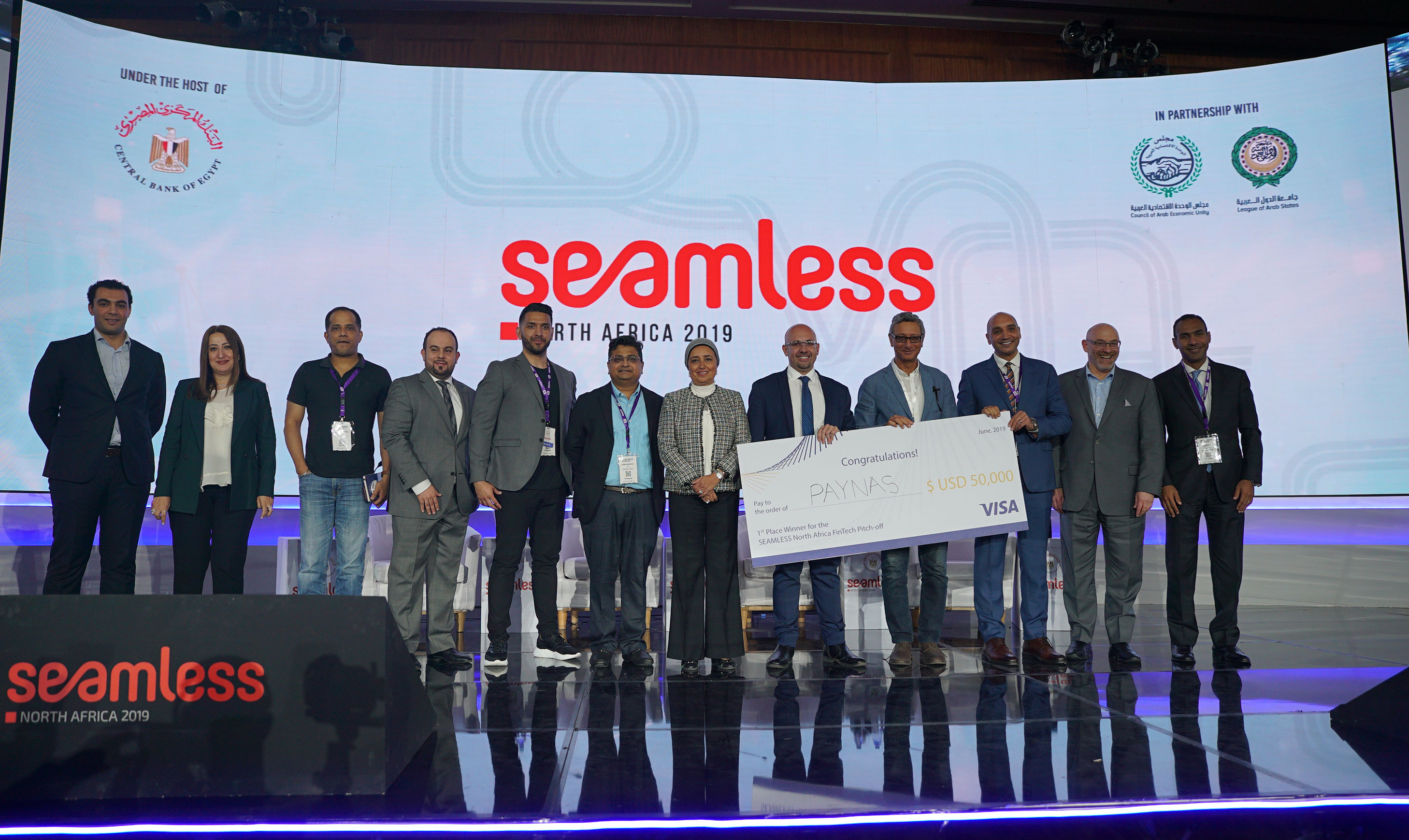

Paynas Wins Big At Seamless North Africa 2019

.jpg)

Seamless North Africa 2019

Announcing The Inaugural AFI FinTech Showcase

Fintech Trends In 2019 - Blockchain Adoption

.jpg)

Discounted Start-Up Passes

0

0

15.2k

15.2k

Comments