FinTech Ecosystem Stakeholders

As the FinTech arena grows, so does the demand for faster and easier financial technology solutions. In that regard, it has become essential to clearly identify the different stakeholders that directly or indirectly influence the FinTech arena.

Regulators & Legal

Traditional finance requires regulatory authorities that establish a framework for dictating the rules & regulations that institutions must adhere to; the same notion applies to the FinTech ecosystem.

Their basic functions involve setting rules, monitoring the finance sector and resolving any disputes between entities that fall within their authority.

FinTechs, labs & academics

As stated previously, FinTechs are the companies that offer technology-enabled innovative solutions in the financial sector. They are supported and empowered by entities pertaining to the government and private sector such as incubators, accelerators, hubs and labs that could be run by both sectors.

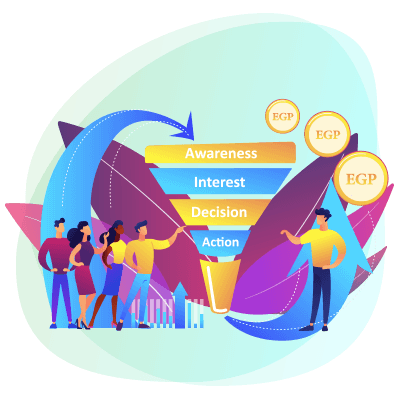

Investors

Investors are indispensable entities when it comes to financing startup companies and SMEs (small & medium-sized enterprises) as they provide the funds required for these businesses to profit, grow and expand while expecting to generate profit themselves in return for their investments.

Investors include banks, venture capitals, angel investors, private equity and any other entity that can provide funding.

Mentors

Mentors are industry and subject matter experts who represent a main pillar of the ecosystem through their commitment and dedication in supporting startups through knowledge transfer and guidance.

Infrastructure providers

Infrastructure organizations provide the fundamental hardware, software and services to FinTech companies for their core offering to function.

Electronic payment gateways, clearing systems and similar financial services require an agile and reliable infrastructure to successfully deliver services on different platforms across the world, marking the difference between an opportunity missed and an opportunity won.

Financial Institutions

The core establishments that conduct financial transactions such as investments, loans and deposits constitute banks, microfinance, savings & loan associations, brokerage firms, credit unions and insurance companies.

Although financial technology came to be with the digital age, there is no certified substitute yet for traditional institutions that bridges the gap between the physical and digital world.

MNOs and aggregators

Mobile network operators provide wireless voice and data communication for its users whereas aggregators act as integrators that connect payment providers to third-party systems, while providing the technical know-how.

Aggregators stimulate the industry and are usually at the forefront of creating and developing technology to facilitate mobile systems.