Critical FinTech Questions That Only the Near Future Can Answer

10 March 2020

As FinTech as an industry continues to explode around the

world, FinTech aficionados are seeking answers to their burning questions.

How would consumers’ attitudes and behaviors change if

mobile became the most popular payment mechanism, as opposed to cash and cards?

The short answer is that consumers would easily adapt to

that alteration for the obvious ease of access and convenience that mobile

brings into the palm of our hands. It’s also safe to assume that they would

expect much better services in no time.

To elaborate more and bring things into perspective, let’s

compare the amount of mobile payment transactions between the United States and

China for example, in the period between January and October of 2017. The US

processed transactions worth $49.3 billion, while China processed the

staggering amount of $12.8 trillion in mobile payment transactions. It should

also be noted that more than 90% of these transactions in China were processed

by Alipay (owned by Alibaba) and WeChat Pay (owned by Tencent).

Brett King, an Australian futurist, author, and co-founder

and CEO of New York-based mobile banking startup Moven stated that “Alipay

and WeChat Pay now annually process more mobile payments than the world’s

plastic cards”

What would happen if large technology companies

aggressively tried to disrupt every part of the financial services industry

simultaneously?

The short answer to that question is that they would

(probably) create super apps that deliver a completely overhauled experience to

what we have today, but a more detailed answer can provide more insight.

Taking a look at Alipay, we find that the e-finance giant

encompasses several financial services into one platform; the equivalent of

several popular U.S companies into one. Alipay allows Chinese consumers to make

payments in store and online (similar to Apple Pay), place and track orders in

Taobao and TMall (similar to Amazon), view offers from thousands of retail

outlets (similar to Honey), send/receive money between friends (Venmo style),

pay their bills (Prism-like), invest in wealth management products (like

Robinhood), book air, public transportation and movie tickets (similar to

Expedia and Fandango), order food from local restaurants (DoorDash) and order a

taxi (like Uber).

If that’s not enough, Alipay is just one of many apps that

fall under Ant Financial, the parent company for all of Alibaba’s financial

services. Ant Financial includes online lending apps (like Marcus), insurance

(like Oscar health), SME business lending (like Kabbage) and credit score

monitoring (similar to Credit Karma). It seems that the ultimate direction for

Alipay and similar ‘super’ apps is to create an all-encompassing ecosystem of

interconnected services that offers all that consumers can think of in the

world of digital finance, with an objective of continuously attracting new

users and third-party service providers. The Wall Street Journal reports that 8

out of 10 Ant Financial customers use at least 3 of its 5 primary services,

while 4 out of every 10 customers use all five services.

How much faster can financial inclusion be driven if all

the assets of global tech giants could be properly leveraged?

Again, the short answer would be: a lost faster than the

current situation, but not without negative implications on debt handling, in

terms of consumers’ ability to tackle it.

Although FinTech is a booming sector worldwide, tech giants

need to plan properly

All in all, it appears that worldwide FinTech initiatives

have an obvious positive impact on financial inclusion, especially to the young

and middle-to-lower class global consumers. Despite these innovative solutions,

there are also indications that the ease of use, availability and convenience

of these apps could also contribute to a more lenient attitude towards debt

accumulation by consumers under 30.

For now, the global FinTech community has a unique approach to

answering some of the most sought-after questions in the industry, however a

watchful eye needs be kept on these answers as we progress together into the

future, because, just like the digital world, the future is dynamic and full of

surprises we don’t know about yet.

related articles

A New Milestone in Egypt’s FinTech Journey

The FinTech Reality Show

Egypt Shines at the FinTech Arab Challenge 2025!

Announcing the Winners of FinTech Got Talent 2025!

Why does innovation often fail in organizations, and how can we truly enable it?

How can banks successfully enable AI — safely, strategically, and at scale?

We’re excited to announce the kick-off of the FinTech Hackathon

.jpg)

Attention all FinTech/FinTech-enabled Startups and PSPs!

.jpg)

Calling all Investors!

.jpg)

Calling all the accelerators and incubators!

AI is not the future. It’s NOW.

Most important moments from FinTekrs Assiut Round!

Celebrating Innovation: Top 10 Universities in the FinTech Got Talent Competition!

Proudly Announcing Mansoura Demo Day From Fintekrs Program Round 3!

Announcement: FinTech Got Talent Competition - 2nd Edition!

Don’t miss the chance to be part of a live conversation on the latest in FinTech, right at the Central Bank of Egypt Booth during the Cairo ICT!

Thrilled to announce that FinTekrs is taking the FinTech track by storm at Techne Summit!

.png)

The Central Bank of Egypt Supports Women’s Empowerment to Expand their Businesses

Agri-FinTech Applications by Fresh Source

4th Episode of 7areef FinTech Podcast – Supply Chain Finance

3rd Episode of 7areef FinTech Podcast – Digital Payments

2nd Episode of 7areef FinTech Podcast – ROSCA

1st Episode of 7areef FinTech Podcast - FinTekrs Introduction

Are you interested to be “7areef FinTech”?!

.jpg)

“FinTech Egypt” Launches the First Digital Academy to Upskill the Workforce Skills in the Banking, Financial, and FinTech Sector

FINTECH IS EGYPT’S NEXT BIG OPPORTUNITY..Catch up with FINTEKRS

The Future is FinTech..JOIN FINTEKRS NOW!

FinTekrs’ Alex Round Sponsor

FinTech Worldwide Statistics...FINTEKRS is Not-To-Miss!

Who Can Apply to FINTEKRS

Knowledge from FINTEKRS!

4 Reasons to Join FINTEKRS!

Launching FINTEKRS

FinTech Egypt releases its FinTech Investments-focused H1 2022 Landscape Review “Why Egypt is a promising market for FinTech Investments?”

The Women Techsters Initiative Fellowship Class of 2023

We're bringing top LPs and GPs from around the world

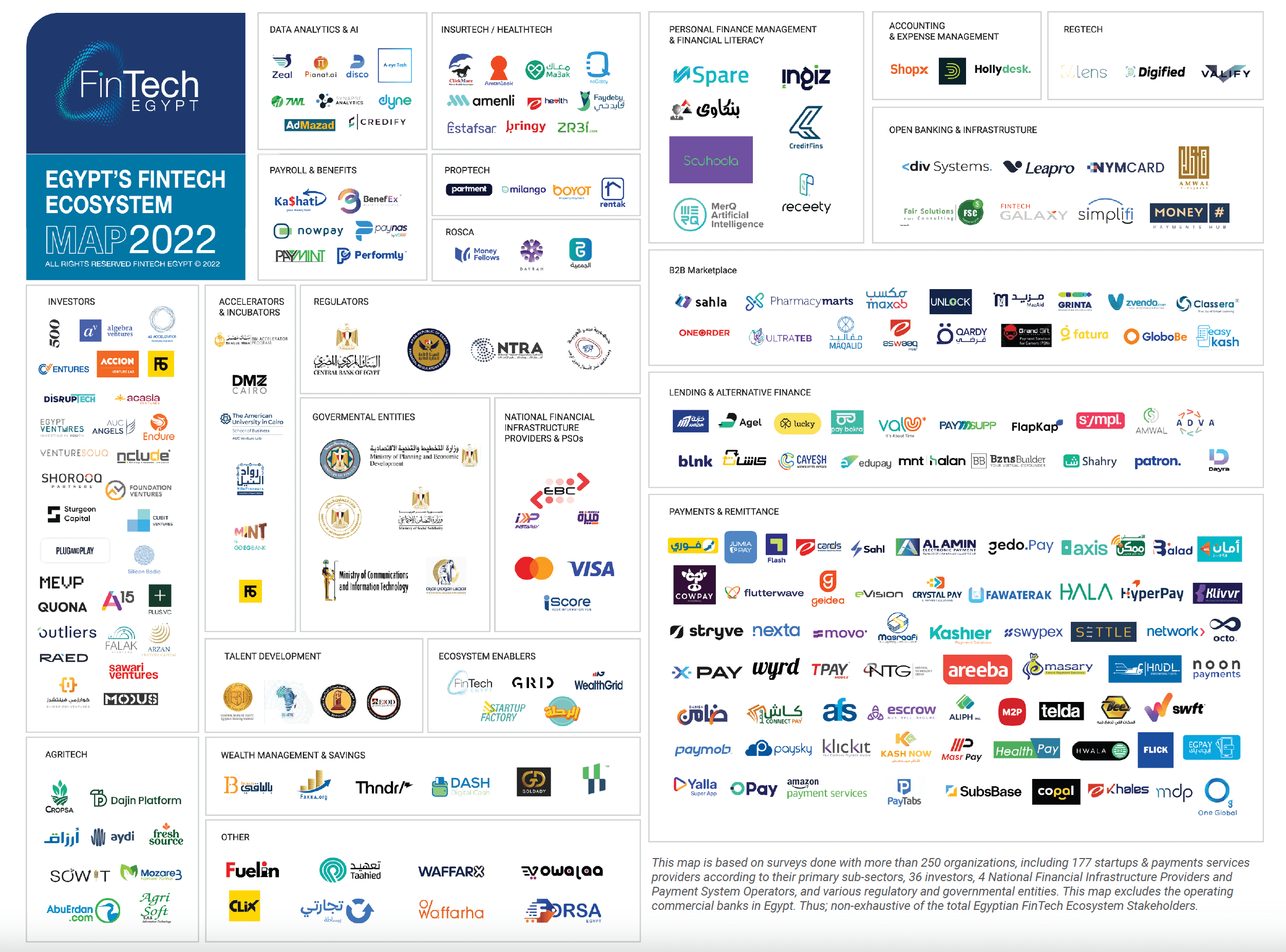

The Egyptian FinTech ecosystem is booming

We've joined forces to bring the best LPs and GPs together

We're taking a closer look at Egypt

Come and join the key players in the Middle East & Africa’s VC market

Connect with Egypt

Frontier of Egypt, Africa & the middle East in the 2022

Egypt’s First VC Summit kicks off in partnership between GIZ Egypt, AfricaGrow and Fintech Egypt

BANQUE MISR, NATIONAL BANK OF EGYPT, AND BANQUE DU CAIRE LEAD INVESTMENT IN NEW FINTECH FUND

The Increasing Influence of Women in FinTech

FinTech Egypt is releasing the first comprehensive report of its kind providing an overview of the unprecedented growth of FinTech in the Egyptian market

5 FinTech Trends to Follow in 2022

How FinTech is Disrupting an Age-Old Industry

RESHAPING FINTECH WITH AI: TOP AI INNOVATIONS IN THE FINANCIAL INDUSTRY

Accelerate’ha’ Female-Focused Problem Statements Now Live!

Breaking Entry Barriers for Women in FinTech

Have Traditional Banks Realized the Full Potential of Fintech By Now?

Episode 5: Accelerating FinTech Innovation through Open APIs

Episode 4: Understanding Blockchain’ s Potential in Disrupting FinTech

.png)

Episode 3: Discovering FinTech Talent through “FinYology - FinTech for Youth”

Episode 2: The Current & Future state of FinTech during COVID-19

FinTech Egypt Dialogue podcast launches its first-ever session about E-KYC Regulations and Regulatory Sandbox

Where does Artificial Intelligence fit in FinTech?

Special Interview With Dor-E, Winner Of The AI-Customer Experience FinTech Innovation Challenge

Egyptian Banking Institute Announces “The Future Of FinTech And Latest Digitalization Trends” Field Trip

Artificial Intelligence Is Transforming Banking As We Know It

Artificial Intelligence Is Transforming Banking As We Know It

Hub71 Partners With Techstars In Launching An Accelerator Program To Boost Startups

FINTECH IN THE SAVANNAH: Afro-Asia FinTech festival 2019 that took place in Nairobi Kenya

How Machine Learning Supports Credit Profiling

The Central Bank of Egypt’s Regulatory Sandbox started its first cohort in “e-KYC” to empower the FinTech ecosystem in Egypt.

Dubai Smart City Accelerator invites Egyptian startups to join Cairo Fast Track

Calling All Egyptian FinTech Startups To Participate In The Afro-Asia FinTech Festival!

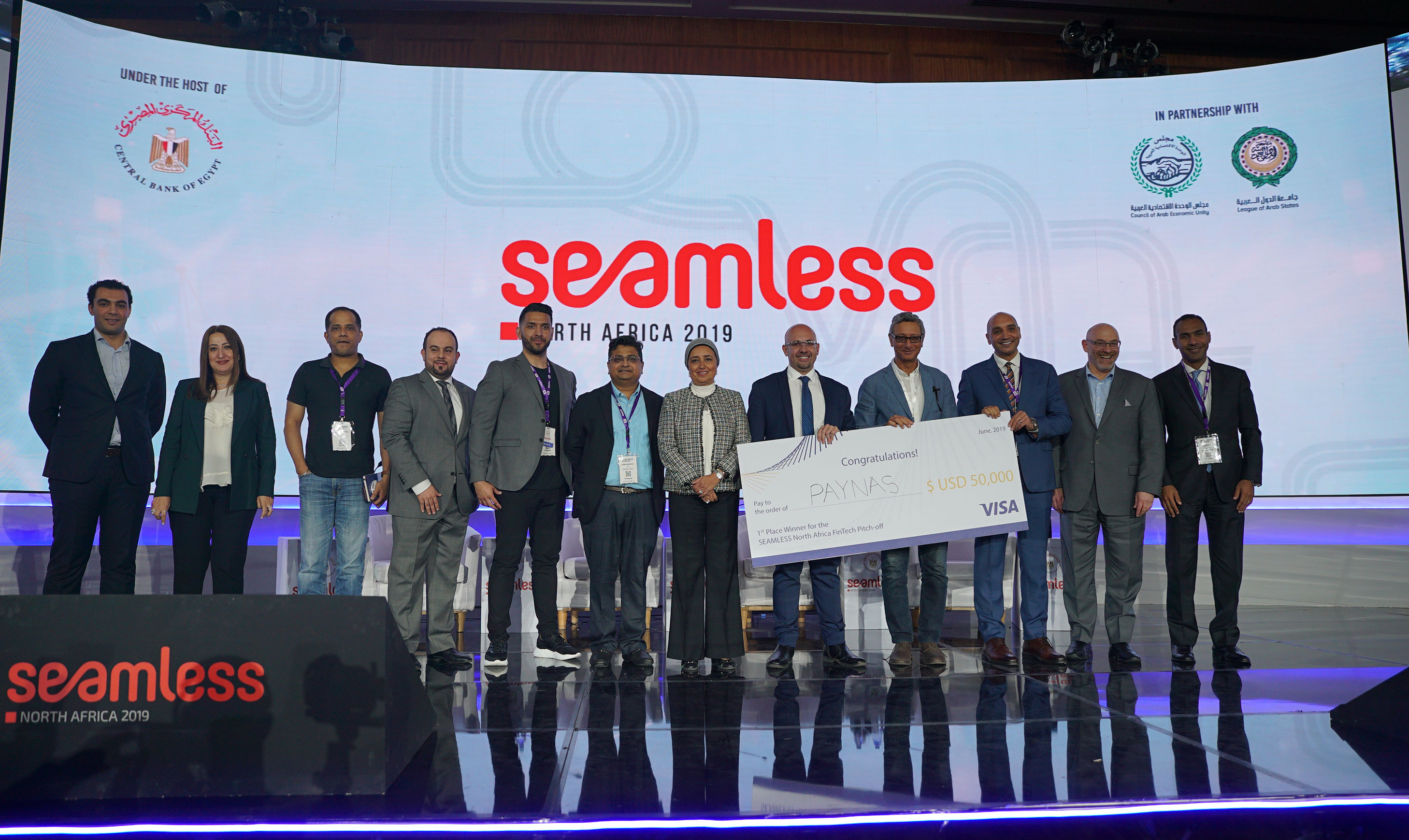

Paynas Wins Big At Seamless North Africa 2019

.jpg)

Seamless North Africa 2019

Announcing The Inaugural AFI FinTech Showcase

Fintech Trends In 2019 - Blockchain Adoption

.jpg)

Discounted Start-Up Passes

0

0

12.5k

12.5k

Comments