Bridging the Digital Divide with APIs

9 July 2020

related articles

Mutually Beneficial Partnership Scenarios for Banks and FinTech Companies

How FinTech is Revamping the Insurance Sector

Financial Health is What FinTech Should Be Empowering

How IoT is Infiltrating FinTech Payments

Setting Digital Banking Transformation Priorities During a Pandemic

The Challenges that FinTech Startups in Emerging Markets need to consider

The State of Biometrics in 2020 and Beyond

Regulatory Technology is the Unsung Hero of Digital Transformation

The Impact of IoT on FinTech & Banking

How is Banking Changing with COVID-19?

Customer Service Transformation has become a must in a Digital World

How FinTech can relate to the Healthcare Industry

Humanizing Services through Smart Banking Technologies

MSME Lending & FinTech: What to Expect in 2020

How Digital Innovation can Transform the Future of Banks

Banking Experts Forecast Key FinTech Trends in 2020

How FinTech is Changing the Finance Industry.

6 FinTech Trends That Will Transform Banking In 2020

FinTech Trends To Keep An Eye On In 2020

How FinTech Can Contribute To Healthcare

How many digital Middle Eastern companies have unlocked their full innovative potential?

Singapore FinTech Festival 2019: A Meeting of the Minds

Digital Banking vs Physical Branches: Competition Not Mandatory

Central Bank of Egypt Holds Third Roundtable Discussion for FinTech in Egypt

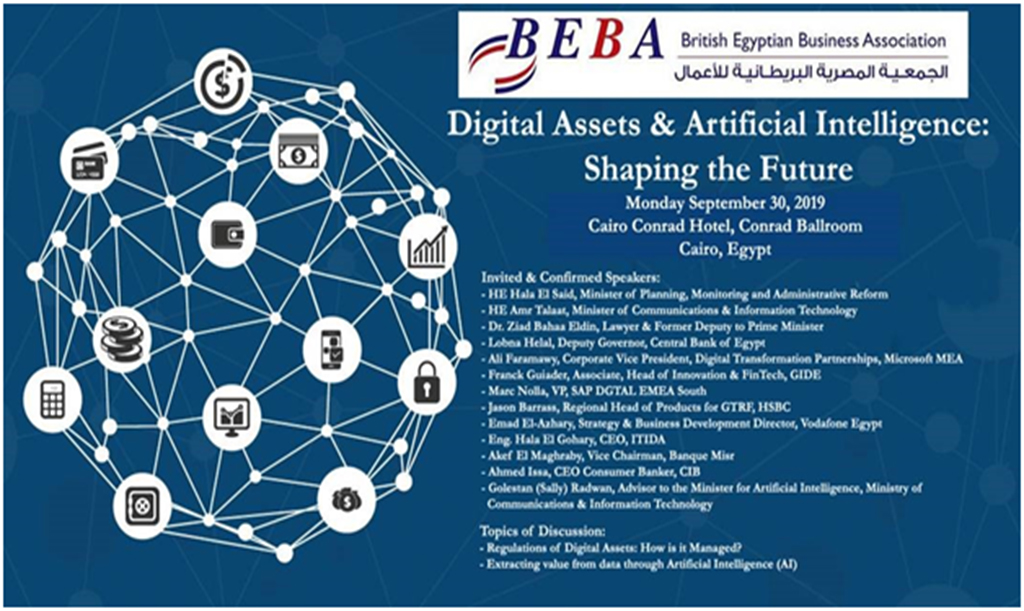

BEBA presents the Digital Assets & Artificial Intelligence: Shaping the Future event

Five Technologies Expected to Reshape FinTech in 2020

Rising Startup Netsahem Digitizes Charity In Egypt

.jpg)

Is Authentication by Facial Recognition an Ideal Method to Combat Financial Fraud?

.jpg)

Egypt’s First Artificial Intelligence Faculty launched at Kafr El Sheikh University

Bahraini Bank ABC pioneers e-KYC Capability in the Middle East

0

0

29.1k

29.1k

Comments