How Digital Innovation can Transform the Future of Banks

13 January 2020

(FinTech Egypt – FinTechMagazine.com)

As we enter the second decade of the millennium, digital

innovation has never been more revolutionizing or relevant to financial

services and the banking sector. Financial institutions are continuously

developing digital strategies and incorporating them into traditional

processes, but the challenge here is to keep the pace and catch up with rapidly

developing consumer expectations.

Consumers today are flooded with innovative solutions from

FinTech startups and tech-centric companies, with each product or service

providing intuitive and easy-to-use interfaces while granting better security.

It’s a highly competitive medium that banks need to tackle with an innovative

approach, if they are to stay relevant and make a solid impact.

Emerging technologies are increasingly finding their way

into complex financial structures to provide a myriad of endless possibilities

in their application. The rapid development and adoption rates of trendy tech

like social media, cloud, big data and analytics, machine learning (ML) and

artificial intelligence (AI) are quickly enhancing processes and customer

experiences by delivering innovative methods of dealing with money. Banks need

to get on board and integrate these technologies into their strategy to meet

their short and long-term objectives.

With FinTech companies already gaining new ground in regards

to acquiring new customers and attracting bank-loyal ones, it’s now or never

for banks that are still resistant to explore the digital spectrum. The world

of digital finance is witnessing unique partnerships, mergers and acquisitions

between traditional banks and FinTech entities, where they establish mutually

beneficial relationships that allow FinTechs to get access to a wide database

of customers in addition to having a huge backbone represented by these FIs,

while FIs benefit from the innovative reach and creative practices that FinTech

companies can provide. These partnerships are actually more beneficial to banks

and similar institutions as they give them an instant boost into the digital

world with minimal efforts. They focus on their core capabilities while not

having to worry about the needs of the digital customer. For example, the tech

companies have innovation labs that focus on developing tailored solutions

through randomized controlled trials (RCTs), resulting in adding value and

increasing efficiency towards attaining their goals.

FinTech companies can also contribute to keeping banks aware

of tech-related regulatory and risk-oriented needs, with RegTech companies

popping up to serve this exact purpose. InsurTech agencies are also growing to

cater to insurance needs and concerns in the digital world. Big data is also an

area where tech firms can greatly support banks and FIs, resulting in a

critical aspect of personalization and an overall better quality of customer

experiences.

Ernst & Young released a survey that reported that 93% of

banks consider improving data quality as their biggest risk management priority

for the next three years.

There isn’t just a need for banks to evolve into the

digitization age, but there are clear benefits to that notion. FIs can safely

assume that their growth will be sustainable with the introduction of digital

services into their core offering, and by transforming their organizational

culture into a future-oriented one for the coming years. Leaders of the finance

industry need to reimagine their business models and adapt to a rapidly

changing ecosystem that is propelled into the future on the back of digital

entities.

Tags

Ernst & Young, InsurTech, RegTech, digital banks,

financial institutions, artificial intelligence, AI, machine learning, ML, social

media, big data

related articles

How FinTech is Revamping the Insurance Sector

Financial Health is What FinTech Should Be Empowering

Setting Digital Banking Transformation Priorities During a Pandemic

The State of Biometrics in 2020 and Beyond

Regulatory Technology is the Unsung Hero of Digital Transformation

Bridging the Digital Divide with APIs

The Impact of IoT on FinTech & Banking

How is Banking Changing with COVID-19?

Customer Service Transformation has become a must in a Digital World

How FinTech can relate to the Healthcare Industry

Humanizing Services through Smart Banking Technologies

MSME Lending & FinTech: What to Expect in 2020

Banking Experts Forecast Key FinTech Trends in 2020

How FinTech is Changing the Finance Industry.

6 FinTech Trends That Will Transform Banking In 2020

FinTech Trends To Keep An Eye On In 2020

How FinTech Can Contribute To Healthcare

How many digital Middle Eastern companies have unlocked their full innovative potential?

Top Five MENA Venture Capital Investments in Q3 2019

Singapore FinTech Festival 2019: A Meeting of the Minds

Digital Banking vs Physical Branches: Competition Not Mandatory

Central Bank of Egypt Holds Third Roundtable Discussion for FinTech in Egypt

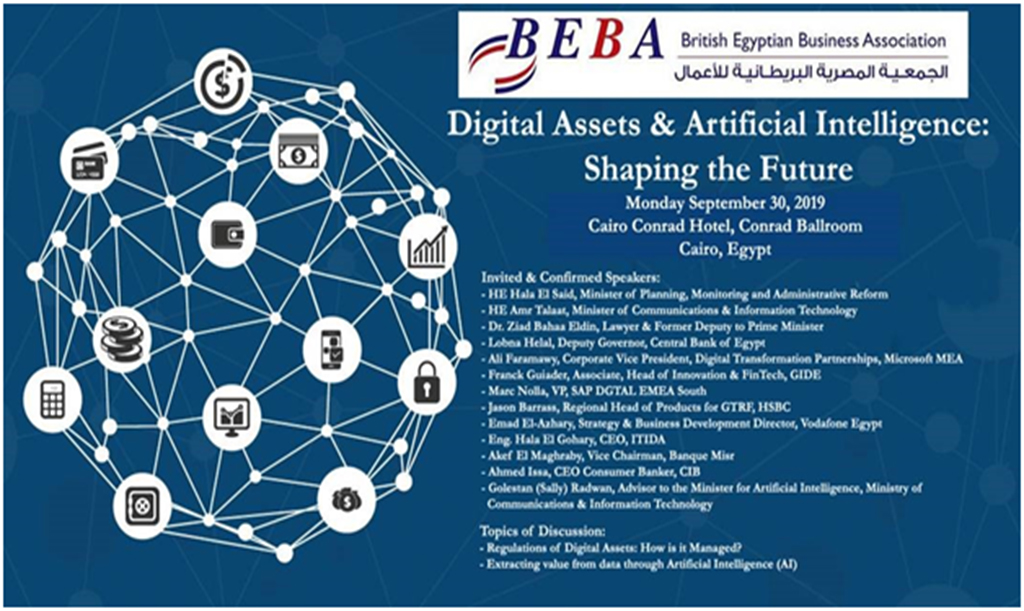

BEBA presents the Digital Assets & Artificial Intelligence: Shaping the Future event

Five Technologies Expected to Reshape FinTech in 2020

3 FinTech Trends You Should Pay Attention To

.jpg)

Egypt’s First Artificial Intelligence Faculty launched at Kafr El Sheikh University

0

0

3.6k

3.6k

Comments