Setting Digital Banking Transformation Priorities During a Pandemic

16 September 2020

Today, financial mobile applications and similar digital

platforms need to provide much more than simple banking processes like payments

and transactions, due to consumers’ high expectations and an increasingly

competitive e-banking industry. FIs already recognize that advanced

technologies like artificial intelligence (AI), machine learning (ML), applied

robotics, and biometrics are more and more relevant to deliver innovative

products and services that cater to consumers’ dynamic needs. These

ever-changing needs require solid prioritization by FIs in terms of investment

and shifting their budgets to the proper channels in hopes of overcoming the

competition and delivering what their customers expect.

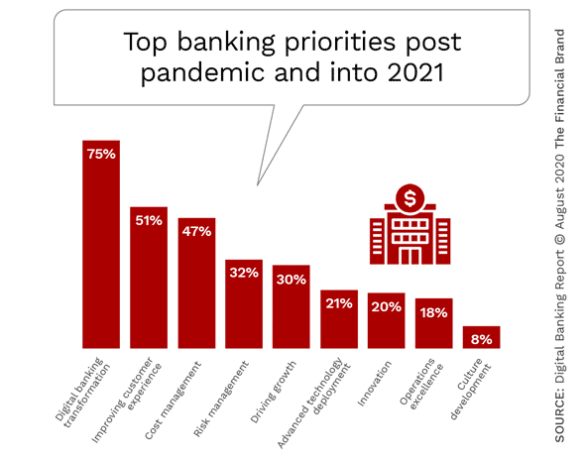

A dramatic shift was shown in global priorities in the

banking sector post-COVID-19, pertaining to 2020 and into 2021. The actual

digital transformation stood out as a top priority for banks, with 75% of them

acknowledging that these dire times are in critical need for them to fully

switch their offerings to digital channels. This emphasizes that even

traditional FIs have increased awareness that digital is the way to go during a

global crisis; a fact that is even more amplified by the 51% of them that

believe that improving customer experiences is their second top-most priority. Customers

today are digitally savvy and have low tolerance for bad user experiences and

non-responsive customer service channels, so FIs need to step up their game in

providing fluid experiences that people of all ages can relate to. When

considering that organizations are always looking out for cutting costs and

minimizing risks, it’s hardly a surprise that, even after Coronavirus, they are

still holding both these aspects in high regard.

Source: The Financial Brand

It’s not enough to just find out what FIs think of digital

transformation in and of itself, it’s also critical to understand how they

perceive the importance of the transformation and the impact it will have on

different aspects of their business, and ultimately their clients. The shift to

digital has obvious enhancements to improving all customer experiences and

engagement metrics. Another obvious advantage to using advanced digital

technologies is the direction being taken by many FinTech companies and trendy

financial organizations today, which is implementing artificial intelligence,

machine learning and deep analytics in their offerings. These emerging

technologies have demonstrated tremendous potential over the last few years, witnessing

FIs putting these technologies as the second-most important area of

implementing digital transformation strategies today. Another key takeaway,

although financial organizations accept and are moving forward with

digitization, some of them are still reluctant to apply that change to their

overall business models as well as their legacy core systems. This indicates

that conventional legacy banks and FIs understandably value their core systems

as they are, but are simultaneously willing to go digital in other aspects of

their business. In that regard, the future could show them the benefits of

digital enough to convince them to transform their legacy system at some point

in time.

related articles

Financial Health is What FinTech Should Be Empowering

Can the Middle East Bloom Into A Global FinTech Hub?

Can Blockchain Technology Affect Banking and FinTech?

The Challenges that FinTech Startups in Emerging Markets need to consider

Four FinTech Elements Affecting the Retail Banking Ecosystem

The State of Biometrics in 2020 and Beyond

Regulatory Technology is the Unsung Hero of Digital Transformation

Bridging the Digital Divide with APIs

The Impact of IoT on FinTech & Banking

Shifting from Disruption to Innovation through FinTech Partnerships in COVID19 pandemic.

Going Cashless is the new way to go in a Post-Coronavirus Future

Relevance of Scheduling Apps for Bank Appointments is Skyrocketing

How is Banking Changing with COVID-19?

Customer Service Transformation has become a must in a Digital World

The Opportunities and Threats of FinTech during COVID-19

How FinTech can relate to the Healthcare Industry

The Impact of Coronavirus on the Financial Sector

FinTech’s Critical Role in the Battle Against the Coronavirus

Humanizing Services through Smart Banking Technologies

MSME Lending & FinTech: What to Expect in 2020

How Digital Innovation can Transform the Future of Banks

Banking Experts Forecast Key FinTech Trends in 2020

How FinTech is Changing the Finance Industry.

6 FinTech Trends That Will Transform Banking In 2020

FinTech Trends To Keep An Eye On In 2020

How FinTech Can Contribute To Healthcare

How many digital Middle Eastern companies have unlocked their full innovative potential?

Top Five MENA Venture Capital Investments in Q3 2019

Singapore FinTech Festival 2019: A Meeting of the Minds

Digital Banking vs Physical Branches: Competition Not Mandatory

BEBA presents the Digital Assets & Artificial Intelligence: Shaping the Future event

Five Technologies Expected to Reshape FinTech in 2020

AlexBank Grants Access To Microfinance For First Time Ever In Egypt

Why Is Digital Transformation A Vital Step For Today’s Banks?

.jpg)

Is Authentication by Facial Recognition an Ideal Method to Combat Financial Fraud?

.jpg)

Egypt’s First Artificial Intelligence Faculty launched at Kafr El Sheikh University

0

0

6.8k

6.8k

Comments